This stay weblog is refreshed periodically all through the day with the newest updates from the market.To seek out the newest Inventory Market At present threads, click on right here.

Completely happy Wednesday. That is TheStreet’s Inventory Market At present for Nov. 5, 2025. You’ll be able to comply with the newest updates in the marketplace right here in our every day stay weblog.

Replace: 8:51 a.m. ET

Every part Taking place (That We Know Of)

Good morning. At day 36, the U.S. authorities shutdown is now the longest in historical past. And regardless of a full-court press on by President Trump, it appears unlikely that Republicans will pursue the ‘nuclear possibility’ and finish the filibuster to reopen the federal government.

As an alternative, solely partial SNAP and WIC advantages might be paid; the improved tax credit for market plans will stay a speaking level; authorities staff will proceed to be unpaid. On the identical time, Trump has been squarely targeted on dealmaking and bringing again nuclear exams.

We have heard a terrific deal concerning the perils of all of these elements, chief amongst them are a major drop-off in client sentiment noticed within the Morning Seek the advice of’s every day sentiment index, particularly amongst decrease earnings customers.

On the identical time, the market has been busy specializing in different champagne issues: inventory market valuations, the December fee minimize, and Trump’s tariffs — that are heading to the Supreme Court docket for argument this morning. Shares had rallied to data early within the shutdown, however given latest occasions, traders appear much less inclined to take issues as they’re.

That a lot is obvious within the S&P 500 and Nasdaq’s Tuesday efficiency, which was punctuated by steep declines in equities, largely on the prime of the index. And there remained worries into the wee hours after the market closed, as even acceptable earnings had been punished with excessive single-digit and low double-digit draw back reactions.

This morning, merchants in Japan and Europe noticed promoting. However by early indications, at present is perhaps a day of moderation for traders as they wait to listen to the newest on the tariffs, the shutdown, and different elements sitting on the horizon. U.S. fairness futures had been up modestly after a memorable Election Day for the Democrat opposition (one thing we’ll contact on a bit later).

A.M. Earnings: Novo Nordisk, McDonald’s, Marriott

Listed here are this morning’s largest earnings, per TipRanks:

Financial Occasions & Information

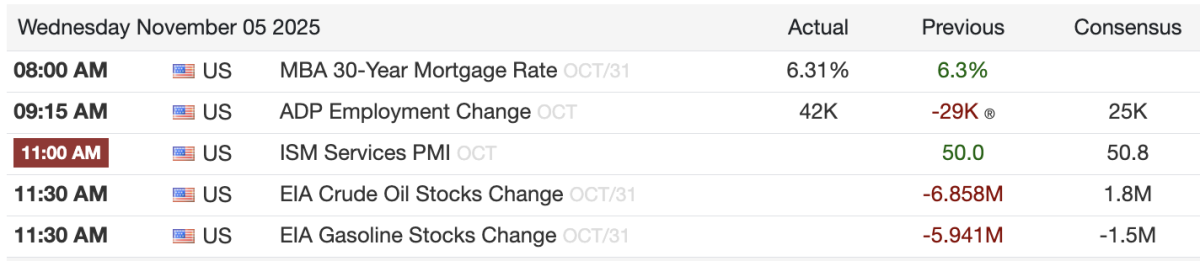

This morning, experiences from the MBA and the ADP Employment Change have already dropped, displaying moderation in each the housing market and labor market. This is what’s slated for the remainder of the day: