Picture supply: Getty Photographs

Whereas dividends are by no means assured, with the best technique it’s potential to generate a second earnings that helps a cushty retirement.

In reality, due to the big payouts UK shares usually pay, retirees can realistically count on monetary freedom by shopping for dividend shares. That is comforting in an age when the way forward for the State Pension comes beneath elevated scrutiny.

But establishing a passive earnings portfolio takes some preparation and common consideration. Need to know the way to get began?

Falling yields

Dividend yields on FTSE 100 and FTSE 250 shares have traditionally ranged between 3% and 4%. Sadly from a passive earnings perspective, surging share costs in 2025 have pushed yields to the underside finish of this vary.

The common dividend yield on Footsie shares is now 3.1%. In dividend phrases, which means a £20,000 funding in an index tracker would supply an earnings of £620.

That’s not horrible, and particularly when in comparison with the yields on abroad shares. Nevertheless it’s hardly the type of return that can give most individuals the monetary freedom they’re searching for in retirement — until you might have one million kilos or extra invested.

Take a look at this dividend hero

But dropping index yields don’t imply it’s time to panic. The UK inventory market stays stuffed with high quality shares that may ship a powerful and sustained earnings.

Let’s have a look at the instance of Phoenix Group (LSE:PHNX). At 8%, its dividend yield is greater than double the FTSE 100 common.

At this fee, a £20k lump sum would supply a a lot tastier £1,600 earnings.

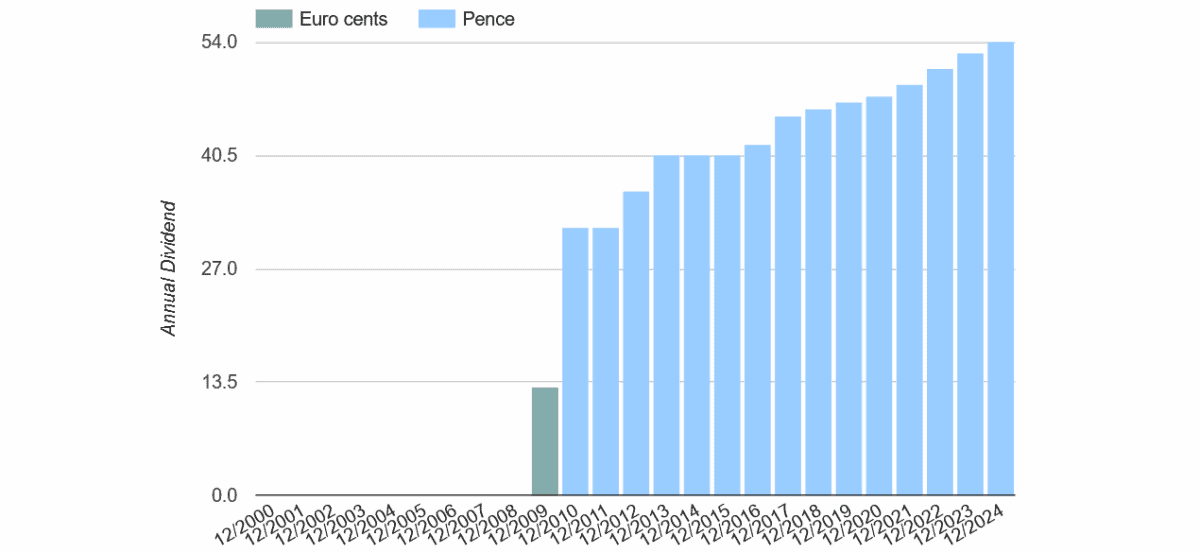

However can Phoenix maintain payouts at this stage? The reply’s an emphatic ‘yes,’ as the corporate’s lengthy document of huge and rising dividends demonstrates:

Phoenix Group’s dividend historical past. Supply: dividenddata.co.uk

Phoenix Group’s dividend historical past. Supply: dividenddata.co.uk

The pensions and insurance coverage agency advantages from huge money flows, supported by the common premiums it collects from policyholders. This offers it loads of surplus capital to return to shareholders.

It’s churning out cash at such tempo, in truth, that in 2024 the agency hit its working money era (OCG) goal of £1.4bn two years early. Encouragingly for future dividends, cumulative OCG is now anticipated at £5.1bn between 2024 and 2026, up from £4.4bn beforehand.

The chance for dividend chasers is that Phoenix might determine to make use of extra of its further money in different areas. This might embrace natural investments, funding acquisitions, or deleveraging.

Even so, I feel the corporate will stay one of many FTSE’s greatest dividend payers.

Producing a £49k second earnings

Naturally I wouldn’t put all of my money into Phoenix shares for dividends. I’d diversify throughout 15-20 totally different shares, trusts, and funds to scale back danger and supply a smoother return over time.

With a portfolio of shares together with Phoenix, I feel an investor may realistically obtain a median yield of seven%. At this fee, a £700,000 funding would throw off a wholesome £49,000 a 12 months in passive earnings. That’s the type of windfall that might fund a cushty retirement even with out the State Pension.