This dwell weblog is refreshed periodically all through the day with the newest updates from the market.To search out the newest Inventory Market Immediately threads, click on right here.

Completely happy Thursday. That is TheStreet’s Inventory Market Immediately for Dec. 11, 2025. You may observe the newest updates available on the market right here in our every day dwell weblog.

Replace: 9:35 a.m. ET

A.M. Replace

The U.S. markets at the moment are open. The Dow (+0.40%) is main the pack this morning, trailed by a Russell 2000 (+0.20%) recent off intraday highs and a report shut.

On the identical time, the extra diversified massive cap indexes just like the S&P 500(-0.36%) and Nasdaq (-0.71%) are in decline this morning. Main the cost decrease is Oracle (-14.8%), which ignited recent fears concerning the endurance of the AI increase in its after hour earnings report yesterday.

Oracle Credit score Default Swaps (CDS) surged 139 foundation factors, whereas its $100 billion rout weighed on the remainder of the tech sector this morning.

Zooming out, U.S. jobless claims rose by 44,000 within the newest week, hitting 213,000. Nevertheless, the persevering with advantages fell by 99,000, coming in at 1.84 million, the bottom degree since Apr. 2025.

In steady futures, Silver (+3.39%) is on a run once more at this time after smashing by means of the $60 level. This morning, it is up one other $2 to $63.11. Gold (+0.93% to $4,263) can be becoming a member of it to the upside. In the meantime, vitality commodities like Pure Gasoline (-5.18% to $4.357) and Brent Crude (-1.96% to $60.99) are in decline.

Additionally notable, U.S. Treasury yields have dropped a bit throughout the yield curve, reflecting optimism concerning the Fed’s commentary yesterday. Here is a take a look at at this time (blue) vs. yesterday (pink):

Lastly, after the Fed’s quarter-point reduce, the U.S. Greenback Index hit a seven-week low at 98.46.

Replace: 8:38 a.m. ET

A.M. Replace

Good morning. A lot consideration has been paid to the guesswork within the Fed’s December coverage assembly, however now that it is within the rear view and we’ve a quarter-point reduce in hand, the estimation is that the central financial institution was extra dovish than initially thought — and even bullish in some methods.

That revelation is paying off this morning as U.S. equities futures are cut up. The Russell 2000 and Dow are up, whereas the S&P 500 and Nasdaq are in ‘promote the information’ mode. Yields additionally fell.

Here is what’s on deck for at this time’s buying and selling day:

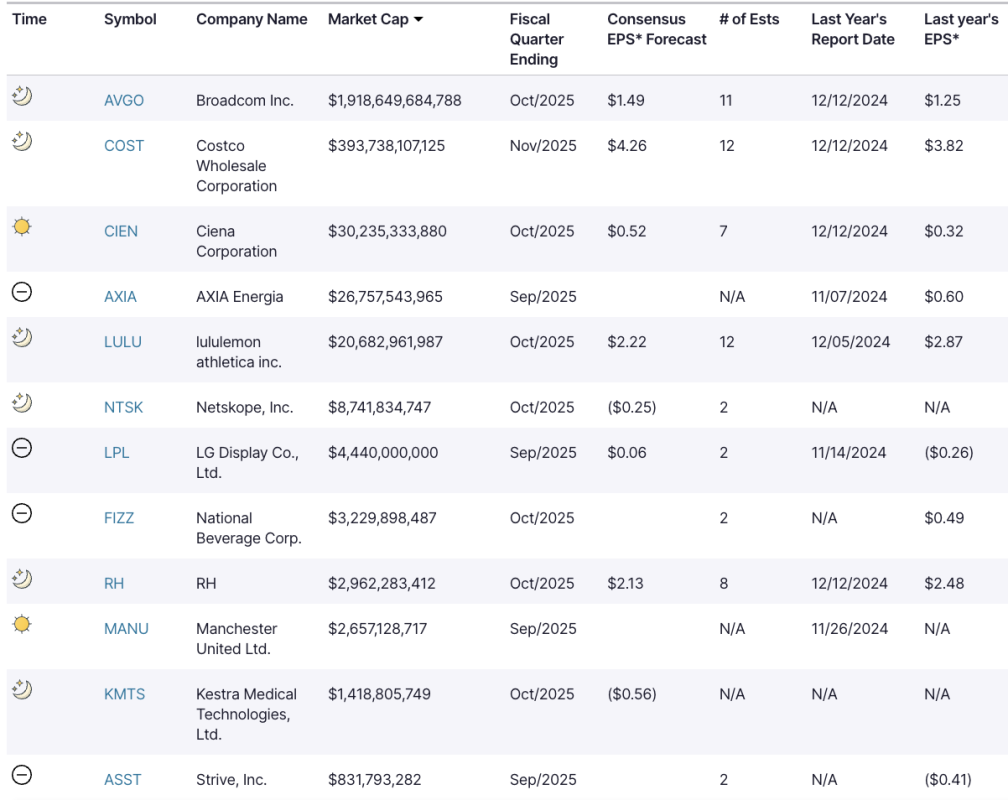

Earnings Immediately: Broadcom, Costco, Lululemon

This morning’s largest stories come from Ciena Company and Manchester United, however if you need a inventory that may outline the day — and maybe the week — you would possibly wish to maintain out till Broadcom stories after the market shut. It will be joined by Costco and lululemon, amongst others. Listed here are at this time’s earnings with a market cap of not less than $1 billion:

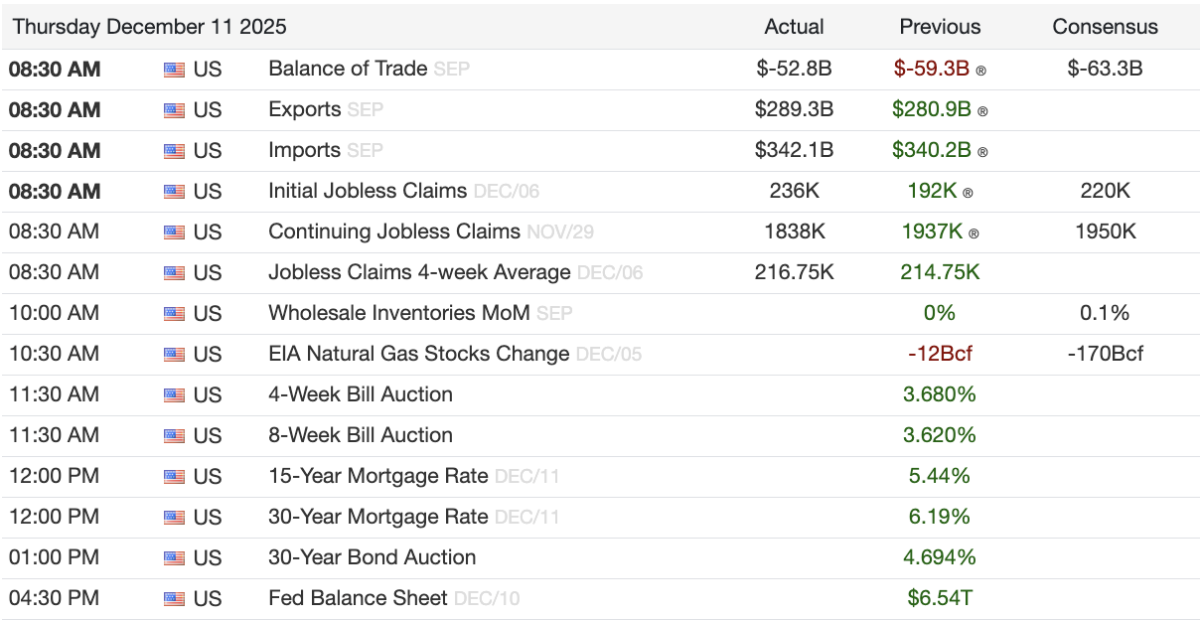

Financial Information + Occasions: Exports, Imports, Jobless Claims

This morning, we’ve exports and imports information, plus the newest jobless claims within the U.S. financial system. Here is an up to date graphic (9:41 a.m.) of at this time’s occasions, plus what stays: