Picture supply: Getty Photos

ChatGPT has revolutionised how we do many issues, however can it give me the sting in constructing passive revenue?

I gave it a particular process: “Build me the perfect passive income portfolio.” It got here up with some attention-grabbing concepts. However the AI additionally threw up some stuff that made me query the knowledge of its choices.

Concentrate on dividend ETFs

Right here’s the “diversified, resilient, and low-maintenance” portfolio that ChatGPT gave me:

Asset classAllocationAnticipated positionWorld dividend ETFs40percentBroad, diversified revenue with long-term dividend progress.REITs20percentProperty revenue with out being a landlord; inflation hedge.Funding-grade bonds20percentStability and predictable curiosity revenue.Excessive-yield bonds/rising market debt10percentBoosts yield, and balances issues out

with safer bonds.

Infrastructure/utilities10percentExtremely secure, defensive dividends

(pipelines, grids).

The AI mannequin didn’t lean closely on buying particular person shares, which was disappointing (extra on this later). But it surely did present some meals for thought.

ChatGPT described its 40% allocation to dividend exchange-traded funds (ETFs) as “the core engine of the portfolio.” It supplies “instant diversification across thousands of companies,” the AI mentioned, and dividends that might develop “3% to 7% yearly.“

Good concepts, I assumed. ETFs that maintain many shares can nonetheless ship stable returns even when one or two shares disappoint. Dividend progress can be necessary to assist offset rising inflation.

Its different options

In together with actual property funding trusts (REITs), ChatGPT mentioned that I may gain advantage “inflation-linked rents” and “historically some of the highest risk-adjusted income.”

Please observe that tax therapy will depend on the person circumstances of every consumer and could also be topic to alter in future. The content material on this article is supplied for info functions solely. It isn’t meant to be, neither does it represent, any type of tax recommendation.

Funding-grade bonds, in the meantime, present “low volatility [and] predictable coupons.” The upper-risk, higher-yield bonds and rising market debt it discusses ship “greater payouts to boost your total yield,” the AI mentioned.

It rounded issues off with infrastructure and utilities corporations, praising the “stable cash flows from their essential services.”

Black gap

These are worthwhile concepts, in my opinion. But as an skilled dividend investor, I observed an enormous downside ChatGPT’s options.

By not together with extra particular person dividend shares, the AI’s portfolio may go away traders on the mercy of mediocre returns. Certainly, it mentioned a portfolio like this could yield solely 4% to six% yearly.

I maintain ETFs in my very own portfolio for diversification to decrease threat picks. However I additionally personal a variety of standalone shares to assist me obtain market-beating returns.

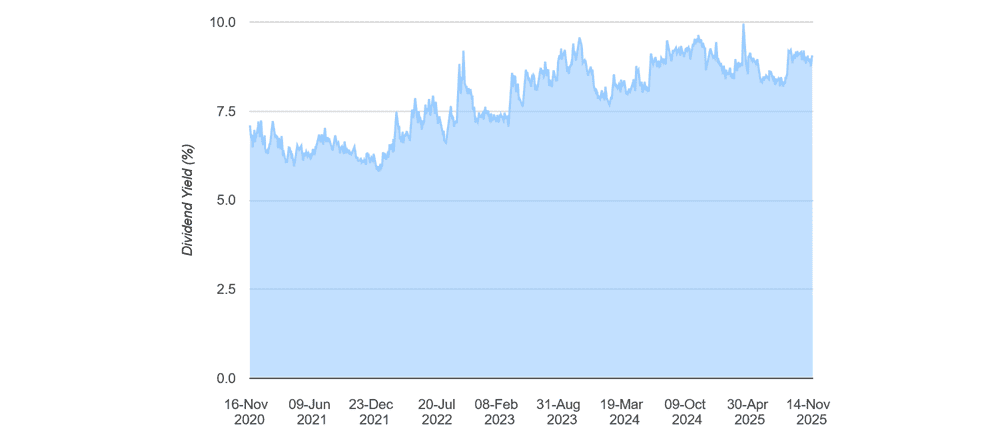

Authorized & Basic (LSE:LGEN) is one I truly personal. In reality, it’s the one largest holding in my portfolio. Because the chart reveals, it’s long-term dividend yield is properly above the 4% to six% that ChatGPT’ mentioned its portfolio could present:

Supply: dividenddata.co.uk

Supply: dividenddata.co.uk

It’s a document analysts anticipate to proceed. For 2025 and 2026, Authorized & Basic shares ship dividend yields of 9.1% and 9.4% respectively. This makes it probably the best-paying passive revenue inventory on the FTSE 100.

The corporate’s glorious long-term dividend document displays its glorious money era and restricted progress alternatives. Mixed, these imply the board is dedicated to prioritising money rewards for traders.

Authorized & Basic’s cyclical operations imply its share worth can wrestle throughout downturns. But that sturdy steadiness sheet means such occasions don’t affect its potential to maintain paying massive dividends. At present, its Solvency II capital ratio is a strong 217%.

ChatGPT has its makes use of. However as I’ve proven, utilizing it to advise on passive revenue era may find yourself costing traders a packet. On the subject of investing I want the human contact.