Dave Ramsey, one of many loudest voices in private finance, constructed the majority of his wealth by means of actual property and later by means of his profession in private finance media. Now at age 65, a lot of his recommendation—which he dispenses on his video/audio podcast The Ramsey Present—focuses on retirement.

- Who’s Dave Ramsey & why is he thought of a retirement professional?

- Dave Ramsey’s 5 most essential retirement insights

Whereas many financially minded youthful individuals choose to think about retirement as a far-off eventuality, the reality is that the easiest way to organize for it’s to begin early. Even college students and other people simply starting their careers can profit vastly by taking just a few easy steps to set themselves up for fulfillment many years down the road.

Right here, we’ve collected and distilled 5 of Dave Ramsey’s finest items of retirement recommendation that anybody can profit from, whether or not they plan to retire in 10 years or 40.

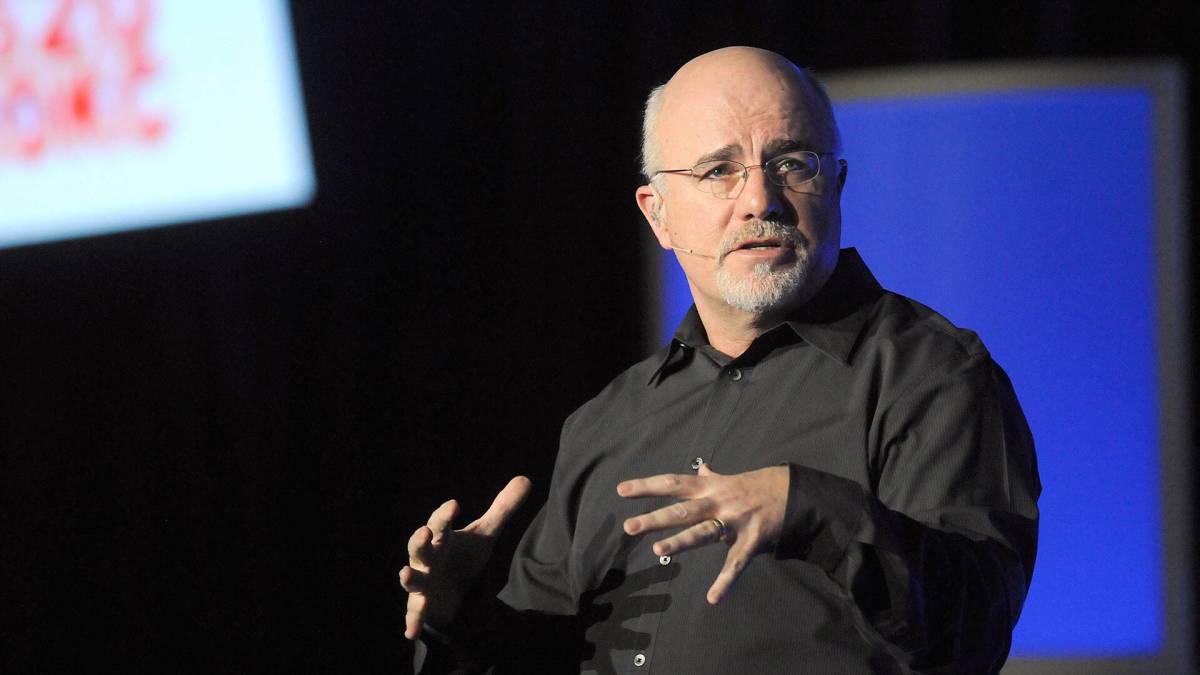

However first, who’s Dave Ramsey, and why do you have to hearken to monetary recommendation from a controversial evangelical speaking head with a chapter in his previous?

Ramsey’s recommendation on bank cards and debt has been criticized by different private finance authorities, however his retirement recommendation is broadly considered stable.

Jackson Laizure/Getty Photos

Who’s Dave Ramsey & why is he thought of a retirement professional?

Like most public figures, Dave Ramsey has acquired some criticism through the years, however he’s additionally constructed a large following by means of his books, podcasts, and different media efforts. A number of the fundamental criticisms leveled at Ramsey level out that a few of his monetary recommendation is broad, lacks nuance, and fails to take particular person circumstances under consideration.

Others fault him for incorporating his Christian faith into his monetary discourse and assuming his listeners all have (or are attempting to construct) a conventional nuclear household — i.e., a partner, a mortgage, and several other college-bound youngsters.

And whereas these criticisms are completely legitimate, they’re most related to Ramsey’s recommendation on issues like saving, spending, debt, and bank cards. Retirement, like actual property, is certainly one of Ramsey’s specialties, and whether or not you’re keen on him or hate him, following his recommendation on the topic may aid you construct and nurture a post-career nest egg that your older self will thanks for.

Associated: Dave Ramsey’s web price: The retirement professional’s wealth in 2025

Dave Ramsey’s 5 most essential retirement insights

Listed here are 5 of Ramsey’s most poignant items of recommendation with regards to retirement planning. These are factors he touches on many times, each in his books and when giving recommendation to listeners who name into his reveals.

1. Don’t plan to depend on Social Safety

Certainly one of Ramsey’s most frequent warnings on retirement is to not rely absolutely on Social Safety for retirement revenue.

What’s Social Safety & how does it work?

Social safety is a publicly funded retirement revenue security web for American employees. It’s been round for over 90 years, and it’s one thing a number of working-class retirees depend on every month to make ends meet. Each employee pays into it by way of revenue tax, so present employees’ Social Safety tax funds fund present retirees’ month-to-month Social Safety revenue funds.

Why Ramsey says don’t rely on it

It’s a superb system, but it surely has its limitations, as Dave Ramsey is fast to level out. First, Social Safety funds aren’t big. They range relying on how a lot a retiree made throughout their profession (calculated based mostly on their 35 highest-earning working years) and after they select to start receiving advantages. “The earlier you start taking benefits, the less money you’ll get each month,” in Ramsey’s phrases.

These with larger profession revenue and those that select to retire and begin receiving advantages later are eligible for larger month-to-month funds. That being stated, for many retirees, Social Safety funds aren’t sufficient to reside on — at the least not comfortably. Ramsey, “The average post-retirement Social Security payout [is] barely enough to live above the national poverty level for a two-person household.”

Ramsey explains that these advantages weren’t designed to fund retirement. Fairly, they have been designed to complement revenue from retirement accounts like 401(ok)s and IRAs.

The second purpose Ramsey cautions eventual retirees about Social Safety revenue is that it is probably not assured. As a result of it’s funded by present employees, the sum of money in this system’s belief fund is finite and topic to alter relying on what number of energetic employees are paying into it.

With so many Child Boomers reaching retirement age, present estimates posit that this system might solely stay absolutely funded till 2034 until some form of corrective motion is taken. That implies that those that plan to retire after that won’t obtain the complete quantity of Social Safety revenue they’re eligible for. The best way Ramsey places it, “in its current state, the Social Security system is a mess — and you shouldn’t count on an inept government to fix it.”

Associated: Suze Orman’s 5 finest saving & spending suggestions

2. In case your employer provides a 401(ok), make investments the utmost that they are going to match

“Your workplace 401(k) is the foundation of a solid retirement plan,” Ramsey assures his readers. In relation to employer-sponsored retirement accounts, he continually urges his viewers to contribute at the least the utmost quantity their employer will match. That’s usually round 3% p.c of every paycheck, though sure employers match contributions at a lot larger charges, like Apple (6%) and Boeing (10%).

How does 401(ok) matching work?

If an employer provides employees a 401(ok) contribution match, that implies that the corporate will deposit the identical sum of money the worker does into their retirement account as much as a sure share of every paycheck.

So, if a employee makes $2,500 per 30 days, and their employer provides a 4% match, which means the worker can elect to divert $100 (which is 4% of $2,500) into their 401(ok) every month, and their employer will present a further $100, doubling their contribution. Over the course of a yr, that primarily interprets into $1,200 in additional pay.

Why Ramsey encourages it

Ramsey is fast to level out the apparent. Employer 401(ok) matching is actually free cash. The best way he places it, “If your employer matches your contributions (and most do), you get an instant 100% return on part of the money you invest in your 401(k). That’s free money. Take it!”

In different phrases, contributing at the least the sum of money your employer will match is a no brainer, even when it means barely reducing the quantity you get to take residence and spend every month. Your retired self will thanks.

401(ok)s and Roth IRAs are each nice investing instruments for retirement, and in keeping with Dave Ramsey, they work finest when utilized in tandem.

Getty Photos

3. Complement your 401(ok) with a Roth IRA

401(ok)s are a superb retirement financial savings software, and Ramsey, as beforehand talked about, has at all times advocated for contributing the utmost quantity your employer will match every month. That being stated, Ramsey additionally factors out that 401(ok)s have a number of drawbacks, which is why he recommends pairing them with a Roth IRA.

Limitations of conventional 401(ok)s

- Not all workplaces provide 401(ok) accounts. That implies that for a lot of employees, no employer-sponsored retirement account is obtainable.

- 401(ok) accounts have annual deposit limits. In 2025, this restrict is $23,500 (though older employees are allowed to make extra “catch-up” contributions). Because of this larger earners might not be capable to put as a lot cash as they’d like into their retirement account.

- Most office 401(ok)s are conventional (versus Roth) 401(ok)s. Because of this the cash you and your employer put in is pre-tax, which might be advantageous within the quick time period as a result of it lowers your taxable revenue for the yr. Alternatively, you need to pay taxes on this cash (which can have grown considerably) afterward once you withdraw it throughout retirement.

What’s an IRA?

IRAs, or particular person retirement accounts, are just like 401(ok)s, besides that anybody with earned revenue can open one. For that reason, they’re common with people whose employers don’t provide a 401(ok). IRAs might be conventional, which means you contribute to them utilizing pre-tax {dollars} after which get taxed in your withdrawals throughout retirement, or Roth, which means you contribute to them utilizing post-tax {dollars} however get to withdraw your cash tax-free throughout retirement.

Why Ramsey recommends opening a Roth IRA

- Roth IRAs can help you pay tax in your deposits earlier than you add them to your account, so that you don’t should cope with taxes in your withdrawals throughout retirement. Because of this any capital beneficial properties, dividends, and curiosity your Roth IRA investments make won’t ever be taxed.

- Roth IRAs have a $7,000 contribution restrict in 2025, so when paired with a 401(ok), this ups your complete annual retirement plan contribution restrict to $30,500.

- Some 401(ok) plans might solely provide just a few totally different mutual funds to select from, whereas IRAs permit their house owners to select from a greater diversity of funding choices.

By utilizing each kinds of retirement accounts, you may benefit from your employer’s matching contributions, the longer term tax advantages of the Roth IRA, and the elevated contribution restrict afforded by having two retirement accounts.

In Ramsey’s phrases,” the best-case situation is that you simply put money into each accounts (and in the event you can max them each out—knock your self out).”

Associated: Scott Galloway’s 5 finest wealth-building suggestions for younger individuals

4. Put money into mutual funds

Ramsey, like most retirement specialists, doesn’t advocate utilizing your retirement accounts to put money into particular person shares. Your retirement account goes to be round for some time, and the easiest way to develop your cash whereas mitigating danger is to diversify your investments.

The best means to try this is by investing in mutual funds or ETFs, Ramsey’s favourite long-term funding automobiles. These are professionally curated baskets of shares that can help you put money into dozens or lots of of shares with every contribution.

By spreading your cash out this fashion, you scale back the affect every firm’s inventory worth has in your portfolio. That means, if one firm goes below and its inventory drops to zero, your financial savings gained’t be closely impacted.

What kinds of mutual funds does Ramsey advocate investing in?

Ramsey’s go-to mutual fund funding technique concerned dividing your cash between 4 various kinds of funds:

- Giant-cap development and revenue funds: These mutual funds primarily put money into massive, established firms, typically known as “blue-chip” shares—assume Walmart, Pepsi, Apple, and GE. These firms usually pay dividends (quarterly funds disbursed to shareholders out of the corporate’s earnings), they usually’re normally comparatively low danger over the long run as a result of they’re very established by way of market share, infrastructure, and client sentiment.

- Mid-cap development funds: These funds put money into mid-sized firms that also have loads of runway for development. They could not pay dividends but, however they’ve extra upside potential than extra mature, blue-chip firms. That being stated, they’re established sufficient that their danger of complete failure is comparatively low.

- Small-cap aggressive development funds: These types of funds put money into promising, youthful firms, lots of which can not even have turned a revenue but. The shares in these funds are more likely to be extremely unstable, which means their costs can rise and fall dramatically over comparatively quick durations. These funds are riskier than the opposite varieties Ramsey recommends, however additionally they have by far essentially the most development potential over the long run.

- Overseas fairness funds: The ultimate fund class Ramsey recommends is worldwide. By investing in a basket of overseas firms from world wide, you additional diversify your portfolio by exposing it to different inventory markets and defend it considerably from market downturns within the U.S.

Ramsey recommends this diversified method to retirement investing as a result of, as he says, “nobody can time the market or predict the future.” That’s why investing in a broad array of shares by way of mutual funds and ETFs is the easiest way for a passive investor to observe their retirement fund develop steadily over time.

Extra on Dave Ramsey:

- Dave Ramsey sounds alarm on main cash mistake to keep away from

- Dave Ramsey has blunt phrases for Individuals about Social Safety

- Dave Ramsey warns Individuals about one massive Social Safety truth

5. Contribute 15% of your revenue to your retirement

The final tip on this record is the trickiest for many working individuals. In any case, the price of residing is larger than ever, and plenty of Individuals have a tough time making ends meet on a weekly foundation, not to mention setting apart cash for the longer term.

Nonetheless, Ramsey ardently urges his viewers to allocate 15% of their month-to-month revenue towards their retirement (or as a lot as they presumably can as much as that quantity).

The best way he views it, 15% is sufficiently small to go away sufficient wiggle room for different bills and monetary targets, however massive sufficient that it may well flip into a big nest egg—one thing he says retirees want, as their bills are sometimes larger than anticipated.

In line with Ramsey, “estimates show that a 65-year-old couple will need about $315,000 for health care costs in retirement. And that doesn’t even include any long-term care costs, which can run an average of around $108,400 a year in a nursing home or $54,000 a year for assisted living.”

One caveat right here, although, is that Ramsey recommends holding off on investing till you’re debt-free (except for a mortgage) and have a small emergency fund. As soon as that’s the case, although, he advises residing under your means with the intention to sustain together with his 15% a month suggestion.

Associated: Suze Orman’s web price in 2025: The private finance icon’s wealth