Ethereum is making an attempt to stabilize after weeks of heavy promoting. The value is holding close to the $1,950 zone, up round 6% from its current low. On the identical time, the most important Ethereum whales have began accumulating aggressively.

However short-term sellers and derivatives merchants stay cautious, making a rising tug-of-war across the subsequent transfer.

Greatest Ethereum Whales Accumulate as Bullish Divergence Stays Intact

On-chain information reveals that the biggest Ethereum holders are positioning for a rebound. Since February 9, addresses holding between 1 million and 10 million ETH have elevated their holdings from round 5.17 million ETH to just about 6.27 million ETH. That’s an addition of greater than 1.1 million ETH, price roughly $2 billion at present costs.

Sponsored

SponsoredEthereum Whales: Santiment

This accumulation aligns with a bullish technical sign on the 12-hour chart.

Between January 25 and February 12, Ethereum’s worth made a decrease low, whereas the Relative Energy Index, or RSI, fashioned a better low. RSI measures momentum by evaluating current positive factors and losses. When worth falls, however RSI rises, it typically alerts weakening promoting stress.

This bullish divergence suggests draw back momentum is fading.

The construction stays legitimate so long as Ethereum holds above $1,890, as the identical sign flashed even on February 11 and nonetheless appears to be holding. A breakdown under this degree would invalidate the divergence for now and weaken the rebound case.

For now, whales look like betting that this assist will maintain.

Sponsored

Sponsored

Brief-Time period Holders Are Promoting?

Whereas giant traders are accumulating, short-term holders are behaving very otherwise.

The Spent Cash Age Band for the 7-day to 30-day cohort has surged sharply. Since February 9 (the identical time when the whale pickup began), this metric has risen from round 14,000 to just about 107,000, a rise of greater than 660%. This indicator tracks what number of lately acquired cash are being moved. Rising values normally sign attainable profit-taking and distribution.

In easy phrases, short-term merchants are exiting positions. This sample appeared earlier in February as properly. On February 5, a spike in short-term coin exercise occurred close to $2,140. Inside someday, Ethereum dropped by round 13%.

That historical past reveals how aggressive promoting from this group can shortly reverse strikes. So long as short-term holders stay lively sellers, upside strikes are more likely to face resistance.

Sponsored

Sponsored

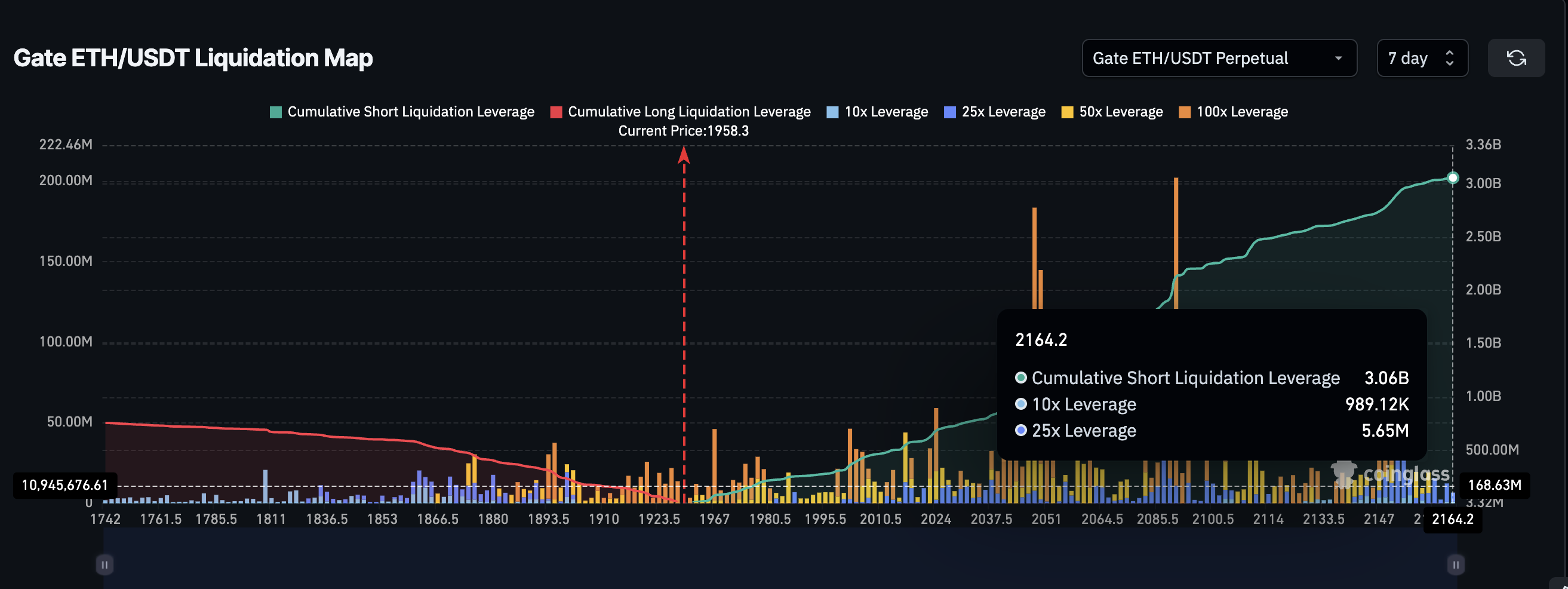

Derivatives Information Reveals Heavy Bearish Positioning

Derivatives markets are reinforcing this cautious outlook. Present liquidation information reveals practically $3.06 billion in brief positions stacked in opposition to solely about $755 million in lengthy leverage. This creates a closely bearish imbalance with nearly 80% of the market betting on the quick aspect.

On one hand, this setup creates gasoline for a possible quick squeeze if costs rise. Alternatively, it reveals that the majority merchants nonetheless anticipate additional weak point. This retains momentum muted however retains the bounce hope alive if the whale shopping for pushes the costs up, even a bit of bit, crossing previous key clusters.

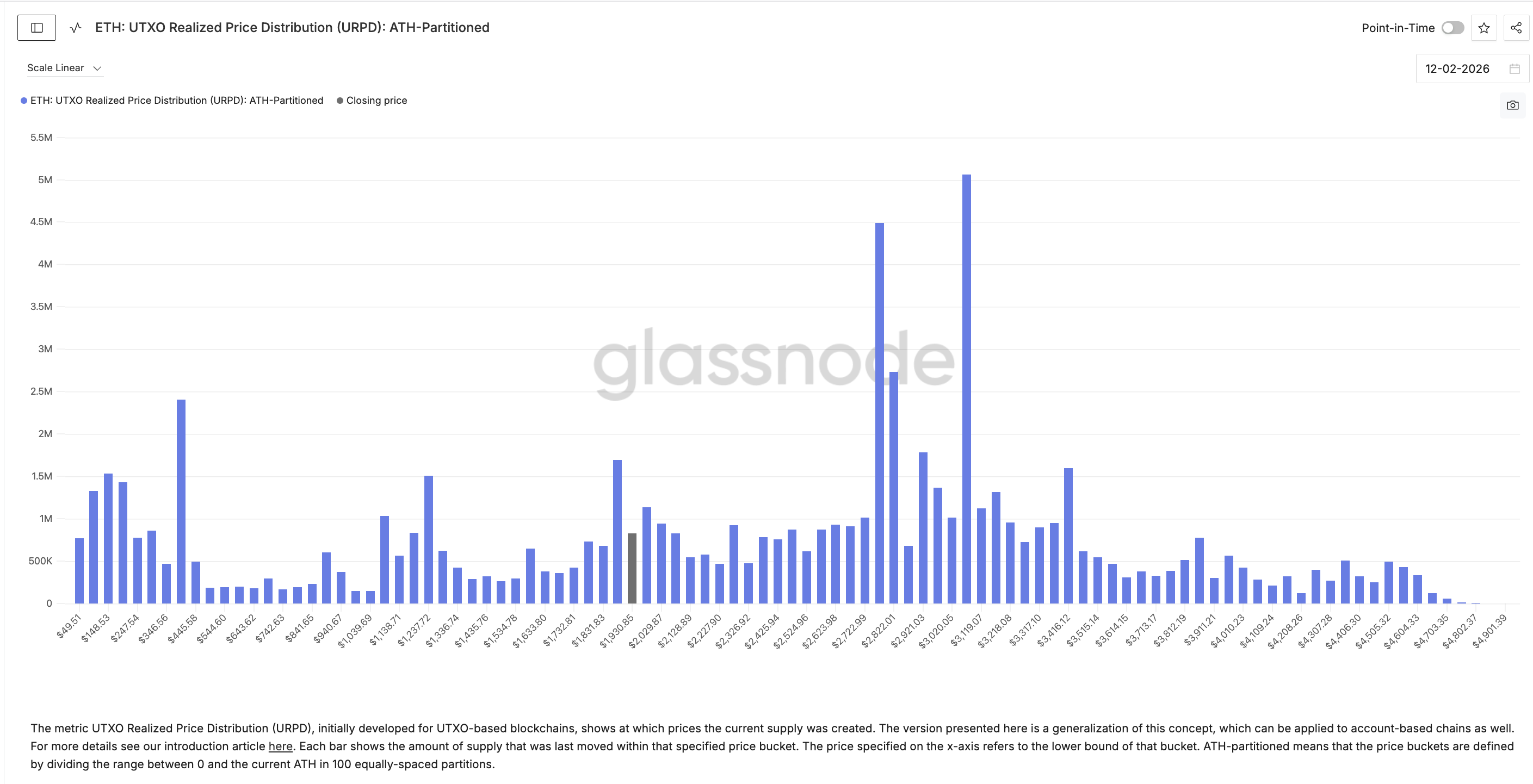

On-chain value foundation information helps clarify why Ethereum struggles to interrupt greater. Round $1,980, roughly 1.58% of the circulating provide, was acquired. Close to $2,020, one other 1.23% of provide sits at breakeven. These zones signify giant teams of holders ready to exit with out losses.

Sponsored

When worth approaches these ranges, promoting stress will increase as traders attempt to recuperate capital. This has repeatedly capped current bounces. Solely a robust leverage-driven transfer or quick squeeze would doubtless be highly effective sufficient to push by means of these provide clusters.

Till then, these zones stay main obstacles.

Key Ethereum Value Ranges To Monitor Now

With whales shopping for and sellers resisting, Ethereum worth ranges now matter greater than narratives.

On the upside, the primary main resistance sits close to $2,010. A clear 12-hour shut above this degree would enhance the chance of quick liquidations. And it sits close to the important thing provide cluster.

If that occurs, Ethereum might goal $2,140 subsequent, a robust resistance zone with a number of touchpoints. It additionally sits round 10% from the present ranges. On the draw back, $1,890 stays the important assist. A break under this degree would invalidate the bullish divergence and sign renewed draw back stress. Beneath that, the subsequent main assist sits close to $1,740.

So long as Ethereum holds above $1,890 and continues testing $2,010, the rebound construction stays intact. A sustained breakdown under assist would cancel the present restoration try.