The query merchants hold asking is easy: Will a crypto crash in 2026 occur, or has it already began? Each main downturn on this market has at all times adopted the identical sample: Bitcoin completes its cycle high, sentiment peaks, and a serious correction begins just a few weeks later.

- Bitcoin’s 4-12 months Provide Clock Is the First Clue For the Crypto Crash

- Why This Cycle Is Operating Longer Than Standard

- Pi-Cycle: What It Is and What the Up to date Numbers Inform Us

- MVRV: What It Measures and When It Can Attain the Danger Zone

- World Liquidity Index: Why It Issues After Bitcoin MVRV

- The Convergence: The Full Image

- When Will the Crypto Crash in 2026 Start?

So, earlier than we discuss concerning the crash timeline, we have to set up whether or not Bitcoin has already topped. The standard peak window has handed, but the important thing high indicators have by no means been triggered. If the highest continues to be forward, the crash window strikes into 2026. Right here is how the information matches collectively.

Bitcoin’s 4-12 months Provide Clock Is the First Clue For the Crypto Crash

Bitcoin runs on a predictable schedule. Each 210,000 blocks, the block reward halves. This reduces new provide and usually pushes costs greater for twelve to eighteen months. Earlier cycles behaved the identical manner. The 2012 halving led to a high after about 13 months, the 2016 halving topped after round 17 months, and the 2020 halving peaked after about 18 months.

By this sample, the April 20, 2024, halving pointed towards a peak between July and October 2025. Bitcoin even touched $126,000 in early October, and on the time, it seemed like a textbook cycle high.

Sponsored

Sponsored

However one affirmation was lacking. The Pi-Cycle High Indicator, which has marked each main peak inside one or two days, didn’t cross. With out that crossover, the October excessive turns into a mid-cycle excessive, not the ultimate peak. That raises the query: what stored the cycle alive?

Why This Cycle Is Operating Longer Than Standard

Two forces prolonged this cycle past its regular timing.

First, ETF flows absorbed extra provide than miners produced. Since early 2024, spot Bitcoin ETFs have pulled in additional than $60 billion. Miners challenge about 13,875 BTC per thirty days, value round $1.4 billion at present costs. Throughout robust influx intervals, ETFs absorbed $4–5 billion per thirty days, eradicating new provide quicker than the community may create it.

Second, world liquidity has remained elevated. Cash provide throughout main economies nonetheless grows over 6% year-over-year, central banks slowed tightening, and reserves stayed excessive.

Sturdy liquidity delays exhaustion and retains threat property supported. These two drivers pushed the cycle additional than the same old halving window permits. With this backdrop, we transfer to probably the most correct timing instrument for closing peaks: the Pi-Cycle High Indicator.

Pi-Cycle: What It Is and What the Up to date Numbers Inform Us

The Pi-Cycle High Indicator compares two shifting averages: the 111-day common and twice the 350-day common. When the 111-day line rises above the slower one, Bitcoin is often one or two days from the ultimate high. The sign has been exact in each main cycle.

As of November 11, 2025:

- 111-day common: $113,394

- 2×350-day common: $205,767

- Hole: $92,373

Sponsored

SponsoredBitcoin High Indicator: Bitcoin Journal

To mission when the strains will meet, we have a look at the slope of the 111-day common. Over latest months, it has risen between $200 and $400 per day. At $200 per day, the crossover can be about 462 days away, which factors to February 2027. In case it strikes at $320 per day, the “lines meet” sit round 289 days away, which factors to August 2026. At $400 per day, it’s roughly 231 days away, pointing to June 2026.

This locations the real looking Pi-Cycle window between June and September 2026. Since Pi-Cycle has by no means missed a serious peak, the October 2025 excessive is unlikely to be the ultimate high. To grasp how excessive Bitcoin can climb earlier than the crypto crash comes knocking, we transfer to valuation — the MVRV Z-Rating.

MVRV: What It Measures and When It Can Attain the Danger Zone

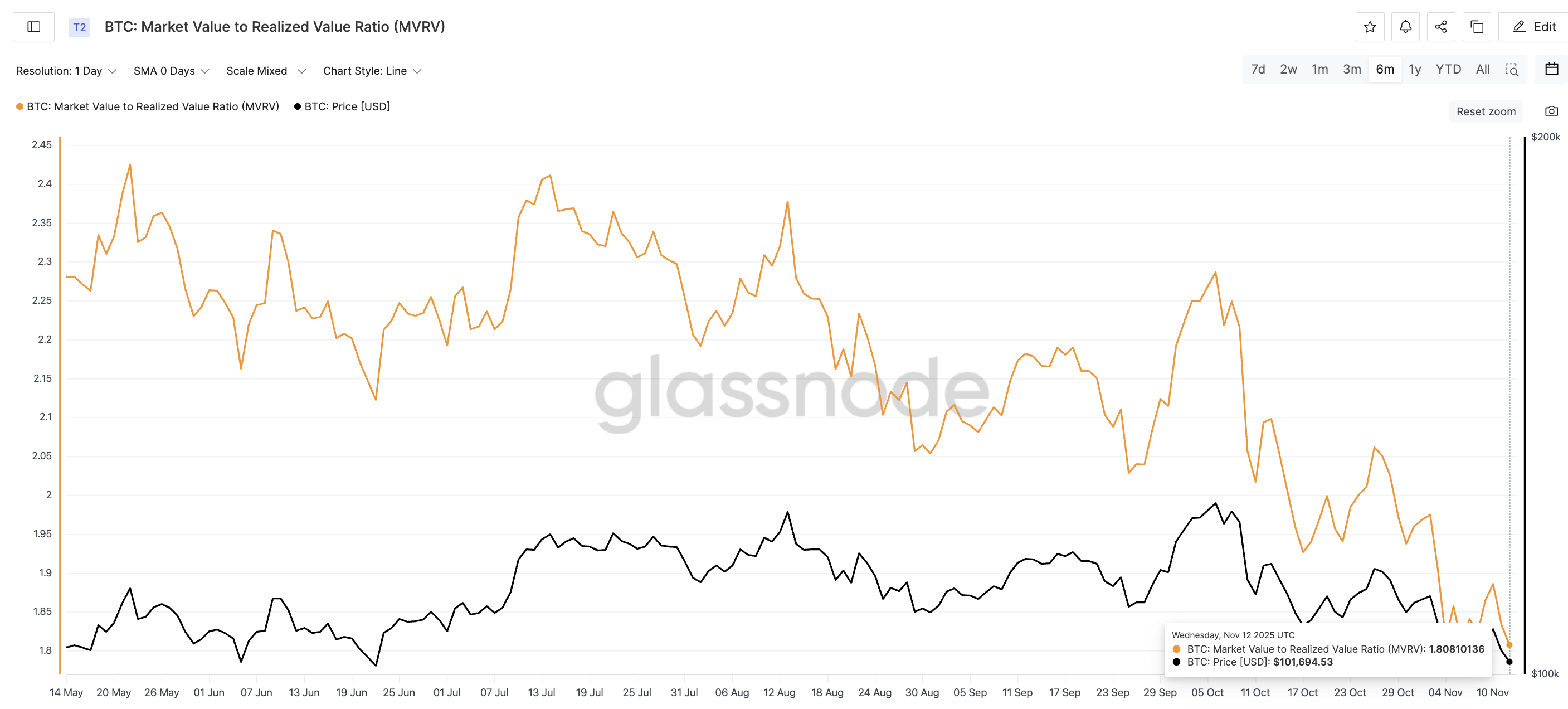

MVRV compares Bitcoin’s market worth with its realized worth, which displays the typical worth at which all cash final moved. Excessive MVRV means holders have massive unrealized earnings, and previous cycles topped when MVRV surged into excessive zones.

As of 12 November 2025:

- Market worth: $2.05 trillion

- MVRV: 1.81

This suggests a realized worth close to $1.13 trillion. Previous cycle peaks sometimes shaped when MVRV reached between 3.0 and seven.0. For this cycle, the warning zone is 3.0 to three.5.

Sponsored

At MVRV 3.0, Bitcoin’s market worth can be close to $3.39 trillion, which equals roughly $174,000 per coin. At MVRV 3.5, the market worth can be about $3.96 trillion, which equals roughly $203,000 per coin. These are the valuation ceilings the place the market often turns into unstable.

The Pi-Cycle high additionally falls in between these MVRV-led projections:

MVRV often enters this zone about one month earlier than the Pi-Cycle crossover. If the crossover occurs in June 2026, MVRV overheats in Could. In case it occurs in August, threat builds in June or July. Whether it is in September, the strain shifts into July or August. This locations the MVRV threat window between Could and August 2026, relying on how shortly the 111-day common of the Pi-Cycle climbs.

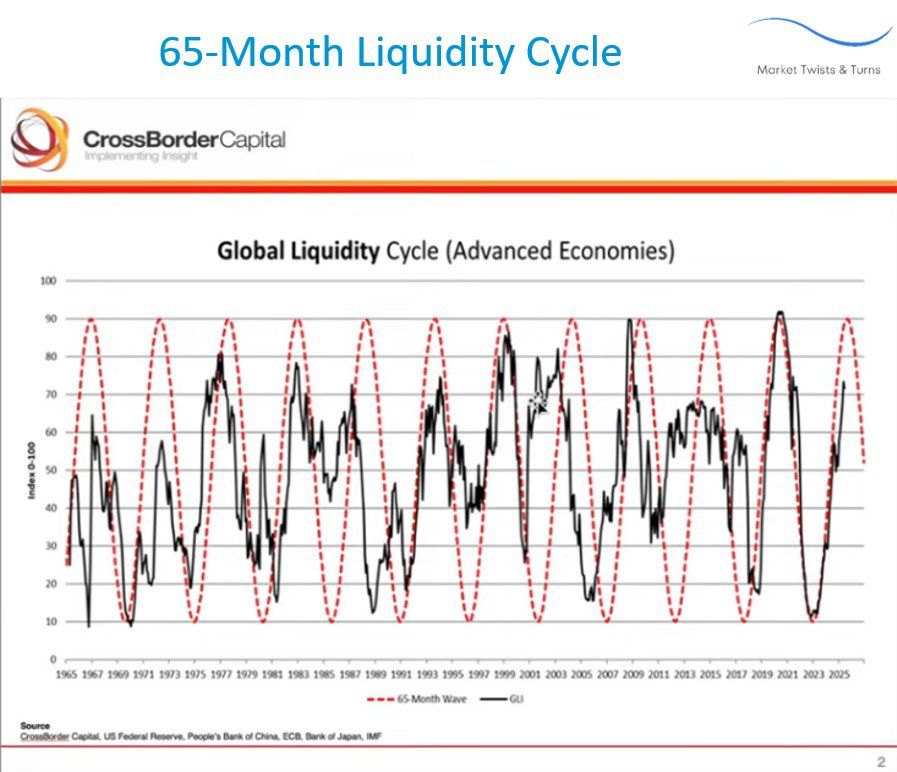

World Liquidity Index: Why It Issues After Bitcoin MVRV

Bitcoin doesn’t depend on inside metrics alone. Liquidity circumstances decide how far the ultimate surge can go. The World Liquidity Index (GLI) tracks liquidity from main central banks and the broad cash provide. Bitcoin reacts strongly to this index. In 2017 and 2021, GLI topped earlier than Bitcoin, and Bitcoin peaked shortly afterward.

As of November 2025, GLI sits close to 75 and has been rising by about 4 factors per thirty days. This tempo comes from the index climbing roughly 18–20 factors over the past 5 months. GLI peaks often shaped close to 90, which locations the following liquidity excessive between March and Could 2026.

If the Federal Reserve turns softer, liquidity might stretch deeper into the 12 months.

Sponsored

Sponsored

This creates a transparent alignment. MVRV overheats in spring 2026, GLI peaks in spring 2026, and Pi-Cycle factors to momentum exhaustion in summer time 2026. The mismatch between liquidity and momentum units up a traditional bull-trap: liquidity peaks first, the market dips, after which Bitcoin pushes right into a closing, greater peak as Pi-Cycle completes.

The Convergence: The Full Image

All main indicators converge inside a single broad construction. The halving extension pushes the cycle high into mid-2026. MVRV exhibits overheating between Could and August 2026. GLI suggests liquidity peaks between March and Could 2026. Pi-Cycle factors to a closing high between June and September 2026.

This creates a March to August 2026 window the place liquidity and momentum collide. The market might type two peaks: a liquidity-driven excessive in spring that turns into a bull lure, and a closing Pi-Cycle peak in summer time. A sensible high vary is $200,000 to $250,000, which inserts the valuation ceiling and the momentum timeline.

When Will the Crypto Crash in 2026 Start?

In earlier cycles, Bitcoin fell one to 4 weeks after the ultimate high. With the symptoms aligning, the following main crypto crash in 2026 can start any time from March to August, relying on which peak arrives first.

A crash, nonetheless, is simply the primary part. A real bear market begins when decrease highs and decrease lows type for a number of consecutive weeks. In previous cycles, this affirmation arrived six to 10 weeks after the ultimate high. Making use of that sample right here, if Bitcoin peaks between June and September 2026, the confirmed bear market would start between August and November 2026. That is when long-term draw back strain takes over, not only a sharp correction.

If liquidity peaks first, Bitcoin might fall 25–35%, reset leverage, after which try a closing surge. If liquidity and momentum align later, the decline begins after the Pi-Cycle crossover.

Anticipated decline ranges:

- A average drop of fifty–60% pulls Bitcoin towards $90,000–$110,000

- A deeper drop of 70% pushes it towards $70,000–$80,000

ETF custody might sluggish the autumn, turning it into an extended correction as an alternative of a sudden collapse. The important thing level stays the identical: the $126,000 excessive in 2025 was not the cycle high. The true peak lies forward in 2026, and the crash window opens quickly after.