Whereas Wall Road could also be satisfied the Federal Reserve (Fed) is about to slash rates of interest, many specialists argue the onerous financial knowledge says in any other case.

In the meantime, Bitcoin (BTC) is trying a restoration, reclaiming above the $111,000 threshold after displaying weak point earlier within the week.

Why Consultants Say Slicing Charges Now May Backfire

Sponsored

In accordance with the CME FedWatch Instrument, markets are pricing in a 99.6% likelihood that the Fed will minimize charges at its September assembly.

Curiosity Fee Minimize Possibilities. Supply: CME FedWatch Instrument

With barely two weeks to the following FOMC assembly, merchants deal with easing as a close to certainty. They wager a softer coverage stance will ignite one other spherical of liquidity-driven asset rallies.

Nevertheless, analysts warn that this consensus rests extra on sentiment surveys than on precise financial fundamentals.

Arduous Information vs. Mushy Narratives

Justin D’Ercole, founder and CIO at ISO-MTS Capital Administration, advised TradFi media that the onerous knowledge alerts the Fed mustn’t minimize charges.

Sponsored

He argued that policymakers threat being swayed by a false narrative arising from tender financial surveys.

D’Ercole famous that these surveys solely replicate shopper frustration with excessive costs however fail to seize the broader power of the economic system.

“The economy is growing at potential, stock valuations are extreme, inflation is running at 3%, and unemployment remains historically low,” The Monetary Instances reported, citing D’Ercole.

He added that out there mixture labor earnings is rising at a 4–5% tempo, whereas bank card delinquencies are down yr over yr. Even industrial actual property, typically painted as a looming disaster, reveals enhancing asset high quality and decrease mortgage delinquencies.

Markets Need Cuts, However Information Says In any other case Amid 2024 Echoes

Sponsored

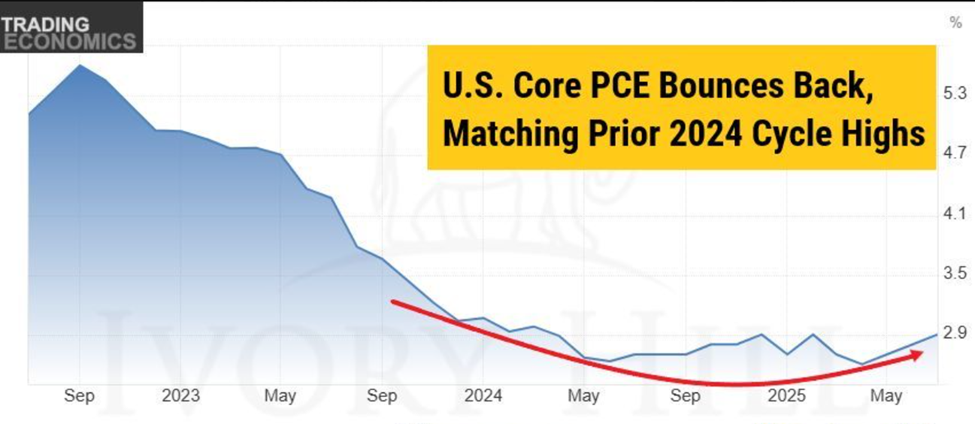

Elsewhere, Kurt S. Altrichter, founding father of Ivory Hill, echoed the sentiment. In a current put up on X (Twitter), he referred to the PCE (Private Consumption Expenditure) inflation knowledge.

“Core PCE is back at 2.9%. Inflation isn’t dead, it’s re-accelerating. GDP just printed 3.3%. That’s not a backdrop for rate cuts. If the Fed forces the cut through, it’s likely the only cut before Powell’s term ends on May 15, 2026. Remember: the market wants a rate-cutting cycle. The data says no,” Altrichter articulated.

US PCE Information Since 2023. Supply: Altrichter on X

US PCE Information Since 2023. Supply: Altrichter on X

Altrichter argued that the chance is that the Fed will cave to market stress on the expense of its long-term credibility in its inflation battle.

Different observers warn of economic market instability if the Fed repeats the 2024 playbook. Impartial analyst Ted in contrast the present setup to September 2024.

Sponsored

A shock rate of interest minimize final yr initially drove crypto markets larger earlier than triggering a pointy reversal.

“September 2024 Fed cut rates, and #Altcoin MCap pumped 109% in just 3 months. After that, $BTC dumped 30%, while alts crashed 60%-80%. In September 2025, the Fed will cut rates again and commit to more cuts. It seems like history will repeat itself. First, a pump for 1–2 months and then a major crash,” wrote Ted.

Sponsored

The broader debate boils right down to credibility versus reduction. Slicing charges could briefly ease stress on indebted households and companies. Nevertheless, critics argue it dangers fueling inflationary pressures, asset bubbles, and long-term instability.

“Is saving more marginal jobs in the US economy now more important than maintaining inflation-fighting credibility and financial stability for all consumers?” D’Ercole posed.

With markets already celebrating a minimize but to occur, the Fed faces considered one of its hardest coverage assessments in a long time, deciding whether or not to comply with the information or the group.