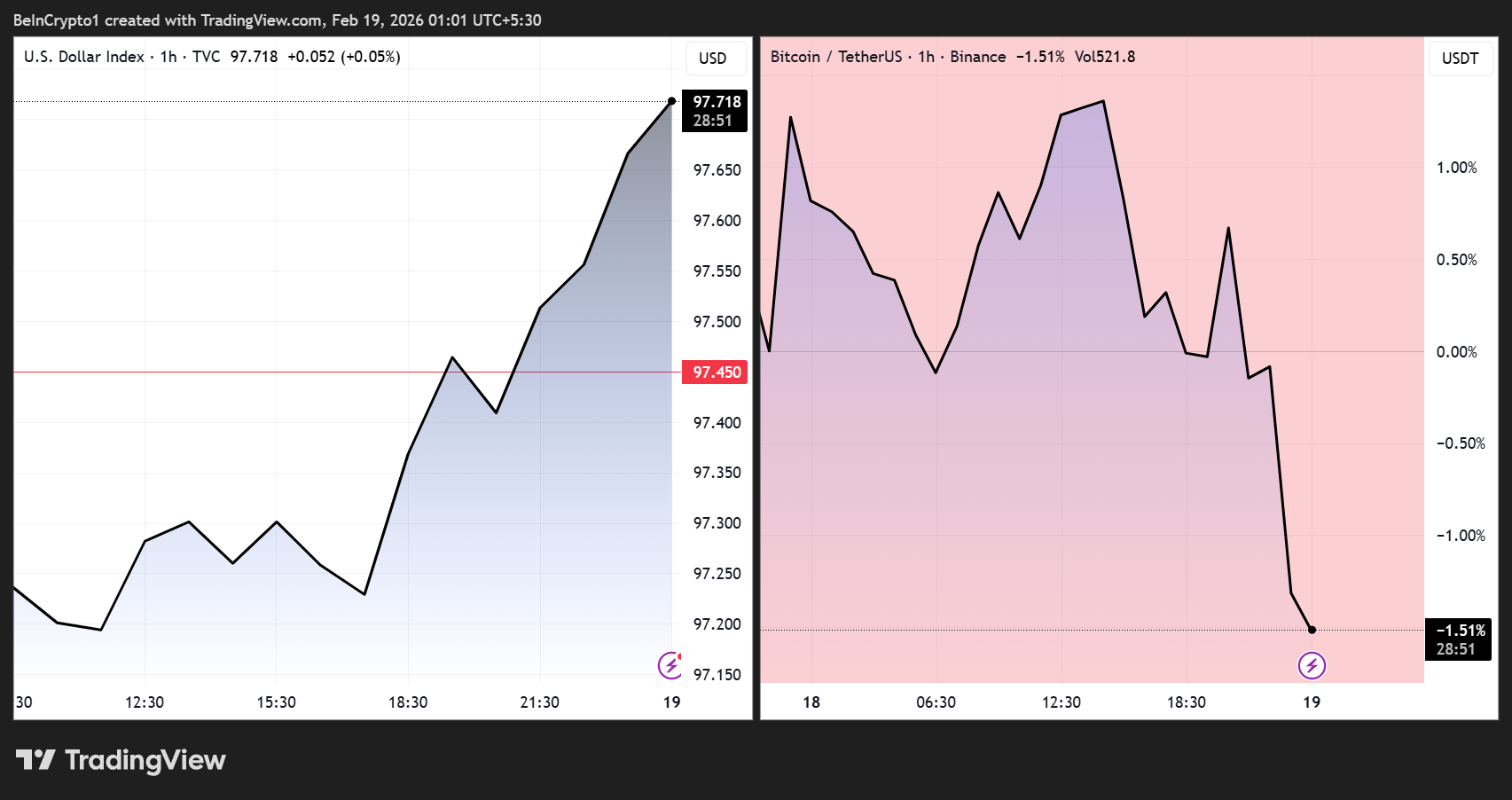

Bitcoin has emerged as the most important underperformer for the reason that launch of the FOMC minutes for the January 28 assembly, whereas the US greenback index and bonds rally.

The January FOMC assembly, which noticed two dovish dissents, mirrored a deeply divided Federal Reserve (Fed).

Sponsored

Sponsored

Fed Minutes Reveal Hawkish Divide as Bitcoin Struggles

Virtually all policymakers supported sustaining the federal funds charge at 3.50–3.75%, although a pair most well-liked a 25-basis-point minimize, citing restrictive coverage and labor market dangers.

A number of officers indicated that additional charge cuts could possibly be warranted if inflation declines as anticipated. In the meantime, others cautioned that easing too early amid elevated inflation might compromise the Fed’s 2% goal.

Some advocated for “two-sided” steering, highlighting that charges may must rise if inflation stays above goal.

*FED: SEVERAL WOULD’VE SUPPORTED TWO-SIDED LANGUAGE ON RATE PATH

*FED: SEVERAL SAW MORE CUTS IF INFLATION DECLINES AS EXPECTED

*FED: MOST CAUTIONED DISINFLATION COULD BE SLOWER THAN EXPECTED

— zerohedge (@zerohedge) February 18, 2026

Latest macroeconomic knowledge have bolstered Fed Chair Jerome Powell’s cautiously optimistic outlook.

Sponsored

Sponsored

Development has shocked to the upside, inflation seems to be drifting decrease, and the job market reveals indicators of steadying.

These developments have pushed 2026 rate-cut expectations larger, although a transfer in March is successfully off the desk following final week’s stronger-than-expected payroll report.

Curiosity Price Lower Chances. Supply: CME FedWatch Software

Market vulnerabilities had been additionally a focus, with a number of members noting dangers in non-public credit score and the broader monetary system.

Analysts counsel that these considerations, mixed with the Fed’s hawkish undertones, have contributed to safe-haven shopping for in bonds and the greenback, whereas Bitcoin continues to face downward strain.

Equities confirmed modest beneficial properties, with the Dow Jones Industrial Common up 0.24%, the S&P 500 up 0.59%, and the NASDAQ up 1.00%, reflecting cautious optimism in markets amid indicators from the Fed.

“The minutes show a Fed still divided but attentive to both inflation risks and growth momentum,” mentioned a senior market strategist. “Bitcoin’s underperformance is partly a reflection of risk-off sentiment and the dollar’s continued strength.”

Traders will now look ahead to any additional commentary from Fed officers as markets digest these minutes, weighing the stability between hawkish vigilance and dovish optimism in shaping 2026’s financial coverage trajectory.