Chainlink is coming into an “ideal accumulation zone” as technical indicators, market sentiment, and on-chain knowledge align for a possible breakout.

If the present development holds, LINK might quickly goal $23.61 within the brief time period and $46 within the mid-term, reaffirming its management place within the international DeFi oracle sector.

Sponsored

Whales Accumulate LINK, Trade Provide Hits Document Low

The market is witnessing an unprecedented wave of accumulation from Chainlink (LINK) whales, marking one of many strongest on-chain accumulation phases lately.

In accordance with latest on-chain knowledge, large quantities of LINK have been withdrawn from centralized exchanges.

Over the weekend, a newly created pockets withdrew one other 490,188 LINK, value round $9 million, from Binance. Simply someday earlier, the identical tackle had already withdrawn 280,907 LINK. This pockets now holds 771,095 LINK, valued at over $14 million, and should proceed accumulating.

Moreover, a cluster of 39 new wallets has collectively withdrawn 9.94 million LINK, equal to $188 million, from Binance. Earlier within the week, the identical group additionally moved 6.2 million LINK (about $117 million) proper after the market crash, when LINK briefly dipped to the $15 zone.

This whale exercise coincides with the Chainlink Basis’s latest buyback of 63,000 LINK (value roughly $1.15 million) on October 24, 2025, as a part of its reserve growth technique, as beforehand reported by BeInCrypto.

LINK Stability on Exchanges. Supply: XSponsored

On-chain knowledge from Glassnode shared on X reveals that LINK’s trade steadiness has dropped from 205 million to 160 million tokens since April 2025. The LINK % Stability on Exchanges has been at its lowest since December 2022, following the FTX collapse.

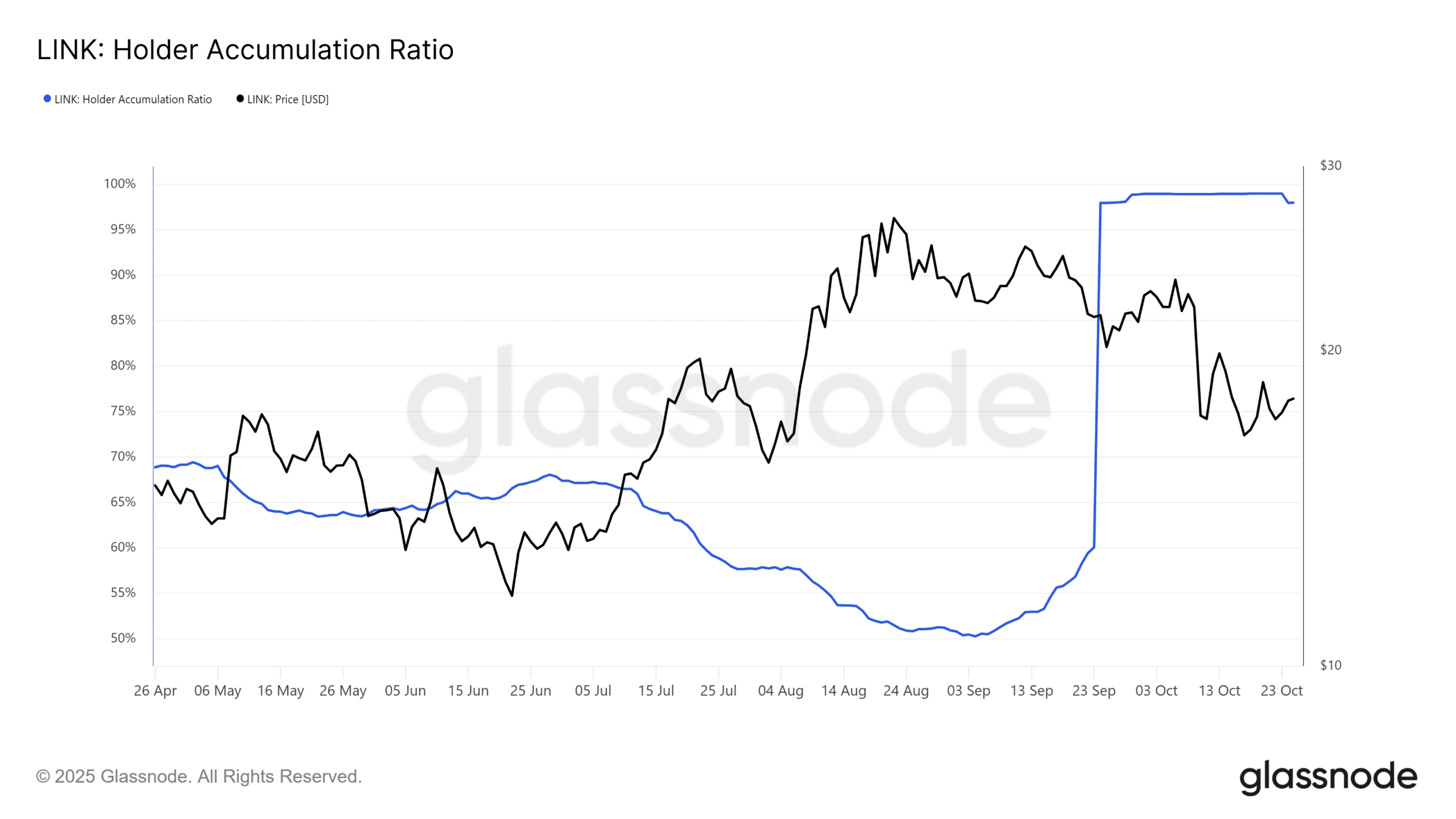

This sharp decline in trade reserves displays decrease promoting strain and rising accumulation sentiment. The Holder Accumulation Ratio has surged to 98.9%, which means almost all lively addresses are web patrons, an especially bullish sign for the market’s long-term route.

“If this trend holds, analysts see a possible move toward $46 ahead,” one analyst commented.

Quick-term merchants betting on a serious breakout in LINK’s worth view the $46 goal as a super take-profit zone.

Technical Outlook and LINK Value State of affairs

LINK is buying and selling round $18.22 on the time of writing, exhibiting robust indicators of a breakout formation. In accordance with market analysts, a sustained break above the descending trendline can be the primary affirmation of a bullish reversal.

As soon as LINK clears $20.19, momentum might develop towards $23.61, aligning with wave 3 of the Elliott Wave construction.

Sponsored

Within the brief time period, the $19.20–$19.70 vary stays the closest resistance space. LINK might intention for the psychological degree at $20 and past if damaged.

This accumulation development displays institutional buyers’ rising confidence in Chainlink’s decentralized oracle ecosystem. The latest partnership between S&P International and Chainlink to develop a stablecoin danger score framework additional strengthens the challenge’s credibility in conventional finance.

Nevertheless, Chainlink’s subsequent main problem lies in growing actual token demand by way of institutional incentive packages and expanded advertising and marketing efforts — a key step towards changing its confirmed know-how into sustainable capital inflows.

“The product is a done deal — they’ve already won. Now they need to figure out how to increase demand for the token, or how to attract more retail interest. But the team is full of geniuses and visionaries. They’ll get there,” one analyst remarked.