Conflict situations don’t reward clear narratives. Markets often do two issues without delay. They dash into security, then they reprice the world after the primary shock passes. Bitcoin sits proper on that fault line.

That’s the reason the “WW3 trade” is just not a single guess. It’s a sequence. Within the first hours, Bitcoin typically behaves like a high-beta threat asset. Within the following weeks, it will probably begin behaving like a transportable, censorship-resistant asset, relying on what governments do subsequent.

Are ‘World War 3’ Fears Actual Proper Now?

Given the present geopolitical escalations, the world world 3 dialog is extra actual than ever. Some may even say we’re within the midst of a world conflict, but it surely’s functioning in another way than it did 90 years in the past.

Over the previous few weeks, a number of flashpoints have tightened the margin for error.

America is making ready to struggle World Conflict III — The US President simply proposed to extend the army finances by 50%. WOW 🤯 pic.twitter.com/Uj6NmzBoBg

— The Enforcer (@ItsTheEnforcer) January 7, 2026

Europe’s safety debate has shifted from concept to operational planning. Officers have mentioned post-war safety ensures round Ukraine, a subject that Russia has traditionally handled as a pink line.

Within the Indo-Pacific, China’s army drills round Taiwan have regarded more and more like blockade rehearsals. A blockade-style disaster doesn’t want an invasion to interrupt markets. It solely wants transport disruption and an incident at sea.

Sponsored

Sponsored

Add america’ broader posture. President Trump is mainly ‘running Venezuela’ in his personal feedback after capturing its president from his house.

And now, the US authorities is speaking about shopping for Greenland, a sovereign nation that’s a part of Denmark and the EU.

TRUMP: “Greenland should make the deal because Greenland does not want to see Russia or China take over… we’re not going to let that happen… and if it effects NATO then it effects NATO… They need us much more than we need them, I will tell you that right now.” pic.twitter.com/WuaFvgqdC5

— ALX 🇺🇸 (@alx) January 12, 2026

Then there’s Sanctions enforcement, higher-risk army signaling, and sharper geopolitical messaging. Add these, and also you get a worldwide setting the place one mistake can set off one other.

That is precisely how crises grow to be linked.

What “WW3” Means on this Mannequin

This evaluation treats “World War III” as a particular threshold.

- Direct, sustained battle between nuclear powers, and

- Growth past one theater (Europe plus the Indo-Pacific is the clearest route).

That definition issues as a result of markets react in another way to regional conflicts than to multi-theater confrontations.

How Main Property Behave Round Conflict

The one most helpful lesson from previous conflicts is structural: Markets often promote the uncertainty first, then commerce the coverage response.

How Main Property Truly Carried out Throughout Wars & Crises

Shares

Equities typically drop across the preliminary shock, then can recuperate as soon as the trail turns into clearer—even whereas conflict continues. Market research of contemporary conflicts present that “clarity” can matter greater than the battle itself as soon as buyers cease guessing and begin pricing.

The exception is when conflict triggers an enduring macro regime change: vitality shocks, inflation persistence, rationing, or deep recession. Then equities wrestle for longer.

The one most necessary factor U.S. buyers can do proper now’s get out of the U.S. greenback, U.S. shares, and U.S. bonds. Meaning shopping for gold and silver, in addition to overseas shares and bonds. The earlier you are able to do this, the higher. Contact https://t.co/hluaqf2QhA right this moment!

— Peter Schiff (@PeterSchiff) January 12, 2026

Gold

Gold has an extended report of rising into concern. It additionally has a report of giving again features as soon as a conflict premium fades and coverage turns into predictable.

Gold’s edge is easy. it has no issuer threat. Its weak point can be easy: it competes with actual yields. When actual yields rise, gold typically faces strain.

Sponsored

Sponsored

Silver

Silver behaves like a hybrid. It will probably rally with gold as a concern hedge, then whipsaw as a result of industrial demand issues. It’s a volatility amplifier greater than a pure protected haven.

The dam has damaged

JP Morgan has fully misplaced management

Gold, Silver and Platinum have entered value discovery

We’re getting into unprecedented instances for treasured metals pic.twitter.com/M2KbIH3bCO

— Twin (@TwinTowerCity) January 12, 2026

Oil and Vitality

When conflicts threaten provide routes, vitality turns into the macro hinge. Oil spikes can shift inflation expectations shortly.

That forces central banks to decide on between development and inflation management. That selection then drives all the pieces else.

Bitcoin in a World Conflict: Bulls or Bears?

Bitcoin doesn’t have a single conflict id. It has two, they usually struggle one another:

- Liquidity-risk Bitcoin: behaves like a high-beta tech asset throughout deleveraging.

- Portability Bitcoin: behaves like a censorship-resistant, borderless asset when capital controls and forex stress rise.

Which one dominates depends upon the section.

Section 1: Shock Week

That is the pressured promoting section. Buyers increase money. Threat desks lower leverage. Correlations leap.

On this section, Bitcoin often trades with liquidity threat. It will probably fall alongside equities, particularly if derivatives positioning is crowded or if stablecoin liquidity tightens.

Gold tends to catch the primary security bid. The U.S. greenback typically strengthens. Credit score spreads widen.

Section 2: Stabilization Try

Markets cease asking “what just happened?” and begin asking “what does policy do next?”

Sponsored

Sponsored

That is the place Bitcoin can diverge.

If central banks and governments reply with liquidity help, backstops, or stimulus, Bitcoin typically rebounds with threat property.

If policymakers tighten controls—on capital, banking rails, or crypto on-ramps—Bitcoin’s rebound can grow to be uneven, with greater volatility and regional fragmentation.

Section 3: Protracted Battle

At this level, the battle turns into a macro regime. Right here Bitcoin’s efficiency depends upon 4 switches:

- Greenback liquidity: tight USD situations damage Bitcoin. Simpler situations assist.

- Actual yields: rising actual yields strain Bitcoin and gold. Falling actual yields help each.

- Capital controls and sanctions: improve demand for portability, however can even prohibit entry.

- Infrastructure reliability: Bitcoin wants energy, web, and functioning alternate rails.

That is the place “Bitcoin as digital gold” can emerge, however it’s not assured. It requires usable rails and a coverage setting that doesn’t choke entry.

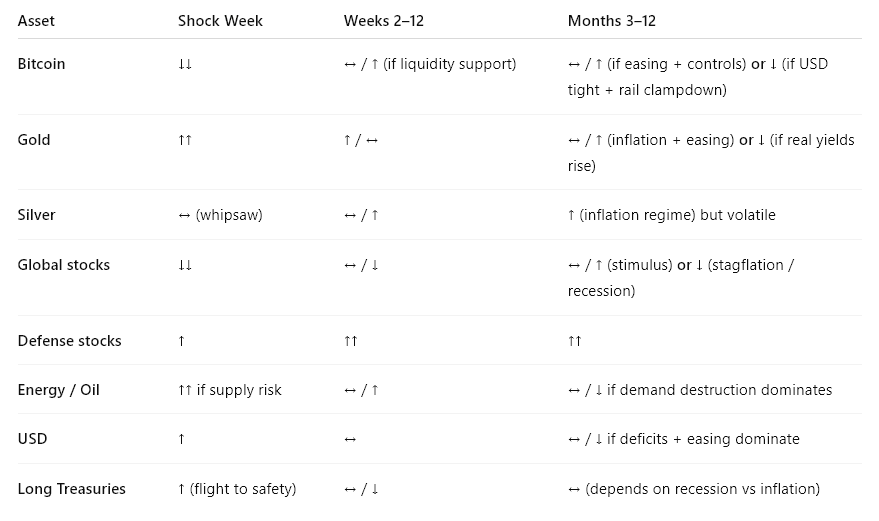

Under is a simplified stress desk that readers can truly use. It summarizes directional expectations throughout the three phases for 2 WW3-style branches: Europe-led and Taiwan-led.

The important thing takeaway is uncomfortable however helpful: Bitcoin’s worst window is the primary window. Its finest window is usually later—if coverage and rails enable it.

What Would Most Possible Determine Bitcoin’s Final result

The “Real Yield” Regime

Bitcoin tends to wrestle when actual yields rise and USD liquidity tightens. Conflict can push yields down (recession concern, easing) or up (inflation shock, fiscal stress).

Which one wins issues greater than the headlines.

Sponsored

Sponsored

The Rails Drawback

Bitcoin will be priceless and unusable on the identical time for some members.

If governments tighten alternate entry, banking ramps, or stablecoin redemption paths, Bitcoin can grow to be extra unstable, not much less.

The community can operate whereas people wrestle to maneuver capital by means of regulated choke factors.

Capital Controls and Forex Stress

That is the setting the place Bitcoin’s portability turns into greater than a slogan.

If battle expands sanctions, restricts cross-border transfers, or destabilizes native currencies, demand for transferable worth will increase. That helps Bitcoin’s medium-term case, even when the primary week appears to be like ugly.

Vitality Shock Versus Development Shock

An oil spike with persistent inflation will be hostile for threat property. A development shock with aggressive easing will be supportive.

Conflict can ship both. Markets will value the macro path, not the ethical narrative.

The Easy Forecast Construction

As an alternative of asking “Will Bitcoin pump or dump in WW3?”, ask three sequential questions:

- Can we get a shock occasion that forces deleveraging? If sure, anticipate Bitcoin draw back first.

- Does coverage reply with liquidity and backstops? If sure, anticipate Bitcoin to rebound quicker than many conventional property.

- Do capital controls and sanctions widen whereas rails stay usable? If sure, Bitcoin’s portability premium can rise over time.

This framework explains why Bitcoin can fall onerous on day one and nonetheless find yourself trying resilient by month six.

#Bitcoin – Potential Energy of Three.

Value pushing for the reclaim of the gray field as mentioned earlier right this moment. Holding there would set off the facility of three setup.

Value consolidates, deviates beneath the lows, after which expands to new highs.

Let’s examine! pic.twitter.com/QeVWo3qOin

— Jelle (@CryptoJelleNL) March 6, 2025

The Backside Line

A World Conflict III or main geopolitical escalation shock would possible hit Bitcoin first. That’s what liquidity crises do. The extra necessary query is what comes after.

Bitcoin’s medium-term efficiency in a significant geopolitical battle depends upon whether or not the world strikes right into a regime of simpler cash, tighter controls, and fragmented finance.

That regime can strengthen the case for moveable, scarce property—whereas nonetheless preserving them violently unstable.

If readers need one sentence to recollect: Bitcoin most likely doesn’t begin a conflict as “digital gold,” however it will probably find yourself buying and selling like one if conflicts drag on.