When individuals search for a dividend ETF to put money into, they often goal the business’s largest names: the Vanguard Dividend Appreciation ETF (VIG), the Vanguard Excessive Dividend Yield ETF (VYM), the iShares Core Dividend Development ETF (DGRO), and the Schwab U.S. Dividend Fairness ETF (SCHD).

- Just a few dividend ETFs have crushed the S&P 500 in 2025

- The LAFFER TENGLER Fairness Revenue ETF is among the many better of the perfect proper now

- Why is TGLR such a profitable dividend ETF?

- Key takeaways for TGLR:

Collectively, these funds handle $270 billion of investor cash.

However greater isn’t all the time higher. DGRO and VYM carry 4-star Morningstar rankings, however VIG and SCHD solely have 3-star rankings, indicating simply common risk-adjusted returns over time. In actual fact, SCHD has been one of many worst-performing ETFs inside its Morningstar class over the previous 1-, 3- and 5-year intervals.

Typically it’s essential dig to search out higher choices, since efficiency solely tells a part of the story.

In the event you discover a strong-performing dividend ETF and uncover that it’s additionally backed by a sensible and considerate inventory choice technique, that’s when you understand you could have discovered a little-known winner.

Just a few dividend ETFs have crushed the S&P 500 in 2025

It’s not stunning that dividend shares haven’t been the perfect performers this 12 months. That market continues to be managed by tech, development, and AI-driven shares. The Magnificent 7 shares are nonetheless driving the narrative, and most buyers need to preserve leaping in earlier than the rally runs out of gasoline.

Dividend shares, which consist largely of well-established, sturdy, mature firms, haven’t discovered a number of curiosity. When AI appears to be taking up the world, no person needs to put money into firms that make cereal and loo tissue.

Associated: Neglect VOO, SPY, VTI: Greatest inventory investing decide is that this Constancy fund

There are some winners within the dividend ETF area, however they’re few and much between. Of the 108 U.S. dividend ETFs listed within the ETF Motion database, simply 10 are beating the S&P 500 year-to-date.

One in all them, nevertheless, is performing exceptionally nicely. Not solely is it an elite performer throughout the dividend ETF universe, it’s an elite performer inside its whole Morningstar class.

The LAFFER TENGLER Fairness Revenue ETF is among the many better of the perfect proper now

Don’t really feel unhealthy in the event you haven’t heard of the LAFFER TENGLER Fairness Revenue ETF (TGLR). Most individuals haven’t.

With a mere $19 million in AUM, it resides under the radar for a lot of buyers. However a fund doesn’t have to be large to carry out nicely. It simply wants a sensible technique and a few success at hitting the appropriate shares on the proper time. TGLR has carried out simply that.

Its 21% year-to-date return (as of Oct. 2, 2025) is thrashing the S&P 500 by practically 6% and VIG & VYM by roughly 9%. Inside the U.S. dividend ETF class, it is the second-best-performing ETF over the year-to-date and 1-year intervals (it hasn’t been round lengthy sufficient to qualify for something additional).

Its efficiency in opposition to its large-cap worth fund friends could also be higher. Of practically 1,000 funds, TGLR ranks within the high 1%.

A snapshot of TGLR efficiency.

Supply: Morningstar

Why is TGLR such a profitable dividend ETF?

To know how TGLR has carried out so nicely, we have to do a deeper dive into the portfolio and the way it’s constructed.

The method begins by a lot of qualitative and quantitative basic elements. Based on the fund’s prospectus:

Qualitative Components:

- Catalyst for Outperformance

- Franchise Worth & Market Development

- High Administration/Board of Administrators

Quantitative Components:

- Gross sales/Income Development

- Working Margins

- Relative P/E

- Constructive Free Money Circulation

- Dividend Protection/Development

- Asset Turnover Ratio

- Use of Money (buyback, debt, dividend)

- Leverage

- Monetary Threat

Utilizing this as a basis, it then evaluates equities utilizing two proprietary valuation metrics — relative dividend yield (RDY) and relative price-to-sales ratio (RPSR). With the top quality profile established utilizing basic metrics, the RDY and RPSR measures assist determine present worth alternatives throughout the large-cap dividend inventory universe.

In abstract, you’ve received a multi-factor method — high quality and worth. The ultimate consideration, the inventory’s dividend, helps TGLR produce an total yield greater than that of the S&P 500.

The ensuing portfolio does have a definite tech presence, however not an outsized one. It’s comparatively diversified with double-digit allocations to tech, shopper discretionary, financials, and industrials.

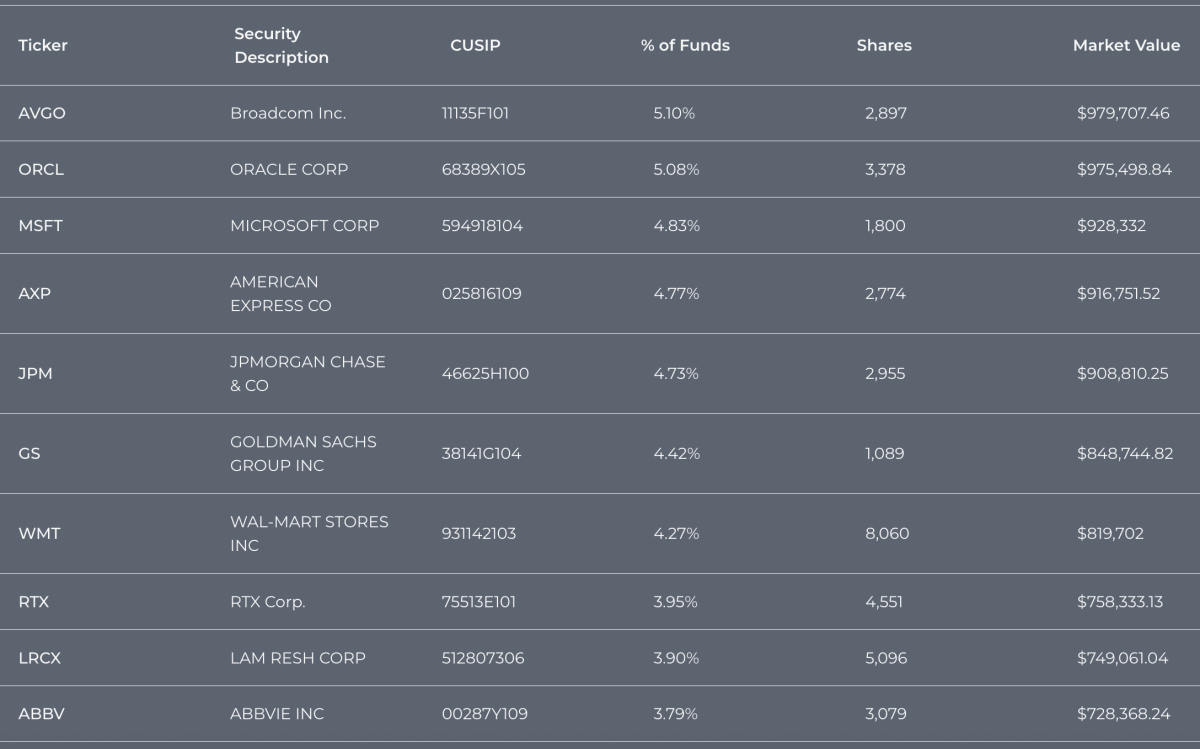

The TGLR inventory portfolio.

Supply: LAFFER TENGLER

The fund solely holds about 25-35 positions, so there’s a focus issue to contemplate, however that implies that these are high-conviction picks.

The truth that TGLR is actively managed implies that latest outperformance is a results of supervisor talent and aptitude. This issue is commonly a robust predictor of long-term success.

Key takeaways for TGLR:

- TGLR makes use of deep basic analysis for energetic inventory choice.

- The portfolio tilts in the direction of top quality, worth, and above-average yield.

- TGLR is the second-best-performing U.S. dividend ETF 12 months thus far.

- Its efficiency ranks within the high 1% of Morningstar’s Giant Worth class.

TGLR can proceed this outperformance development

Given its historical past of superior absolute and risk-adjusted returns, TGLR in all probability deserves extra consideration than it’s getting. It has a well-rounded inventory choice method, emphasizes high quality, worth, and short-term catalysts and has the observe document that proves this system works.

The administration crew has additionally demonstrated a capability to ship for shareholders.

The market could have you concentrate on VIG, VYM, and different standard dividend ETFs. You must also be specializing in TGLR.

Associated: QQQ vs. QQQM vs. QQQJ: Current tech vs. future innovation