Picture supply: Getty Photographs

Duolingo (NASDAQ:DUOL) is a progress inventory that has been on a stomach-churning spherical journey since its IPO in 2021.

After opening at $141, it misplaced 50% of its worth by way of the start of 2023, earlier than surging 630% to a peak of $544 by Might 2025. Since then, it has crashed 73% and is now again the place it began at $142.

I purchased shares of the language studying agency 3 times in 2025. And my holding is now deep underwater with a lack of 50%.

¡Qué desastre!

Is Duolingo now doomed in my Shares and Shares ISA?

Guidelines

After I first explored Duolingo, I wasn’t satisfied. I feared this was only a buzzy, gamified language studying app that would simply be replicated.

Simply because an app is in style, it doesn’t imply that interprets (pun meant) into an excellent funding (see Snap or Pinterest). I nervous that Duolingo had no sturdy moat.

Nonetheless, one after the other, it began ticking off containers on my progress inventory guidelines. Beneath, I’ve listed a few of them.

Massive market?There are almost 2bn language learners. Duolingo has 52m day by day lively customers (~3% of the whole). Fixing an issue? Languages want day by day apply. Duolingo gamifies the training expertise to maintain customers motivated. Proprietary moat?Its AI mannequin is skilled on billions of day by day studying occasions. No rival has 10+ years of granular information. Wholesome unit economics?The agency boasts sturdy profitability and free money circulation. Is it progressive?Duolingo makes use of AI-powered avatars to apply talking expertise in actual time.Visionary management?CEO Luis von Ahn invented reCAPTCHA. He intends the AI-driven app to show billions of individuals.Optionality?Sure. Duolingo now affords maths, music, and chess programs, in addition to 40+ languages.

On prime of this, I search for one thing unusual or distinctive in my progress corporations (a sure je ne sais quoi, because it had been). The corporate ticks this field with its weird Duo owl mascot and quirky social media campaigns.

Von Ahn describes the agency’s tradition as “wholesome but unhinged”.

What’s gone flawed?

The corporate’s newest outcomes for Q3 2025 had been stable. Income jumped 41% to $271.7m, whereas the adjusted EBITDA margin expanded to 29.5% from 24.7% the yr earlier than. Paid subscribers elevated 34% to 11.5m, with Asia now the agency’s fastest-growing area.

Nonetheless, two issues have spooked the market. One is that the agency goes to concentrate on “making the free model the most effective it’s ever been…An amazing free product drives phrase of mouth and, in the end, subscriptions“.

Wall Road hates it when corporations sacrifice near-term income to drive long-term progress. The inventory cratered 25% after the Q3 outcomes.

In 2005, Amazon inventory additionally crashed when CEO Jeff Bezos introduced an “all-you-can-eat express shipping” service (aka Amazon Prime). Wall Road loathed this “charity mission“, nevertheless it in the end strengthened Amazon’s aggressive place.

I believe Duolingo’s transfer to enhance the app’s educating high quality will finally end in extra subscriptions, which is able to drive earnings progress. However a slowdown in bookings clearly provides near-term uncertainty.

A second concern is a basic one about AI disrupting whole software program/know-how classes. In Duolingo’s case, some buyers concern learners will change to ChatGPT and different free AI apps.

Whereas this can be a theoretical danger, it hasn’t occurred but, nor has a rival language app been knocked up in per week with AI-generated code. Moreover, it must encourage behavior formation to cease learners quitting, which is what Duolingo has mastered.

Personally, I believe the AI menace is massively overblown. However solely time will inform.

Doomed Duolingo?

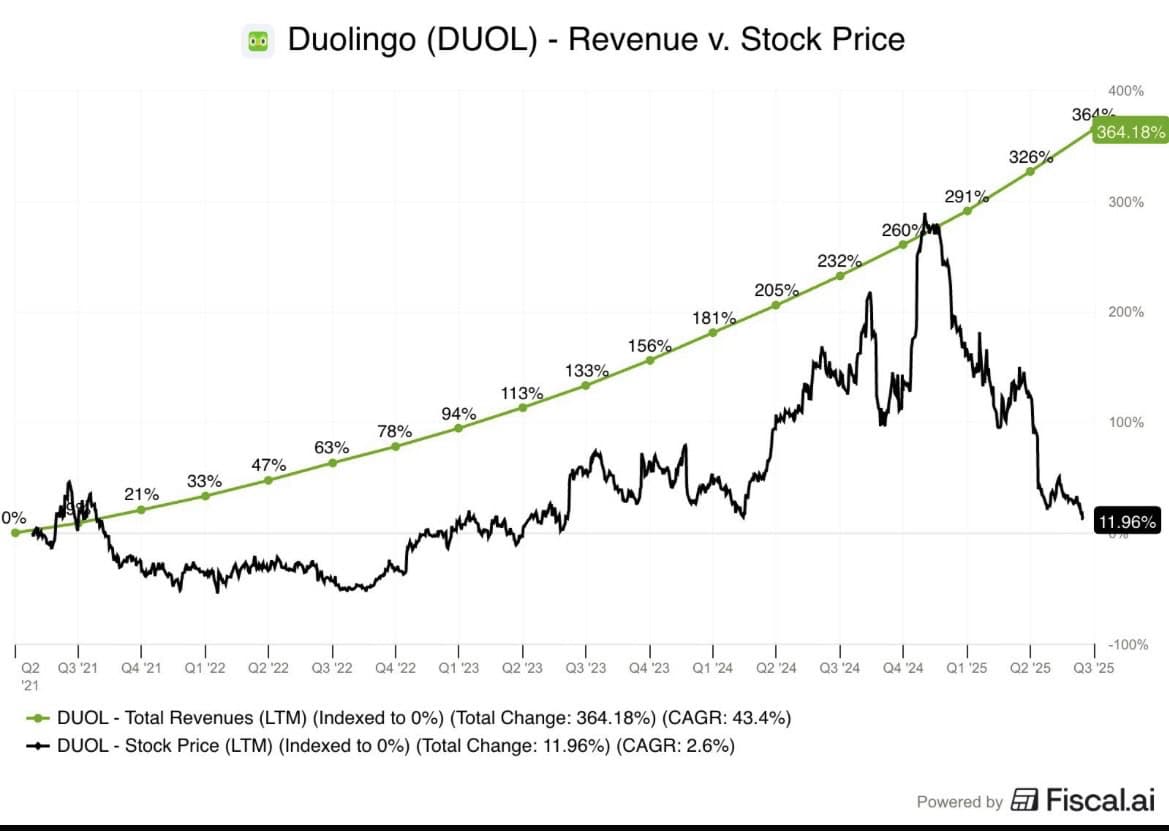

Duolingo is again at its IPO value regardless of rising income almost 4 instances and the variety of paid subscribers nearly 5 instances since 2021. Even CNBC’s Jim Cramer, who doesn’t fee Duolingo’s prospects, now thinks the inventory is “oversold“.

Supply: Fiscal.ai

Supply: Fiscal.ai

So there’s now a stark mismatch between the share value and underlying fundamentals. As such, I received’t be promoting my shares, and I nonetheless assume the inventory’s price contemplating as a part of a diversified ISA.