Picture supply: Getty Pictures

This week, the Diageo (LSE: DGE) share value dropped about 5.9%, becoming a member of different beverage giants like Brown-Forman (roughly -5%) and Constellation Manufacturers (-4.9%) among the many hardest hit within the sector.

Over the previous 12 months, Diageo’s market cap has misplaced roughly 17% of its worth. Income has been solely mildly weaker, however earnings will not be. In H2 FY2025, earnings sank to round £323m, in contrast with about £1.31bn in the identical interval a 12 months earlier.

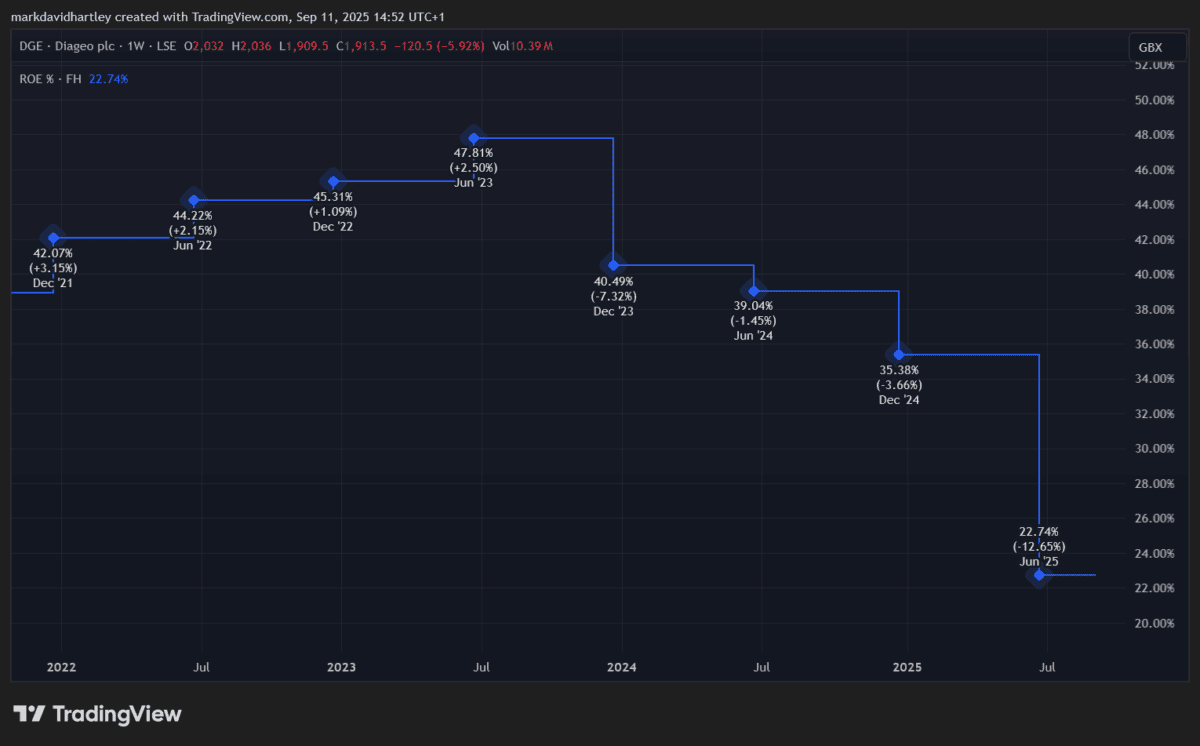

Web margin dropped from 19% to about 11.6% and return on fairness (ROE) has greater than halved since mid-2023.

Created on TradingView.com

Created on TradingView.com

These aren’t small fluctuations – they replicate actual stress on the enterprise.

What’s behind the slide?

A couple of forces are colliding. Throughout Europe, consumption of alcohol has been sliding and US tariff stress have added to prices. A Jefferies survey of three,600 shoppers discovered that rising monetary issues are inflicting many to drink much less – practically 60% cited monetary pressure as a purpose, up sharply from 36% in 2021.

In response, beverage corporations together with Diageo are being pushed to drive premium manufacturers or pivot towards low- or zero-alcohol options.

In help of a restoration

Amid the gloom there are indicators Diageo is attempting to proper the ship. The corporate is implementing value financial savings and unveiled a $500m financial savings programme, aiming to hit $3bn free money circulate a 12 months from FY26 onward. It’s additionally pushing its ‘Accelerate’ programme to enhance productiveness and cut back leverage.

In the meantime, the 4% dividend yield stays engaging to income-oriented traders and seems to be lined, although margins are squeezing.

The product combine is shifting, too. Prepared-to-drink (RTD) spirits, canned cocktails, and flavoured malt drinks appear to be rising in attraction amongst youthful drinkers. If Diageo can seize sufficient of that market whereas controlling rising prices, there may be potential for restoration.

For value-savvy traders, the present pricing might be a compelling alternative to contemplate — offered the dangers are famous.

Diageo’s monetary image and threat elements

Trying nearer at latest financials, Diageo’s natural web gross sales grew 1.7% 12 months on 12 months whereas working revenue slipped 0.7%.

Free money circulate rose modestly to £2.07bn, whereas web debt crept to £15.8bn, giving a leverage ratio of three.4 occasions web debt to adjusted EBITDA. These figures recommend the enterprise is incomes much less on gross sales and carrying a notable debt burden.

Inflation and cost-of-goods pressures stay a key threat. Tariffs nonetheless loom, notably within the US, the place Diageo’s whisky and spirits from Mexico and Canada play a big position. Moreover, exchange-rate fluctuations are dragging on income in some markets.

Maybe most critically, altering shopper preferences towards average or lower-alcohol choices are a key risk to its enterprise mannequin.

Is Diageo a inventory to contemplate now?

It’s sophisticated. Diageo could get well if it might successfully shift its portfolio towards trendier shopper preferences, rein in prices, and cut back its leverage.

For long-term revenue traders, the dividend yield nonetheless seems to be interesting. However with weakening margins, rising money owed, and shopper behaviour shifting, the dangers are actual.

For these holding the shares already, it could be a matter of ready to see whether or not restoration indicators flip into stable outcomes. For these contemplating Diageo, there’s nonetheless alternative — but it surely’s positively a inventory to method with eyes vast open.