BNB has remained one of many few main cryptocurrencies to type a brand new all-time excessive (ATH) even because the broader market struggled.

Nonetheless, after a powerful rally, the Binance ecosystem token could face turbulence. A rising variety of short-term holders seem poised to take income, signaling potential volatility forward.

BNB Holders Prone To Promoting

The Spent Output Revenue Ratio (SOPR) is reflecting early indicators of waning profitability amongst BNB traders. The latest readings are hovering close to the impartial 1.0 degree, indicating that holders are realizing minimal income. Whereas this doesn’t but suggest losses, it highglights that BNB’s revenue margins are tightening.

Sponsored

Sponsored

If the SOPR dips beneath 1.0, it might sign that traders are promoting at a loss. Traditionally, this tends to set off promoting fatigue, usually permitting costs to stabilize and get better. Nonetheless, BNB’s present place above this mark means that profit-taking stays energetic, leaving the altcoin weak to continued downward strain.

BNB SOPR. Supply: Glassnode

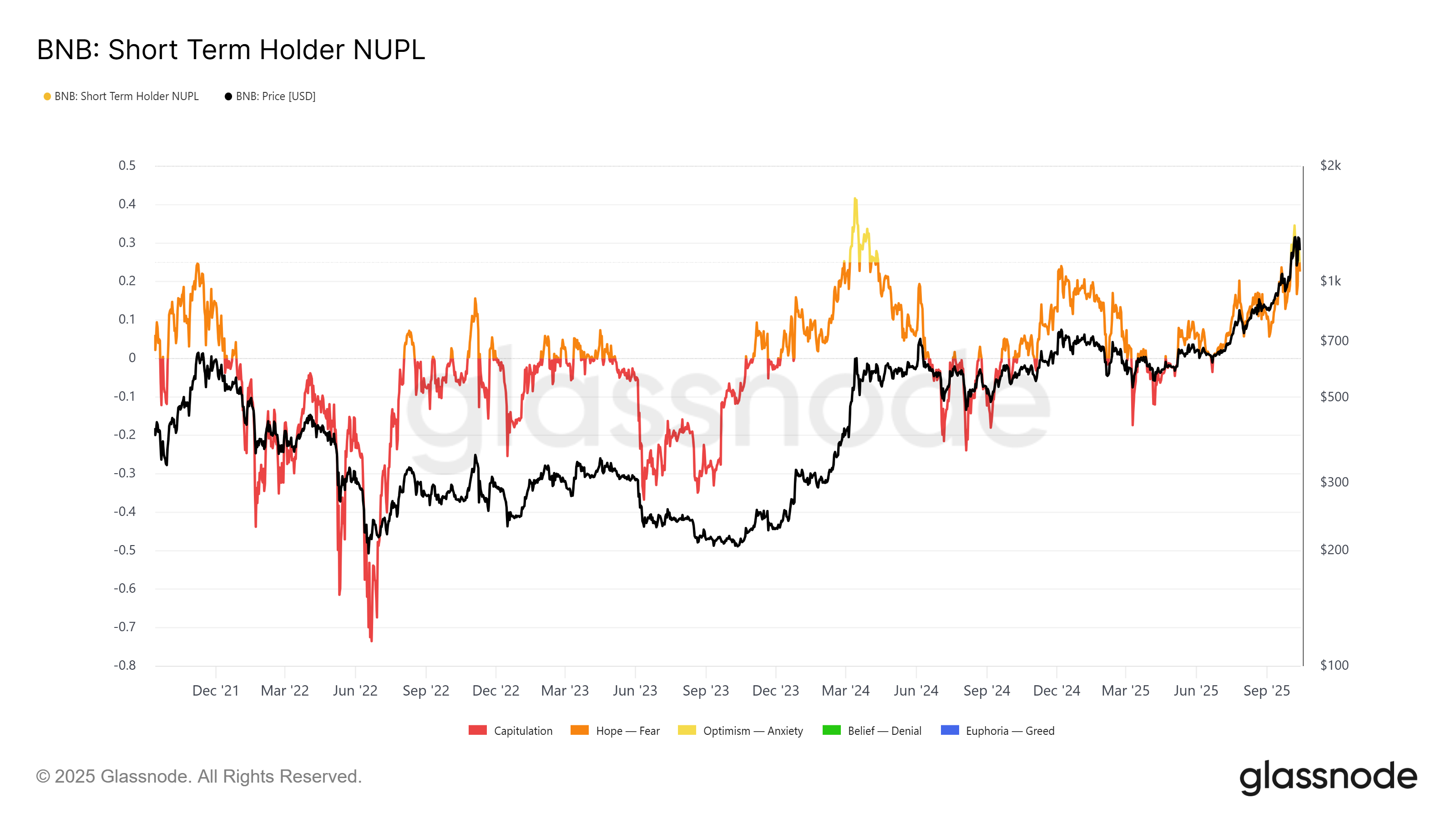

BNB’s short-term holder Web Unrealized Revenue/Loss (STH NUPL) has just lately spiked above the 0.25 threshold, traditionally a warning sign. Breaching this degree has usually preceded a saturation of income amongst short-term traders, resulting in waves of promoting and subsequent value reversals.

The present NUPL information means that many short-term holders are sitting on sizable beneficial properties, rising the probability of sell-offs within the close to time period. With no clear bullish indicators rising on the macro entrance, BNB may very well be getting into a cooling part, the place consolidation or correction turns into more and more possible.

BNB Worth May See Additional Decline

On the time of writing, BNB is buying and selling at $1,181, sustaining a fragile place above its key $1,136 assist degree. Given the weakening sentiment and elevated promoting strain from short-term holders, this assist might quickly be examined.

If bearish momentum intensifies, BNB could fall towards $1,046. Dropping this important degree might open the door to a deeper correction, probably driving the value right down to the psychological assist zone at $1,000. Such a decline might erase a lot of the token’s latest beneficial properties.

Conversely, if BNB manages to carry above $1,136 and entice renewed shopping for curiosity, a rebound towards $1,308 is feasible. A decisive break above this resistance might reignite bullish momentum and convey the token nearer to retesting its $1,375 all-time excessive.