Picture supply: Getty Photos

Passive earnings could possibly be your ticket to a retirement past the measly State Pension quantity of £231. With compounding in your aspect, even modest ISA financial savings, constructed steadily over time, may generate a dependable earnings to high up your retirement earnings.

Crunching the numbers

If you need £924 a month in at the moment’s cash once you retire, inflation means you’ll want greater than that sooner or later. Assuming 3% annual inflation, in 25 years the identical buying energy would require round £23,200 a 12 months.

Utilizing the 4% withdrawal rule, a pension pot of roughly £580,000 can be wanted to generate that earnings.

Let’s assume a person has a 25-year funding horizon and can enhance their yearly ISA contributions based on the desk beneath.

Tiered yearsYearly ISA contribution1-5£5,0006-10£10,00011-15£15,00016-25£20,000

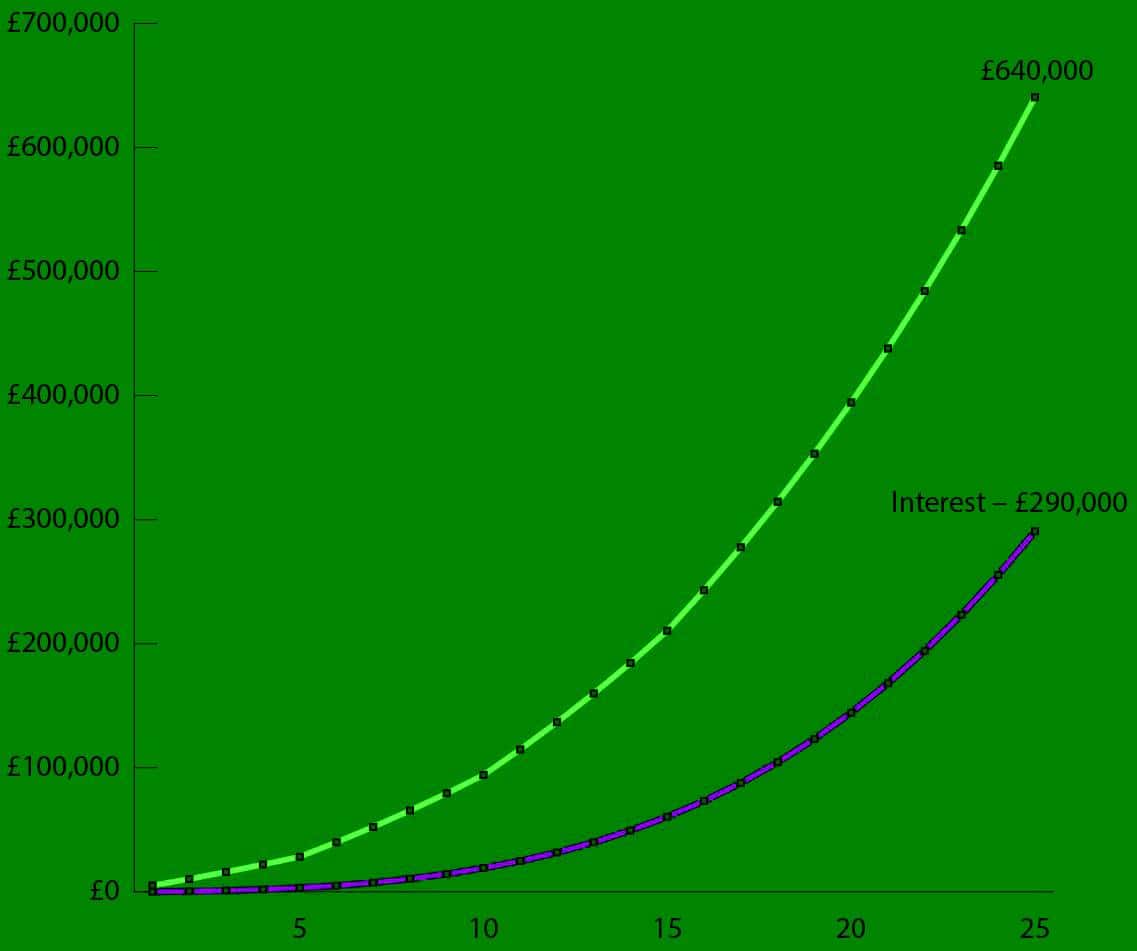

The next chart fashions these contributions, assuming a modest 6% annual return. As proven, the person not solely surpasses their goal but additionally demonstrates the facility of compounding, which alone contributes round 45% of the ultimate complete.

Chart generated by creator

As a way to attain that sizeable pot measurement, my most well-liked alternative is a mix of each progress and dividend shares. One inventory within the latter class that I feel traders ought to contemplate is Authorized & Common (LSE: LGEN). Its trailing dividend yield is 9.2%, comfortably forward of the 6% goal.

Dividend sustainability

Over the previous 10 years complete shareholder returns have amounted to 83%. However in fact it’s the long run that issues.

Dividend cowl at present stands at 0.94, which means that earnings don’t absolutely cowl the payout. That naturally raises questions for an earnings inventory.

For insurers, money dividend cowl is often the true security web. Even when income fluctuate, regular working money flows from premiums and funding earnings usually again up the dividend.

However final 12 months was an exception. The corporate reported detrimental working money circulation of £4.4bn, leaving no money cowl for the payout. On the face of it, that appears like a flashing warning gentle.

Why I nonetheless suppose the dividend is secure

Regardless of that, I feel the chance of a reduce nonetheless seems low. That’s as a result of what actually underpins insurer dividends isn’t short-term money circulation – it’s the capital the enterprise reliably produces to fund each distributions and progress. It’s measured as Solvency II operational surplus technology (OSG).

OSG is predicted to rise round 5% in 2025, comfortably above the deliberate 2% enhance in dividends per share.

The forthcoming £1bn share buyback provides additional help. By decreasing the share rely, it cuts the annual dividend invoice by roughly £100m, additional bolstering OSG.

Backside line

I’ve lengthy held Authorized & Common shares in my Shares and Shares ISA for his or her dependable, market-beating dividends.

Final 12 months was difficult, but the corporate nonetheless grew the money price of its dividend. Its long-term progress drivers stay strong.

The actual engine is pension danger switch. Trustees depend on the insurer to derisk remaining wage schemes; a extremely profitable, increasing market with a complete addressable market set to hit £1trn over the following decade. This mixture of reliability and progress may make the shares a strong supply of passive earnings for affected person traders.