It may very well be labeled as crypto’s November Nightmare. DeFi protocol Balancer was exploited to the tune of $128 million. Additionally, Stream Finance introduced a lack of $93 million, resulting in the depegging of its xUSD stablecoin. Each occurred on November 3.

Decentralized finance is vulnerable to dangers, which might cascade into additional systemic issues. And people issues may very well be extreme – over $150 billion in worth is presently locked into DeFi.

Which begs the query: How a lot does the lack of over $220 million in in the future deliver into query the long-term dangers that DeFi poses to the crypto ecosystem?

Sponsored

Sponsored

Sensible Contract Composability

A number of consultants informed BeInCrypto that good contracts are possible the primary perpetrator behind the Balancer Hack.

“From a technical standpoint, these attacks stemmed from vulnerabilities in the smart contracts themselves, which hackers exploited to drain liquidity pools,” stated Tim Solar, Senior Researcher at monetary companies agency HashKey Group. “This highlights a deeper issue, even mature and previously audited protocols remain exposed to risks under complex contract structures.”

Sensible contracts, that are self-executing capabilities that permit DeFi to function autonomously, are nonetheless comparatively new.

It wasn’t till the reside launch of the Ethereum community in 2015 that good contract programming on a blockchain turned attainable. The good contract sector itself is anticipated to develop 10x over the following decade.

The worldwide good contract sector is anticipated to be nearly $15 billion by 2033. Supply: Market.us

As well as, numerous capabilities throughout protocols require good contracts to work collectively in tandem, a time period within the business referred to as “composability”.

Basically, good contracts are like cash Legos. Every contract is a bit of Lego or constructing block that powers a DeFi protocol. So, systematic issues can happen if the foundations are usually not robust.

“The Balancer exploit is another reminder of how DeFi’s composability, its biggest strength, also creates complex interdependencies that amplify risk,” famous Mark Peng Zho, Common Companion at crypto VC agency Mireafund.

Sponsored

Sponsored

Cease Versus Begin

The largest distinction between Balancer’s exploit and the Stream losses is what occurred to the 2 tasks afterwards.

Throughout the previous 24hrs we have now heard considerations round Stream Finance’ xUSD.

Elixir has full redemption rights at $1 with Stream for its lending place. We’re the one creditor with these 1-1 rights.

deUSD stays absolutely backed and Elixir is starting the method of unwinding…

— Elixir (@elixir) November 3, 2025

DeFi is meant to function 24/7 and mechanically.

So, when Stream determined to briefly droop deposits and withdrawals, the xUSD stablecoin misplaced 77% of its worth.

It didn’t assist {that a} counterparty to xUSD, Elixir, had a behind-the-scenes deal in place with Stream to redeem xUSD at a 1:1 ratio. It’s time for extra transparency from tasks like Stream, which claims in its advertising to be a DeFi “superapp”.

Sponsored

Sponsored

Crypto group members had been making noise earlier than the November Nightmare about Stream Finance.

xUSD has ~$170M backing it on-chain.

They’re borrowing ~$530M from lending protocols.

That’s 4.1x leverage. On many illiquid positions.

This isn’t yield farming.

That is degen playing.

Steer clear of this.

Don’t contact Morpho / Euler vaults tied to this trash.

— CBB (@Cbb0fe) October 28, 2025

There’ll should be extra readability from DeFi protocols like Stream sooner or later. “What this triggers is a shift from blind composability to accountable composability,” stated Sid Sridhar, founding father of the stablecoin protocol of Bima Labs.

“We’re going to see protocols that isolate risk at the vault level, implement circuit breakers, use validator-governed insurance and publish live proofs of solvency.”

Market Reactions To DeFi’s November Nightmare

It wasn’t way back that Ethereum scion Vitalik Buterin mentioned the idea of “low-risk DeFi” to regularly introduce blockchain to TradFi.

Sponsored

Sponsored

Maybe Buterin suspected that there have been nonetheless points with DeFi safety, composability, and transparency.

That could be the case till the sector reaches larger maturity, when as an alternative of one-off safety audits, they’re performed usually.

A type of real-time monitoring could also be obligatory, just like conventional centralized techniques that focus extra on offense somewhat than protection.

“These vulnerabilities will drive the industry to upgrade its security architecture, making continuous and high-frequency smart contract audits the norm,” famous HashKey Solar.

However, merchants might be looking out for instabilities akin to DeFi exploits for alternatives to revenue.

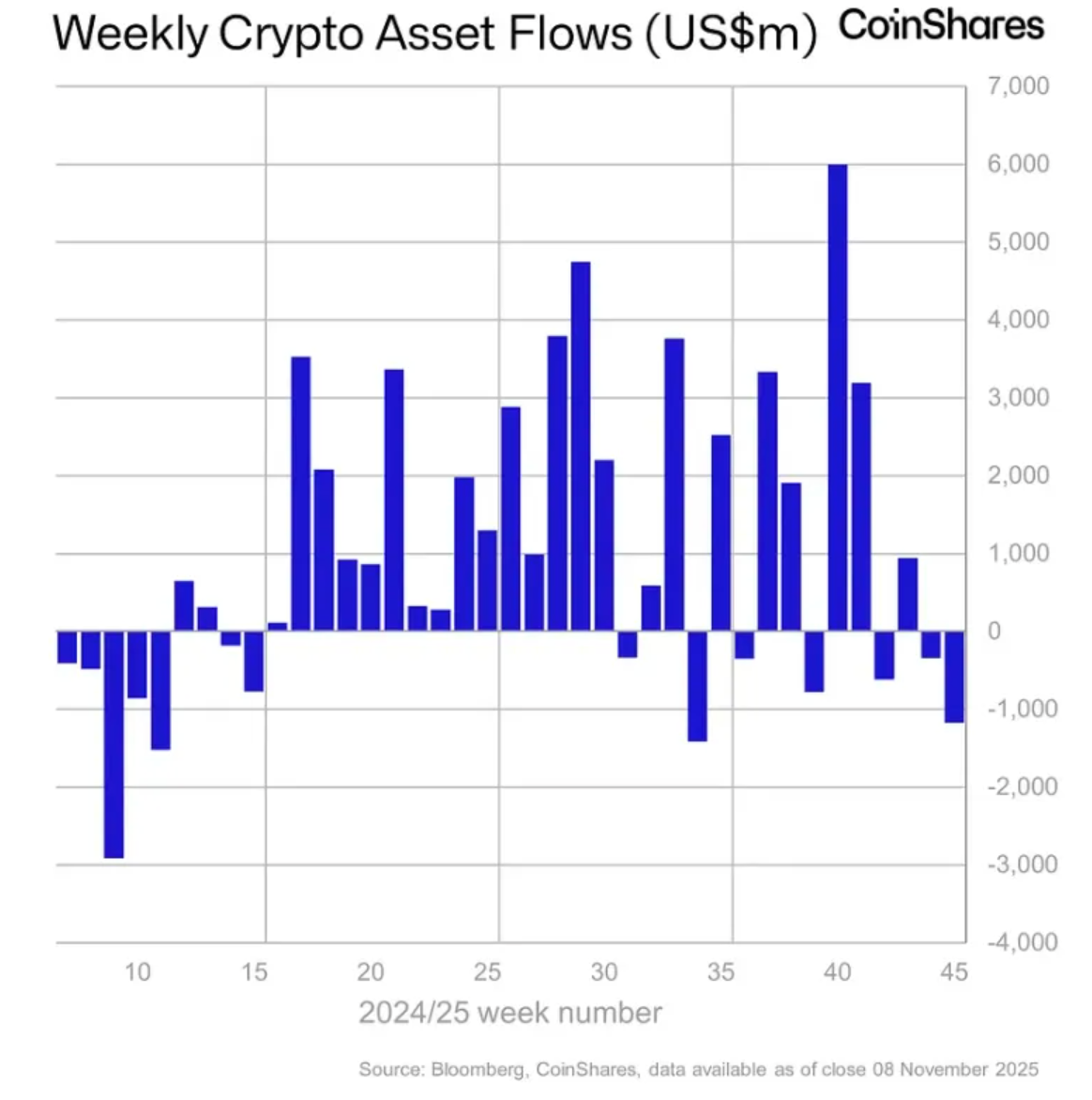

In fact, capital inflows sign purchase, however capital outflows imply promoting, and for a market opportunist, a short-oriented buying and selling scenario on the draw back.

“While such incidents will not end the DeFi sector, in the short term they will trigger capital outflows, loss of trust, and liquidity contraction,” added Solar. “Traditional finance took a century to learn how to price counterparty risk and manage settlement safely,” stated Bima’s Sridhar. “DeFi will get there in a fraction of the time, but in code instead of regulation.”