The iShares Bitcoin ETF from BlackRock has shortly change into the biggest spot Bitcoin ETF within the U.S., with almost $100 billion in belongings.

However is IBIT actually the perfect Bitcoin ETF for traders in 2025, or is it merely the largest?

IBIT controls almost 60% of all spot Bitcoin ETF belongings, however that’s not the entire story. As extra spot Bitcoin ETFs from Constancy, ARK, and Grayscale compete on charges and liquidity, the query of which one is your best option for traders has by no means been extra necessary.

Be taught what inquiries to ask when selecting the perfect bitcoin ETF.

Getty Photographs

What’s the iShares Bitcoin ETF (IBIT)?

IBIT is the spot Bitcoin ETF from BlackRock and iShares. In response to the fund’s web site:

“IBIT enables investors to get exposure to bitcoin through the convenience of an exchange-traded product, helping remove the operational, tax, and custody complexities of holding bitcoin directly.”

iShares Bitcoin ETF (IBIT) web site

iShares Bitcoin ETF at a look:

- Launch Date: January 5, 2024

- Expense Ratio: 0.25%

- Custodian: Coinbase Prime

- AUM: $97.1B (as of Oct. 9, 2025)

Benefits of shopping for the iShares Bitcoin ETF:

- Simplicity & entry: You should buy and personal bitcoin by way of a dealer, comparable to Constancy or Vanguard, without having a crypto pockets.

- Safety & custody: Coinbase is a well known identify within the crypto area. BlackRock oversees the belief.

- Liquidity: Bitcoin ETFs commerce on exchanges all through the day, similar to shares.

Associated: Overlook VOO, SPY, VTI: Finest inventory investing decide is that this Constancy fund

Dangers and issues:

- Regulatory threat: Rules and legal guidelines surrounding bitcoin and crypto are nonetheless altering.

- Charges: The 0.25% expense ratio means there can be a slight drag relative to bitcoin efficiency.

These issues, nonetheless, exist throughout all spot bitcoin ETFs. Determining which is the perfect bitcoin ETF may come down to simply a few small particulars.

How to decide on the best bitcoin ETF

There are greater than 10 spot bitcoin ETFs from which traders can select. Figuring out which is the perfect lies in answering just a few necessary questions:

- Which is the perfect bitcoin ETF for efficiency?

- Which is the lowest-cost bitcoin ETF?

- Which bitcoin ETF has essentially the most liquidity?

Let’s take into account the competitors.

IBIT vs. Constancy vs. Grayscale vs. ARK: head-to-head bitcoin ETF comparability

Constancy Sensible Origin Bitcoin ETF (FBTC): low charges and institutional belief

The Constancy Bitcoin ETF is IBIT’s greatest competitor. It’s the second-largest bitcoin ETF with belongings of $25 billion. Constancy is without doubt one of the greatest and best-known names within the funding administration business. It’s clearly gained a number of traction within the bitcoin ETF area.

Grayscale Bitcoin ETF (GBTC): the unique bitcoin fund

GBTC was the primary bitcoin fund, launched again in 2013 as a belief, not an ETF. Being the unique bitcoin fund has helped it amass $20 billion in belongings. It formally transformed from a belief to an ETF when the opposite bitcoin ETFs launched in 2024.

ARK 21Shares Bitcoin ETF (ARKB): give attention to innovation

Bitcoin is well-aligned thematically with ARK, which is thought for investing in disruptive innovation. In an iShares vs. ARK battle, ARK most likely has a extra tech-savvy, high-conviction investor base, and ARKB’s $5 billion asset base makes it a official competitor to IBIT.

Extra ETFs

- Overlook VOO, SPY, VTI: Finest inventory investing decide is that this Constancy fund

- Dividend ETFs: One sudden ETF is outperforming Vanguard’s VIG and VYM

- Finest Vanguard ETFs for the remainder of 2025

Bitcoin ETF charges: why they matter most

Since all these bitcoin ETFs observe the value of spot bitcoin, their compositions are primarily the identical. The differentiator that helps decide the perfect bitcoin ETF comes all the way down to charges.

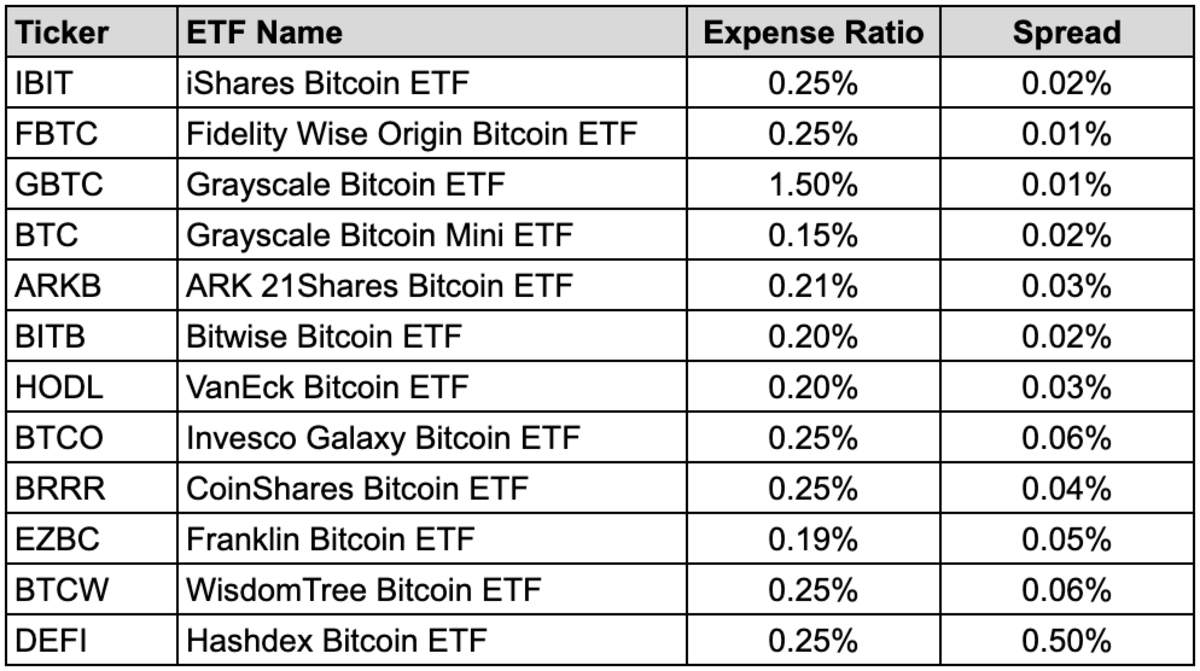

Listed below are the expense ratios and buying and selling spreads for the complete 12 Bitcoin ETF record (as of Oct. 9, 2025):

The most affordable bitcoin ETF in 2025 is the Grayscale Bitcoin Mini ETF (BTC), which is actually only a cheaper model of GBTC extra geared towards retail traders. Most assume it’s simply IBIT vs. FBTC, however Grayscale is the one profitable on charges.

In terms of bitcoin ETF charges, most have an annual expense ratio of 0.20% to 0.25%. GBTC has determined to maintain the payment from its pre-ETF days, however that creates a major efficiency drag for traders.

The unfold is the buying and selling value constructed into ETF transactions. Basically, bigger and extra closely traded ETFs have smaller spreads, and vice versa. A lot of the bitcoin ETFs are closely traded and, due to this fact, have small buying and selling spreads.

The underside line is that charges instantly impression bitcoin ETF efficiency.

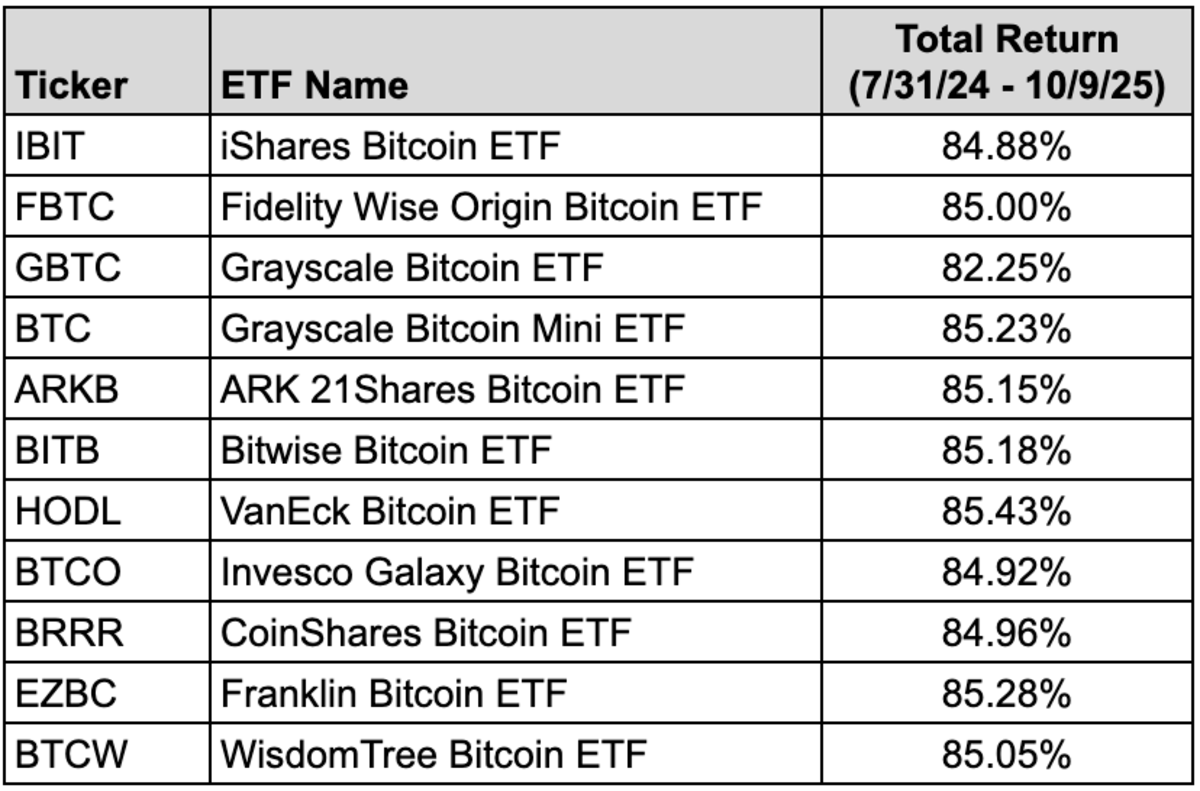

For the reason that composition of the spot bitcoin ETFs is actually the identical, the bottom value normally wins. Decrease charges equal higher shareholder returns, and that’s precisely what we’ve seen within the following bitcoin ETF efficiency chart.

With the bottom charges total, BTC is among the many best-performing bitcoin ETFs. HODL and EZBC have had higher returns traditionally, however they’ve additionally waived their charges prior to now, serving to to skew their returns larger.

GBTC and its unusually giant expense ratio have, not surprisingly, produced the worst returns. That makes GBTC the worst bitcoin ETF of the bunch.

Key takeaways:

- IBIT is one in all 12 spot bitcoin ETFs at present obtainable to traders.

- iShares’ greatest opponents are Constancy, Grayscale and ARK.

- Figuring out the perfect bitcoin ETF comes all the way down to charges and bills.

- Given that each one bitcoin ETFs put money into the identical factor, low charges normally win.

Is the iShares Bitcoin ETF nonetheless the perfect bitcoin ETF?

The iShares Bitcoin ETF is the biggest, however the Grayscale Bitcoin Mini ETF is the perfect.

BTC has the bottom expense ratio, and buying and selling charges are minimal. In a class the place each crypto ETF is actually the identical, the small particulars actually matter.

With Bitcoin ETFs, the differentiator is charges. Proper now, that makes BTC the perfect of the bunch.

Associated: Why the Schwab Dividend ETF (SCHD) Is shedding its edge to Vanguard