his dwell weblog is refreshed periodically all through the day with the most recent updates from the market.To search out the most recent Inventory Market At present threads, click on right here.

Completely happy Wednesday. That is TheStreet’s Inventory Market At present for Feb. 18, 2026. You may observe the most recent updates available on the market right here in our every day dwell weblog.

Replace: 10:00 a.m. ET

Opening Bell

The U.S. market is now opened. U.S. equities are rising this morning after Meta introduced it could broaden the scope of its partnership with Nvidia, committing to make use of much more AI chips in its information heart initiatives.

The constructive AI information has helped float fairness benchmarks this morning. half-hour into buying and selling, the Russell 2000 (+1.15%) and Nasdaq (+1.07%) are main the best way. The S&P 500(+0.74%) and Dow (+0.52%) aren’t far behind.

In Focus: S&P 500

Amongst S&P 500 sectors, tech is among the many six within the inexperienced, up 0.37%. The leaders are vitality (+1.24%), financials (+0.94%), and discretionary (+0.73%).

Constructive Knowledge Lifts Markets

As talked about in our A.M. Replace, this morning noticed a swath of massive financial reviews. Chief amongst them have been housing-related repotrs like Constructing Permits (Prelim) and Housing Begins, plus Sturdy Items Orders and Capability Utilization. Most of those reviews arrived at or exceeding expectations. A minimum of a few of that optimism is likely to be mirrored within the 10Y Treasury, which is 2.9 bips larger at 4.083% in consequence.

State of affairs Screens Are on Iran Watch

In latest weeks, a whole lot of U.S. property (planes, air craft carriers, fighter jets, and so on.) have been mobilized to Europe, showing to stage for an armed battle with Iran. In contrast to the Venezuela operation, which concerned shifting on the nation and nabbing the chief whereas leaving the federal government equipment in place, reviews declare that an incursion within the area could be extra long-lasting.

The revelation has pushed up commodities, with steady contracts in Crude Oil (+3.03% to $64.22) leaping above $60. Gold (+2.37% to $5,022.40) and Silver (+6.09% to $78.015) have additionally risen on the geopolitical jitters.

Replace: 8:31 a.m. ET

A.M. Replace

Good morning.

Right here is right this moment’s slate of financial information and earnings:

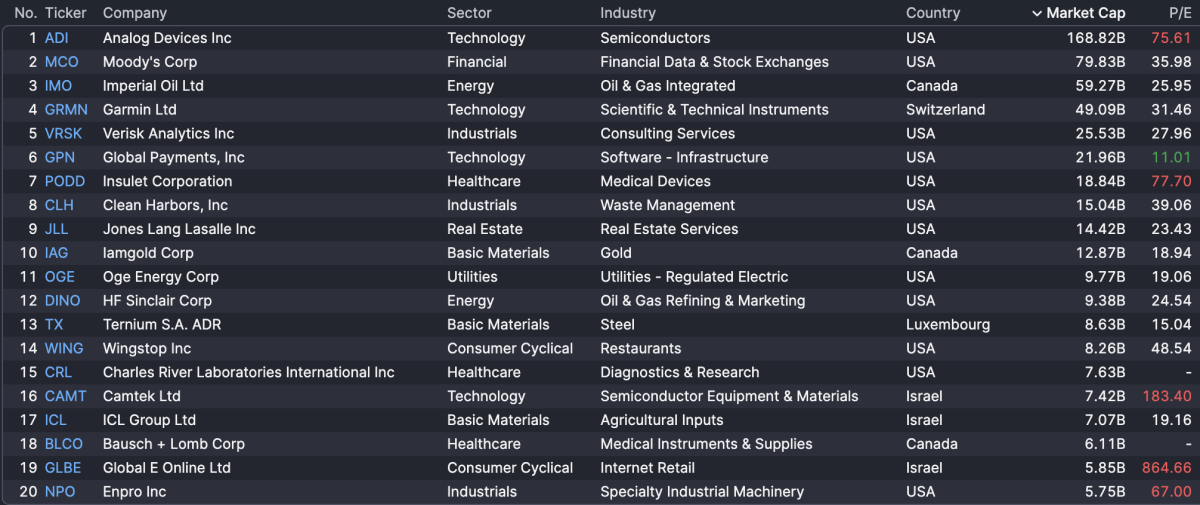

A.M. Earnings: Analog Gadgets, Moody’s, Imperial Oil

Listed here are this morning’s earnings, which embrace massive reviews from Analog Gadgets, Moody’s Corp, and Imperial Oil.

Financial Knowledge: Housing Knowledge, Sturdy Items, Industrial Manufacturing

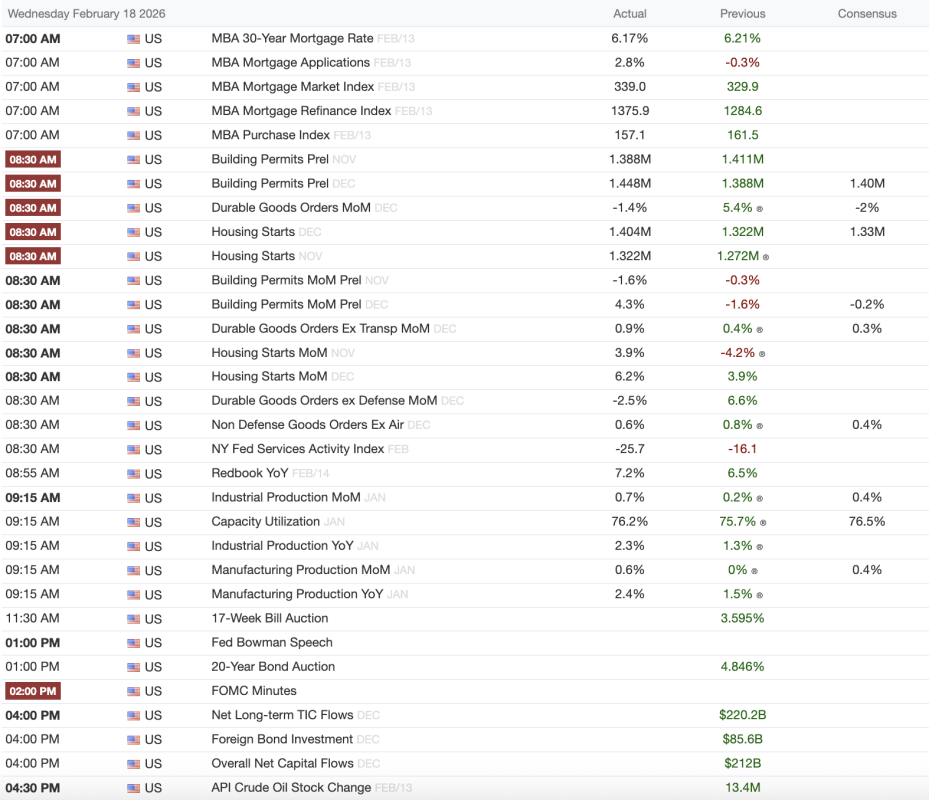

At present would be the lightest of the remaining financial information slate this week, however we have already received most of it out of the best way this morning within the type of older housing reviews, December sturdy items information, and newer industrial manufacturing readouts.

The excellent news is that the majority of that information is constructive; housing begins and preliminary allow information rose year-over-year in December, ending the 12 months on sturdy footing after a cooler October and November report. In December, begins and permits have been 1.322 million (+3.9% month-over-month) and 1.448 million (+4.3% MoM), respectively.

On the similar, Sturdy Items Orders got here in stronger than anticipated, declining only one.4% MoM in December, versus estimates of two%. That was additionally a major enchancment from the 5% MoM decline in November, which coincided with the longest authorities shutdown in U.S. historical past.

Right here is the complete slate of information, plus what’s left for the remainder of the day (particularly, FOMC Minutes and Web Lengthy-term TIC Flows, amongst different issues):