Industrial Logistics Properties Belief (NASDAQ: ILPT). ILPT This autumn 2025 earnings beat expectations. Document leasing momentum and occupancy features impressed traders. The REIT completed 2025 on distinctive momentum.

Market Place

So, the REIT delivered distinctive outcomes. Normalized FFO surged 113% year-over-year. Plus, occupancy hit 94.5%. Additionally, market capitalization reached $4.58 billion. Whole debt stood at $4.21 billion.

ILPT This autumn 2025 Earnings: Monetary Outcomes

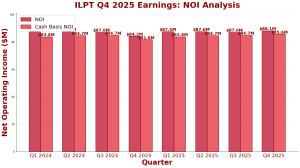

Rental revenue rose to $113.9 million. Compared, This autumn 2024 noticed $110.5 million. Additionally, Web Working Earnings (NOI) jumped to $88.1 million from $84.2 million. Money Foundation NOI improved to $85.6 million. This marks a 5.2% acquire year-over-year. So, outcomes show operational momentum.

Full 12 months 2025 Outcomes

Annual income hit $448.8 million. In 2024, it was $442.3 million. Whole shareholder return topped 55% for the 12 months. So, this ranked third amongst all U.S. REITs. Plus, constant quarterly features drove full-year efficiency.

ILPT This autumn 2025 earnings quarterly rental revenue exhibits constant upward momentum.

Portfolio and Leasing Exercise

The portfolio consists of 409 properties. Whole rentable house is 59.6 million sq. ft. ILPT executed 3.99 million sq. ft of leasing. Hire will increase averaged 25.7%. So, lease phrases averaged 9.5 years. Additionally, 76% of rental revenues got here from funding grade tenants. In the meantime, general lease time period was 7.6 years.

ILPT This autumn 2025 Earnings: Enterprise Drivers

E-commerce demand drove industrial leasing features. So, provide chain resilience bolstered tenant exercise. Hire progress mirrored tight provide in key markets. Renewals accounted for practically all leasing quantity. This exhibits tenant retention. Plus, administration famous a strong leasing pipeline for 2026.

ILPT This autumn 2025 earnings NOI and Money Foundation NOI each trended upward all through 2025.

Outlook and Strategic Path

Administration reported distinctive momentum heading into 2026. The corporate completed with report quarterly leasing quantity. So, a strong leasing pipeline helps 2026 progress. Occupancy features and lease roll-ups place ILPT properly. Additionally, focus stays on high-quality industrial properties in strategic places.

Key Takeaways

- Normalized FFO surged 113% year-over-year

- Occupancy improved to 94.5% in This autumn

- Hire roll-ups averaged 25.7% on new leasing and renewals

- Document quarterly leasing quantity reached 4.0 million sq. ft

For particulars, see the ILPT This autumn 2025 earnings press launch. Additionally go to Yahoo Finance or NAREIT.

Click on Right here to go to the AlphaStreet web site.