Halozyme Therapeutics Inc. (NASDAQ: HALO) hit file income. Full-year 2025 income reached $1.4 billion. So that is 38% development year-over-year. Additionally, royalty income hit $868 million. That is 52% up from final 12 months.

Market Place

Halozyme leads the sphere, so traders belief the model. The market exhibits investor religion. Plus, ENHANZE tech offers an edge. DARZALEX FASPRO drives core gross sales. But RYBREVANT SC bought approval. Additionally, new offers started with key companies.

This fall Outcomes

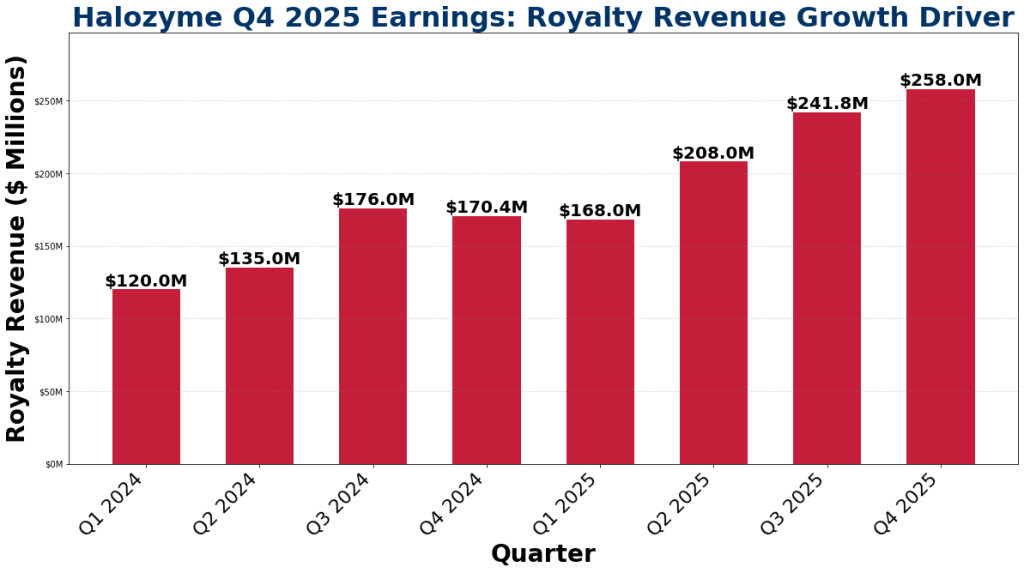

This fall gross sales hit $451.8 million. So that is 52% development. Final 12 months it was $298.0 million. So the tempo stored up. Royalty gross sales hit $258.0 million. That is 51% extra. Final 12 months it was $170.4 million. Plus, product gross sales rose 55% to $122.7 million. So This fall teamed gross sales rose 48%.

Full Yr Outcomes

Yearly gross sales hit $1.397 billion. The prior 12 months was $1.015 billion. The 38% achieve exhibits big development. In reality, all items did effectively. Royalty gross sales hit $867.8 million. The prior 12 months was $571.0 million. So the 52% increase is vital. Additionally, the person base grew loads. Product gross sales rose 24% to $376.4 million. Additionally, group gross sales grew 8% to $152.3 million.

Income by quarter

How It Works

Price of gross sales hit $228.8 million. So that is extra product output. R&D prices went up simply 3% to $81.5 million. So good points in pace occurred. The agency made two huge buys. Plus, Elektrofi got here first. Then Surf Bio got here subsequent. So the combo bought new instruments.

Royalty gross sales by quarter

What’s Subsequent

ENHANZE is the cash maker. So new offers with Takeda, Merus, and Skye assist. RYBREVANT FASPRO bought world approval. Additionally, DARZALEX FASPRO bought the OK. This opens new markets. But the agency signed 10 new ENHANZE offers. Plus, the plan has 15 merchandise in work. So development odds stay good.

Path Forward

The 2026 information says gross sales of $1.710-$1.810 billion. So that is 22%-30% new good points. So the trail appears good. Additionally, EBITDA will hit $1.125-$1.205 billion. So this can be a 71%-83% increase for revenue. Plus, money movement will develop extra.

Key Factors

- This fall beat hopes with 52% good points.

- Yearly royalty gross sales hit $868 million file.

- Gross sales have been up 52% from one 12 months in the past.

- Two key buys expanded the model.

- ENHANZE drives 25+ 12 months gross sales odds.

- The 2026 path exhibits 22%-30% gross sales development.

- 15 items are actually in work.