Farmland Companions Inc. (NYSE: FPI). FPI This autumn 2025 earnings beat steerage. The corporate raised its dividend 50%. Document AFFO efficiency drove outcomes. Certainly, farmland demand stays strong and continues to help valuations.

Market Place and Fundamentals

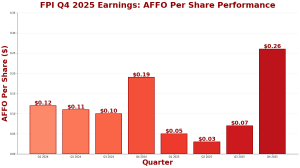

So, farmland demand remained strong in This autumn 2025. The REIT reported AFFO of $11.4 million. Notably, per share AFFO hit $0.26. Plus, web revenue reached $21.8 million. Market capitalization stood at $424.8 million. Complete debt was $160.8 million. In the meantime, the corporate manages roughly 90,000 acres of farmland.

FPI This autumn 2025 Earnings: Monetary Outcomes

Not too long ago, This autumn 2025 whole working income reached $20.7 million. This compares with $21.5 million in This autumn 2024. Rental revenue totaled $20.5 million. Internet Working Earnings (NOI) rose to $17.5 million. So, adjusted funds from operations surged 22% year-over-year. Certainly, full yr 2025 AFFO was $17.9 million, up 27% from 2024. Additionally, web revenue for the total yr totaled $32.2 million.

Full Yr 2025 Efficiency

Annual working income hit $52.2 million versus $58.2 million in 2024. Complete AFFO reached $17.9 million per full-year steerage. So, AFFO per share was $0.39 for the yr. Moreover, the corporate accomplished strategic tendencies. Property gross sales generated $34.9 million in web good points. In the meantime, FPI elevated its dividend by 50%.

FPI This autumn 2025 earnings quarterly income exhibits constant efficiency throughout 2025.

Crop Portfolio and Land Administration

Total, FPI’s portfolio is diversified by crop kind. Roughly 60% of farmland grows major crops. These embody corn, soybeans, wheat, rice, and cotton. In the meantime, 40% grows specialty crops. Specialty crops embody citrus, avocados, and tree nuts. So, this diversification reduces threat. In truth, it gives publicity to international meals demand developments.

FPI This autumn 2025 Earnings: Enterprise Drivers

E-commerce accelerated farmland valuations increased. So, high-quality North American farmland stays restricted. Provide constraints supported rental revenue good points. Additionally, strategic property tendencies improved portfolio high quality. Mortgage portfolio expanded by $25 million in receivables. Plus, variable lease funds elevated as a consequence of increased crop yields. In the meantime, the corporate maintained operational self-discipline. Then, administration raised dividend confidence.

Dividend Improve and Strategic Outlook

Administration raised the quarterly dividend by 50%. The brand new dividend is $0.09 per share. This displays confidence in money era. So, the corporate beat AFFO steerage by $0.05 per share. Importantly, administration continues to amass high-quality farmland. FPI gives buyers with farmland publicity. Plus, the REIT advantages from structural demographic and commodity developments.

Key Takeaways

- This autumn AFFO of $11.4 million, or $0.26 per share

- Full-year AFFO surged 27% to $17.9 million

- Dividend raised 50% to $0.09 per share quarterly

- Property tendencies generated $34.9 million in good points

For particulars, see the FPI This autumn 2025 earnings press launch. Additionally go to Yahoo Finance or NAREIT.

Click on Right here to go to the AlphaStreet web site.