Clear Harbors Inc. (NYSE: CLH) earnings delivered improved outcomes. The corporate reported income of $1.5 billion. This marked a 5% enhance from the prior 12 months’s quarter. The earnings beat expectations. Web earnings rose to $86.6 million. Adjusted EBITDA climbed 8% to $278.7 million. Full-year outcomes highlighted a milestone. Income reached a report $6.03 billion. The corporate additionally achieved report free money move of $509.3 million.

- Clear Harbors This autumn 2025 Earnings: Monetary Outcomes

- Clear Harbors This autumn 2025 Earnings: Full-12 months Efficiency

- Quarterly Income Efficiency

- Enterprise Phase Efficiency: Development and Margin Enlargement

- Adjusted EBITDA Efficiency: Operational Effectivity

- Strategic Development: Capital Deployment and Acquisitions

- 2026 Outlook: Administration Steerage and Strategic Path

- Clear Harbors This autumn 2025 Earnings: Key Takeaways

Click on Right here to go to the Clear Harbors Inc. Investor Relations web site.

Clear Harbors This autumn 2025 Earnings: Monetary Outcomes

Income development accelerated within the fourth quarter. Whole revenues hit $1.5 billion. This in contrast with $1.43 billion in This autumn 2024. The 5% enhance exceeded market expectations. Working earnings jumped to $158.4 million. This marked a 16% achieve from the identical interval final 12 months. So, momentum continued throughout the enterprise.

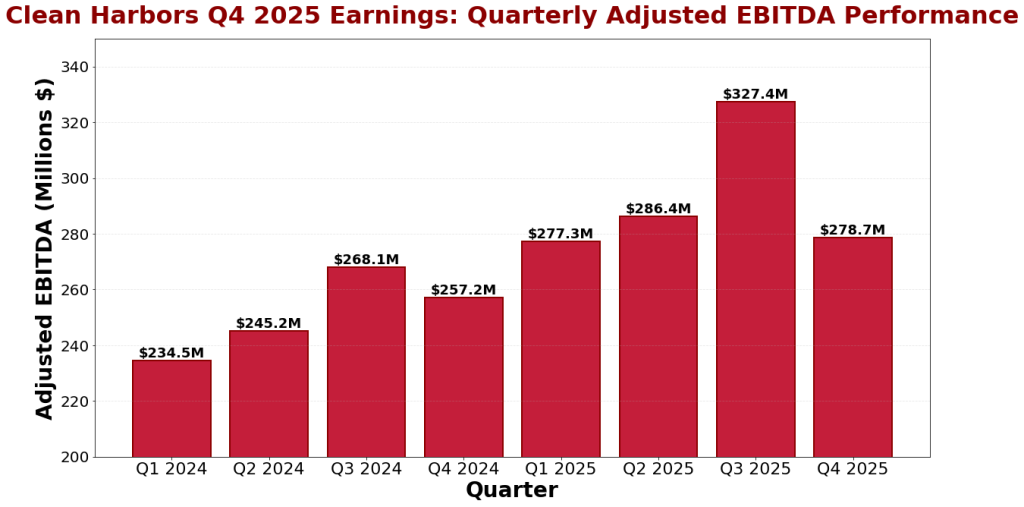

Profitability metrics improved considerably. Web earnings reached $86.6 million in This autumn 2025. This in contrast with $84.0 million in This autumn 2024. Adjusted EBITDA grew 8% to $278.7 million. Final 12 months it was $257.2 million. Additionally, adjusted EBITDA margin expanded to 18.6%. This confirmed pricing energy and value self-discipline.

Clear Harbors This autumn 2025 Earnings: Full-12 months Efficiency

Full-year outcomes underscored constant execution. Additionally, complete 2025 revenues reached $6.03 billion. This represented a 2% enhance from 2024. The prior 12 months had $5.89 billion. Full-year working earnings totaled $673.4 million. This in contrast with $670.2 million in 2024. Plus, adjusted EBITDA grew 5% to $1.17 billion.

Money era proved distinctive in 2025. Working money move hit $866.7 million. Adjusted free money move reached a report $509.3 million. This beat the prior 12 months. Final 12 months generated $357.9 million. The development got here from larger adjusted EBITDA. Working capital administration additionally aided outcomes. So, the corporate generated substantial returns for shareholders.

Quarterly Income Efficiency

Determine 1: Clear Harbors This autumn 2025 earnings quarterly income pattern chart exhibiting outcomes from 2024 to 2025

Enterprise Phase Efficiency: Development and Margin Enlargement

Environmental Providers drove outcomes this quarter. Plus, this section delivered 6% income development. Adjusted EBITDA margin expanded 50 foundation factors to 25.8%. Technical Providers gained 8% on wholesome demand. Demand for disposal and recycling companies remained wholesome. Undertaking volumes climbed larger. Additionally, PFAS service enlargement continued.

Security-Kleen Environmental Providers additionally carried out effectively. In truth, income on this unit climbed 7%. Pricing enhancements and better volumes drove beneficial properties. Vacuum companies captured market share. Incineration utilization reached 87%. Landfill volumes surged 56%. Subject Providers income jumped 13%. Giant-scale emergency response initiatives boosted gross sales.

Adjusted EBITDA Efficiency: Operational Effectivity

Determine 2: Clear Harbors This autumn 2025 earnings adjusted EBITDA quarterly efficiency chart demonstrating profitability development

Strategic Development: Capital Deployment and Acquisitions

Capital allocation remained strategic and disciplined. Plus, the corporate repurchased $250 million of shares in 2025. The Board expanded the buyback program by $350 million. Clear Harbors introduced plans for a $130 million acquisition. The deal targets Depot Join Worldwide companies. The acquired operations span three states. 5 places function in Ohio, Louisiana, and Texas.

Strategic investments in fleet enlargement additionally started. Clear Harbors dedicated $50 million to hoover truck enlargement. This two-year program helps development initiatives. The corporate expects a five-year payback. Cross-selling alternatives ought to drive larger returns. Plus, administration guides to acquisition exercise in 2026.

2026 Outlook: Administration Steerage and Strategic Path

Administration supplied full-year 2026 steering. So, adjusted EBITDA is anticipated to achieve $1.20-$1.26 billion. The midpoint totals $1.23 billion. This assumes revenue development continues. Adjusted free money move steering ranges $480-$540 million. The midpoint stands at $510 million. So, Clear Harbors expects money era to stay wholesome.

Close to-term momentum appears optimistic heading into Q1 2026. Environmental Providers Adjusted EBITDA ought to develop 4%-7%. This displays year-over-year comparisons. Consolidated adjusted EBITDA is guided up 1%-3%. The corporate highlighted a number of development drivers. Reshoring developments ought to assist disposal volumes. PFAS remediation initiatives supply further alternatives.

Clear Harbors This autumn 2025 Earnings: Key Takeaways

- Income reached $1.5 billion, up 5% year-over-year.

- Working earnings jumped 16% to $158.4 million.

- Adjusted EBITDA climbed 8% to $278.7 million.

- Environmental Providers margin expanded to 25.8%.

- Full-year income hit a report $6.03 billion.

- Adjusted free money move reached a historic $509.3 million.

- Share repurchases totaled $250 million in 2025.

- Strategic acquisitions improve the expansion portfolio.

- $50 million invested in fleet enlargement.

- 2026 steering expects continued adjusted EBITDA development.