Columbia Sportswear Firm (NASDAQ: COLM) delivered gross margin growth of fifty foundation factors. Because of this, profitability beneficial properties offset gross sales declines. Columbia This autumn 2025 earnings exceeded expectations because the outside attire large reported web gross sales of $1,070.2 million. This beat analyst forecasts. For the official Columbia This autumn 2025 earnings press launch, go to the investor relations web page.

- Market Efficiency Replace

- Columbia This autumn 2025 Earnings: Fourth Quarter Outcomes

- 2025 Full Yr Efficiency

- Columbia This autumn 2025 Quarterly Income Pattern

- Worldwide Markets Drive ACCELERATE Technique

- Margin Efficiency Evaluation

- Model Momentum and Product Innovation

- Full Yr 2026 Outlook and Steering

- U.S. Tariff Mitigation Efforts

- Columbia This autumn 2025 Earnings: Key Takeaways

Market Efficiency Replace

Columbia trades on the NASDAQ alternate. The corporate maintains robust liquidity with $790.8 million in money equivalents and short-term investments. Moreover, the agency carries no debt. This offers flexibility for strategic investments. As well as, worldwide markets confirmed momentum in This autumn.

Columbia This autumn 2025 Earnings: Fourth Quarter Outcomes

Fourth quarter income was $1,070.2 million. This declined 2% from final 12 months. Nonetheless, gross margin expanded 50 foundation factors to 51.6%. The corporate confronted $20 million in U.S. tariff prices. Regardless of this headwind, profitability metrics improved. Particularly, working earnings reached $116.7 million. This represented 10.9% working margin. Most significantly, worldwide gross sales confirmed robust momentum.

2025 Full Yr Efficiency

Full 12 months 2025 web gross sales totaled $3,397.4 million. This represented 1% progress in comparison with 2024. Notably, gross margin expanded 30 foundation factors to 50.5%. Moreover, the corporate absorbed $31 million in incremental U.S. tariffs. Because of this, working margins confronted strain from impairment prices. Particularly, prices associated to prAna and Mountain Hardwear totaled $29 million. Nonetheless, Columbia maintained profitability by margin growth efforts.

Columbia This autumn 2025 Quarterly Income Pattern

Columbia This autumn 2025 Earnings: Quarterly Income Efficiency (2024-2025)

Worldwide Markets Drive ACCELERATE Technique

CEO Tim Boyle highlighted worldwide progress momentum. Throughout the This autumn name, he famous robust worldwide efficiency. In keeping with Boyle, the Columbia ACCELERATE Development Technique resonates with shoppers. The technique focuses on new product collections and enhanced advertising. Consequently, model momentum improved heading into 2026. Most significantly, the ‘Engineered for Whatever’ marketing campaign supplied model differentiation. This messaging higher positions Columbia in a aggressive market. Because of this, client response exceeded preliminary expectations.

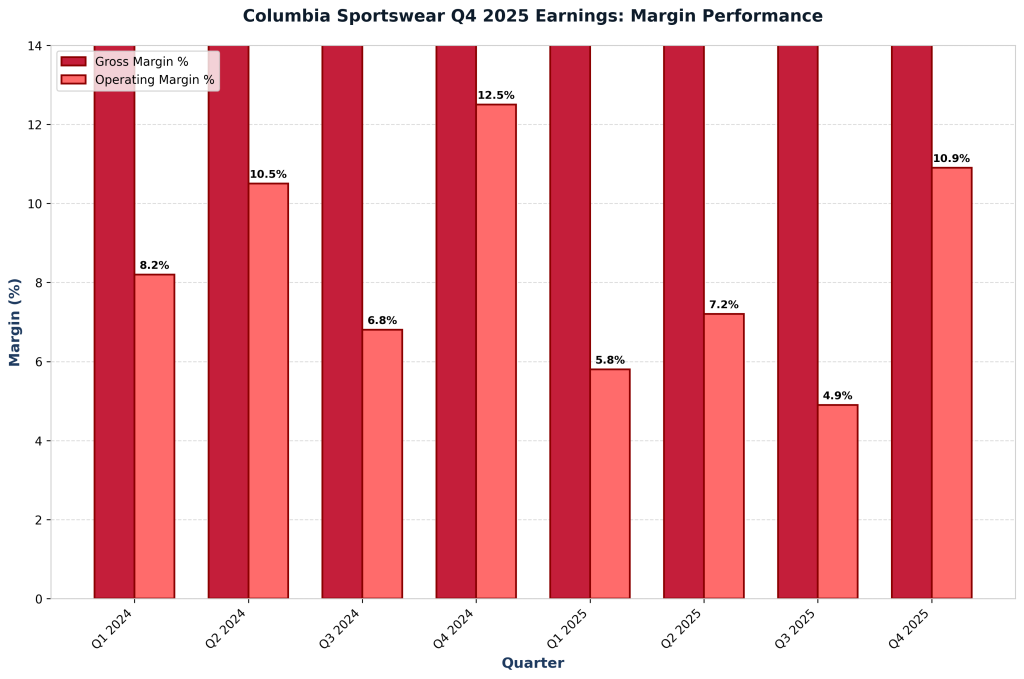

Margin Efficiency Evaluation

Columbia This autumn 2025 Earnings: Gross Margin and Working Margin Traits

Model Momentum and Product Innovation

Columbia’s multi-brand technique spans outside, lively and way of life merchandise. The portfolio contains attire, footwear, equipment and gear. Lately, new product collections acquired optimistic client suggestions. For instance, enhanced footwear strains confirmed robust early demand. Equally, modern attire designs resonated with goal audiences. The truth is, wholesale companions expanded orders. Due to this fact, stock administration turned more and more vital.

Moreover, the prAna and Mountain Hardwear manufacturers required strategic opinions. Impairment prices mirrored market reassessment. Nonetheless, Columbia maintained funding in core manufacturers. Trying forward, product innovation will drive progress.

Full Yr 2026 Outlook and Steering

Administration supplied full 12 months 2026 steering. Web gross sales are anticipated at $3.43 billion-$3.50 billion. This represents 1.0%-3.0% progress in comparison with 2025. Working earnings steering stands at $211 million-$243 million. This interprets to working margin of 6.2%-6.9%. These projections assume normalized tariff impacts. Because of this, the steering displays cautious optimism. Nonetheless, Columbia This autumn 2025 earnings momentum helps execution. Most significantly, worldwide progress initiatives ought to drive outcomes.

U.S. Tariff Mitigation Efforts

U.S. tariffs offered a big headwind. In This autumn 2025, incremental tariffs totaled $20 million. For full 12 months 2025, tariff impression reached $31 million. The corporate carried out mitigation ways. Particularly, Columbia sourced from different geographies. Moreover, provide chain optimization lowered publicity. As well as, pricing methods helped offset prices. Consequently, margin growth partially offset tariff impacts.

Columbia This autumn 2025 Earnings: Key Takeaways

Commercial