Innospec Inc. (NASDAQ: IOSP) introduced This autumn 2025 earnings on February 17, 2026. Outcomes revealed operational momentum throughout key segments. So, the corporate delivered improved money technology. Additionally, profitability features offset income headwinds.

- Innospec This autumn 2025 Earnings: Key Monetary Outcomes

- Innospec This autumn 2025 Earnings: Full 12 months Efficiency

- Innospec This autumn 2025 Earnings Income: Quarterly Pattern Evaluation

- Innospec This autumn 2025 Earnings: Section Efficiency

- Innospec This autumn 2025 Earnings: Gross Margin Dynamics

- Innospec This autumn 2025 Earnings: Stability Sheet and Money Stream

- Innospec This autumn 2025 Earnings: 2026 Outlook

- Key Takeaways from Innospec This autumn 2025 Earnings

Innospec This autumn 2025 Earnings: Key Monetary Outcomes

Quarterly income totaled $455.6 million, however this in contrast with $466.8 million in This autumn 2024. The decline of two% mirrored combined phase efficiency. So, internet revenue reached $47.4 million versus $70.4 million misplaced final yr. The prior yr loss included $116.7 million from the pension scheme buyout. Plus, adjusted EBITDA was $55.7 million. But this was down 2% from $56.6 million. In truth, working money circulation of $61.4 million remained strong. Additionally, Innospec generated stable money returns. Now, internet money improved to $292.5 million. This strengthens the corporate’s monetary place.

Innospec This autumn 2025 Earnings: Full 12 months Efficiency

Full-year 2025 revenues declined 4% to $1.778 billion from $1.845 billion. Plus, internet revenue surged to $116.6 million. This in contrast with $35.6 million in 2024. So, adjusted EBITDA totaled $203.0 million. But this was down 10% from $225.2 million. This decline mirrored decrease exercise in oilfield companies. Additionally, working money circulation declined to $138.3 million from $184.5 million. Nonetheless, the corporate maintained stable liquidity. In truth, internet money totaled $292.5 million, up from $289.2 million. Thus, the monetary basis stays stable.

Innospec This autumn 2025 Earnings Income: Quarterly Pattern Evaluation

Innospec This autumn 2025 earnings quarterly income development reveals variations. This autumn 2025 income of $455.6 million trailed This autumn 2024’s $466.8 million. However the firm maintained stable operational execution. Additionally, phase dynamics created combined outcomes throughout the portfolio. General, the income trajectory displays end-market normalization.

Innospec This autumn 2025 Earnings: Section Efficiency

Efficiency Chemical substances income stayed fixed at $168.4 million. Quantity declines of seven% offset worth features of three%. Plus, foreign money helped by 4%. So, working revenue declined 14% to $17.7 million. Gross margin compressed by 460 foundation factors to 18.1%. Nonetheless, administration initiated margin restoration actions. In truth, sequential enchancment emerged in This autumn. Additionally, the phase anticipates additional features in 2026. In the meantime, operational self-discipline is yielding optimistic outcomes. Thus, the trail ahead seems to be promising.

Gas Specialties delivered the most effective output. Income rose 1% to $194.1 million. Quantity features of 8% offset worth/combine headwinds of 10%. Plus, foreign money offered 3% assist. So, working revenue surged 7% to $37.2 million. Gross margin improved to 34.7%. In truth, this phase leads in margins and returns. Administration anticipates constant ends in 2026. Thus, this division stays the portfolio anchor. Subsequently, Gas Specialties supplies dependable earnings.

Oilfield Companies income declined 12% to $93.1 million. Decrease US completions and Center East exercise drove the decline. Plus, working revenue rose 9% to $8.2 million. Margin features of 180 foundation factors mirrored operational self-discipline. Gross sales combine improved. So, administration anticipates restoration as Center East exercise resumes. The latest DRA enlargement will enhance capability. In the meantime, value controls are enabling margin enlargement.

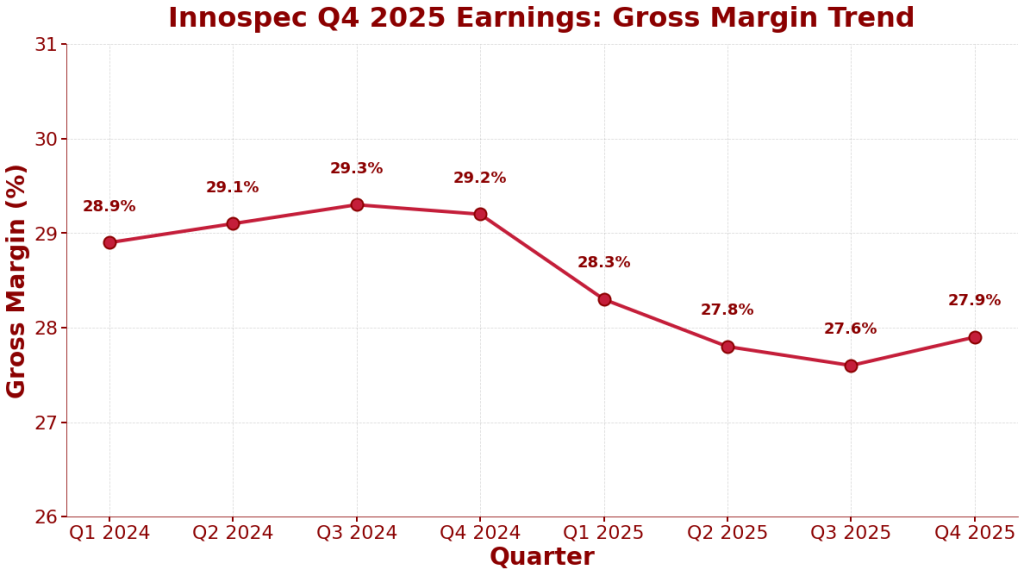

Innospec This autumn 2025 Earnings: Gross Margin Dynamics

Gross margins through the Innospec This autumn 2025 earnings interval present stability. Margin compression in 2025 displays enter value challenges. However administration’s enchancment actions are gaining momentum. In the long run, margin enlargement stays achievable. Thus, the margin trajectory helps future profitability development.

Innospec This autumn 2025 Earnings: Stability Sheet and Money Stream

The stability sheet stays stable with $292.5 million in internet money. Working money technology totaled $61.4 million in This autumn. Capital expenditures of $20.5 million stay disciplined. So, the corporate generated $40.9 million in free money after capex. Administration paid a semi-annual dividend of $21.6 million. This represented a ten% improve versus the prior yr. In truth, the online money place supplies important flexibility. Plus, Innospec can pursue M&A, improve buybacks, or develop dividends. In the meantime, the strong money place helps development funding. Subsequently, shareholders profit from operational self-discipline.

Innospec This autumn 2025 Earnings: 2026 Outlook

Administration outlined a constructive 2026 outlook. Efficiency Chemical substances will pursue margin restoration by means of operational enhancements. New product launches speed up throughout all finish markets. Price discount actions will proceed driving overhead effectivity. So, Gas Specialties will ship constant outcomes. The phase anticipates regular quantity and pricing. Additionally, Oilfield Companies anticipates restoration as Center East exercise rebounds. The DRA enlargement supplies new capability. Mexico gross sales will not be assumed within the outlook. Subsequently, administration targets continued working revenue development. General, the strategic plan addresses a number of development vectors.

Key Takeaways from Innospec This autumn 2025 Earnings

Innospec’s This autumn outcomes reveal operational progress. Margin enhancement initiatives are gaining momentum. The Gas Specialties phase continues to ship dependable outcomes. Money circulation technology stays stable. So, the $292.5 million internet money place allows strategic flexibility. Administration’s balanced method protects shareholder pursuits. Close to-term headwinds in some segments seem manageable. In truth, the transformation specializing in margin and returns exhibits promise. Subsequently, buyers ought to monitor 2026 execution intently. In the meantime, the corporate’s strategic positioning justifies shut statement. Moreover, shareholder worth creation stays on observe.

Click on Right here to go to the AlphaStreet web site.