Ethereum trades above $4,540 at press time on September 12, up practically 3% prior to now 24 hours. Weekly features stand close to 4.7%, whereas month-on-month modifications stay muted at –1.9%. Nonetheless, the breakout that befell on September 10 has put the Ethereum worth again within the highlight.

The falling wedge breakout now in movement suggests room for additional features, with on-chain and derivatives information displaying that two highly effective teams are backing the transfer. Collectively, their actions level to a possible run towards $5,110 if circumstances maintain.

Sponsored

Sponsored

Spot Holders Step Again Whereas Derivatives Merchants Surge In

Ethereum’s rally has been marked by a pointy drop within the Spent Cash Age Band (SCAB). On September 4, cash transferring throughout all age teams reached 417,000 ETH. By September 12, that determine had plunged to simply 148,000 ETH (a 64.5% drop), even with a short lived spike to 365,000 ETH on September 11.

This drop or spot cooldown stands out as a result of current native ETH worth highs, corresponding to August 14 and August 27, noticed spent cash bounce above 500,000 ETH.

Ethereum Spot Market Cools Down: Santiment

In different phrases, rallies earlier in the summertime noticed heavy promoting from older cash. Now, the other is going on. The decline in spent cash reveals that holders — even these with long-held ETH — will not be promoting into the rally. This provides conviction to the breakout, since fewer cash are hitting the market.

The Spent Cash Age Band (SCAB) metric tracks the distribution of cash being moved by age. It reveals whether or not outdated provide is pressuring the market or staying quiet.

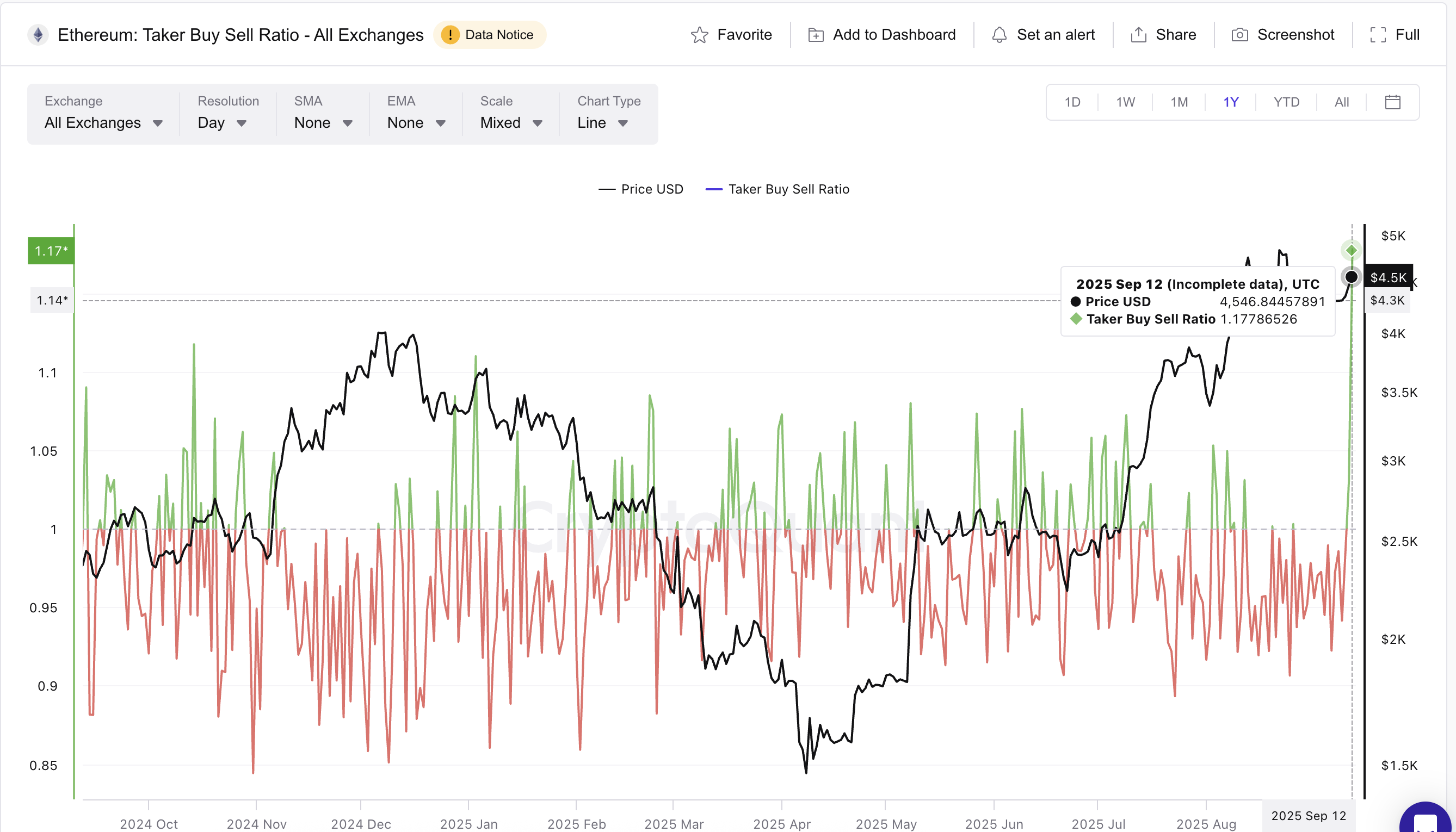

On the identical time, derivatives exercise has surged. The Taker Purchase/Promote Ratio has climbed above 1.0, signaling that patrons are dominating order books by absorbing promote orders. The ratio started rising on September 10, simply as Ethereum broke out of its falling wedge (which we’ll talk about later within the piece), and peaked at 1.17, the best stage in over a yr.

Sponsored

Sponsored

Such peaks usually present aggressive shopping for stress. For context, one of many final main spikes occurred on August 3, when the ratio jumped and Ethereum rallied from $3,490 to $4,750, a close to 36% surge. Whereas these surges typically quiet down later within the day, the present studying underlines sturdy speculative demand from derivatives merchants.

The mix is highly effective: spot holders are displaying conviction by not promoting, and derivatives merchants are piling in with bullish bets. These two cohorts collectively give Ethereum’s breakout a supportive basis.

Falling Wedge Breakout Factors Towards $5,100 for the Ethereum Worth

Ethereum’s technical construction additionally helps this bullish setup. On September 10, ETH confirmed a breakout from a falling wedge — a sample the place costs kind decrease highs and decrease lows inside narrowing traces, ultimately breaking upward.

The goal for this transfer is measured by taking the vertical distance between the wedge’s highest and lowest factors. That distance is then projected from the breakout stage. That provides a goal of above $5,110, or practically 12% larger than present ranges, if market circumstances permit.

Earlier than that, the Ethereum worth should clear a number of resistance ranges. The primary sits at $4,630, adopted by $4,790 and the prior Ethereum worth peak of just about $4,950.

On the draw back, $4,380 is speedy assist. But, a drop below $4,279 would invalidate the falling wedge breakout fully and return ETH to a impartial outlook. And issues get bearish if the value falls below $4,060, one thing that doesn’t look doubtless within the near-term.