Colgate-Palmolive Firm (NYSE: CL) reported fourth-quarter and full-year 2025 monetary outcomes on January 30, 2026. This fall internet gross sales elevated 5.8% to $5.23 billion with natural gross sales development of two.2%. Full-year internet gross sales reached a document $20.38 billion.

Market Capitalization

Colgate-Palmolive had a market capitalization of roughly $68-70 billion as of January 30, 2026.

This fall 2025 Outcomes

Colgate-Palmolive reported consolidated internet gross sales of $5.23 billion for This fall 2025, representing 5.8% year-over-year development. Natural gross sales elevated 2.2%, together with a 0.9% damaging affect from the exit of the personal label pet meals enterprise. International trade supplied a 3.1% profit to internet gross sales.

Gross revenue was $3.15 billion with gross revenue margin of 60.2%, down 10 foundation factors year-over-year. On a GAAP foundation, working revenue was $92 million. On a Base Enterprise (non-GAAP) foundation, working revenue was $1.11 billion, up 3% year-over-year.

The corporate recorded a non-cash, after-tax impairment cost of $794 million associated to goodwill and intangible property for the pores and skin well being enterprise, primarily Filorga, resulting from decrease than anticipated class development and efficiency in China.

Phase Efficiency

By division in This fall 2025: Latin America internet gross sales elevated 12.8% with natural gross sales up 6.5%. Europe internet gross sales grew 9.8% with natural gross sales up 1.8%. Africa/Eurasia internet gross sales elevated 15.0% with natural gross sales up 10.3%. Asia Pacific internet gross sales declined 0.3% with natural gross sales up 0.1%. North America internet gross sales declined 1.5% with natural gross sales down 1.8%. Hill’s Pet Diet internet gross sales grew 4.9% with natural gross sales up 1.5%.

Full-Yr 2025 Outcomes

For full-year 2025, Colgate-Palmolive reported document consolidated internet gross sales of $20.38 billion, up 1.4% year-over-year. Natural gross sales additionally elevated 1.4%, together with a 0.7% damaging affect from decrease personal label pet quantity. Gross revenue was $12.25 billion with gross revenue margin of 60.1%.

Internet earnings attributable to Colgate-Palmolive was $2.13 billion for full-year 2025, in comparison with $2.89 billion in 2024. The decline displays the pores and skin well being impairment cost. Internet money supplied by operations reached a document $4.20 billion. Free money circulate earlier than dividends was $3.63 billion. The corporate returned $2.9 billion to shareholders by means of dividends and share repurchases.

Quarterly Internet Gross sales Pattern

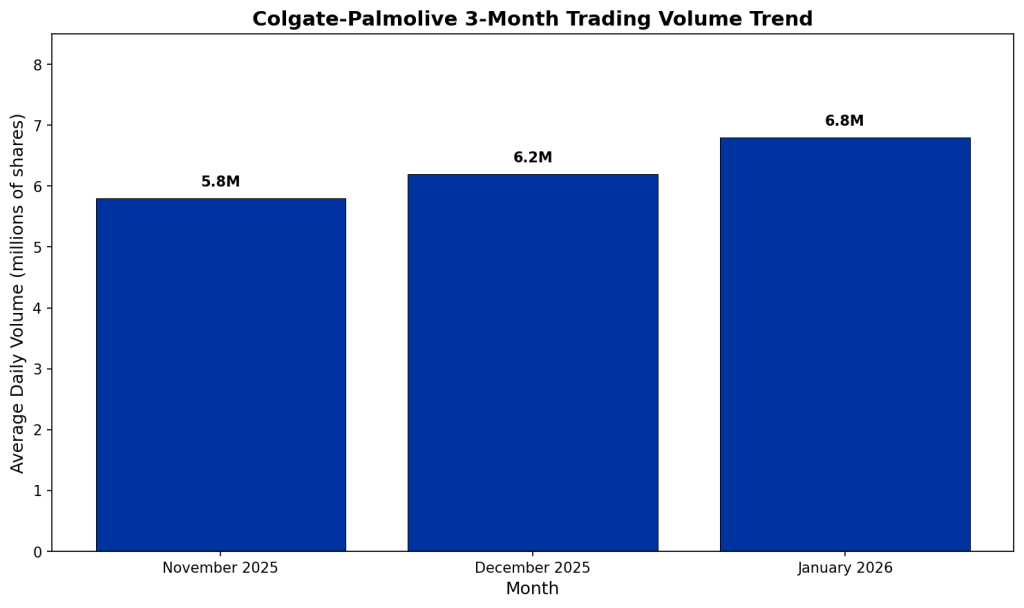

3-Month Buying and selling Quantity Pattern

Enterprise and Operations Replace

Colgate maintained world toothpaste market share management at 41.3% year-to-date and guide toothbrush market share at 32.4% year-to-date. In the USA, the corporate’s toothpaste market share was 33.3% and guide toothbrush market share was 41.3% year-to-date.

The corporate introduced its Strategic Progress and Productiveness Program (SGPP) in 2025, enabling organizational modifications to extend effectivity and supply assets for executing the 2030 strategic plan.

Strategic Developments

Colgate-Palmolive accomplished the acquisition of the Prime100 pet meals enterprise in Australia throughout 2025. The corporate elevated its dividend for the 63rd consecutive 12 months. The corporate’s annual assembly of stockholders is scheduled for Might 8, 2026.

Steering and Outlook

For 2026, Colgate-Palmolive issued the next steering: internet gross sales development of two% to six%, together with a low-single-digit optimistic affect from international trade; natural gross sales development of 1% to 4%, together with an roughly 20 foundation level affect from the personal label pet meals exit; gross revenue margin enlargement on each GAAP and Base Enterprise foundation.

On a GAAP foundation, the corporate expects double-digit development. On a Base Enterprise foundation, the corporate expects low to mid-single-digit development. Promoting is predicted to extend on each a greenback foundation and as a share of internet gross sales. The steering assumes class development charges of 1.5% to 2.5% and relies on tariffs introduced and finalized as of January 28, 2026.

Efficiency Abstract

Colgate-Palmolive reported This fall 2025 internet gross sales of $5.23 billion, up 5.8% year-over-year. Full-year 2025 internet gross sales reached a document $20.38 billion. Internet earnings for full-year 2025 was $2.13 billion. The corporate recorded a $794 million after-tax impairment cost associated to the pores and skin well being enterprise. Internet money supplied by operations reached a document $4.20 billion. The corporate maintained market management in toothpaste at 41.3% world market share.

Commercial