Bitcoin approaches Christmas 2025 in a fragile however attention-grabbing place. Worth trades across the $93,000 space after weeks of strain. 4 key charts present a market late in its correction, but nonetheless missing a transparent bullish set off.

The information highlights three huge forces at work. Latest consumers sit in heavy losses, whereas new whales are capitulating. Macro situations nonetheless drive value, at the same time as spot shopping for energy quietly returns.

Brief-Time period Bitcoin Holders are in Deep Ache

The primary chart tracks short-term holder (STH) realized revenue and loss. This group contains cash purchased in current months. Their “realized price” is the common price foundation for these cash.

Bitcoin Brief-Time period Holders Realized Income and Losses. Supply: CryptoQuantSponsored

Sponsored

Earlier in 2025, STHs sat on sturdy positive aspects. Their common place was 15–20% in revenue as Bitcoin pushed larger. That part inspired profit-taking and added promote strain close to the highs.

Right now, the image has flipped. Bitcoin trades under the STH realized value, and the cohort exhibits about -10% losses. The histogram on the chart is purple, marking one of many deepest loss regimes of 2025.

This has two penalties.

Close to time period, these underwater holders can promote into each bounce. Many merely need out at break-even, which caps rallies towards their entry zone.

Nevertheless, deep and chronic loss pockets often seem later in corrections. They sign that weak palms already took heavy injury.

Sooner or later, the promoting energy of this group runs low.

75% of Brief-Time period Holder’s cash are sitting in loss (over 4.36 million BTC).

Apparently sufficient, it is a comparable development to the prior two native bottoms of this Bitcoin cycle. pic.twitter.com/2w1J4rXzi9

— On-Chain Faculty (@OnChainCollege) December 8, 2025

Traditionally, the important thing turning sign comes when value reclaims the STH realized value from under. That transfer tells you compelled promoting is generally executed and new demand absorbs provide.

Till that occurs, the chart nonetheless argues for warning and vary buying and selling round present ranges.

New Bitcoin Whales Simply Surrendered

The second chart exhibits realized revenue and loss by whale cohorts. It splits flows between “new whales” and “old whales”. New whales are massive holders that collected not too long ago.

Yesterday, new whales realized $386 million in losses in sooner or later. Their bar on the chart is a big destructive spike. A number of different huge destructive bars cluster round current lows.

Sponsored

Sponsored

Previous whales inform a unique story. Their realized losses and earnings are smaller and extra balanced. They don’t seem to be exiting on the identical tempo because the newcomers.

This sample is typical at late levels of a correction. New whales typically purchase late, generally with leverage or sturdy narrative bias. When value strikes towards them, they’re first to capitulate.

That capitulation has a structural profit. Cash transfer from weak massive palms to stronger palms or smaller consumers. Future sell-side overhang from this group decreases after such occasions.

Brief time period, these flushes can nonetheless drag value decrease. But medium time period, they enhance the standard of Bitcoin’s holder base.

The market turns into extra resilient as soon as panicked massive sellers end exiting.

Actual Curiosity Charges Nonetheless Steer Bitcoin

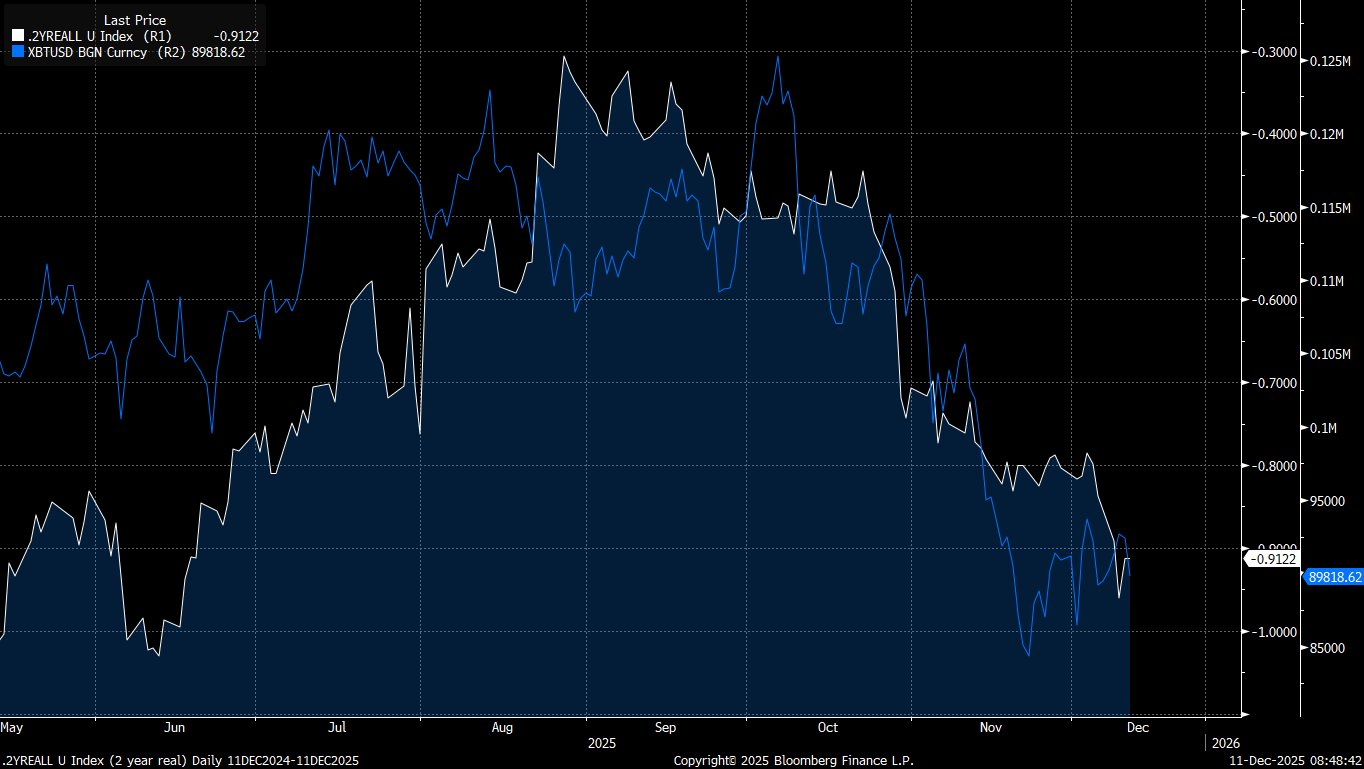

The third chart overlays Bitcoin with two-year US actual yields, inverted. Actual yields measure rates of interest after inflation. The collection strikes virtually tick-for-tick with BTC throughout 2025.

When actual yields fall, the inverted line rises. Bitcoin tends to rise alongside it as liquidity improves. Decrease actual yields make danger property extra interesting relative to protected bonds.

Sponsored

Since late summer season, actual yields have moved larger once more. The inverted line trended decrease, and Bitcoin adopted it down. This exhibits macro situations nonetheless dominate the bigger development.

Federal Reserve fee cuts alone might not repair this. What issues is how markets count on actual borrowing prices to evolve. If inflation expectations fall sooner than nominal charges, actual yields may even rise.

For Bitcoin, a sturdy new bull leg doubtless wants simpler actual situations. Till bond markets value that shift, BTC rallies face a macro headwind.

What’s driving the drawdown in Bitcoin?

Whenever you cease listening to Bitcoin pundits and begin listening to what Bitcoin is saying about itself, then you will notice the actual fact

I’m going to put out the three main issues it’s essential look ahead to Bitcoin proper now 🧵 pic.twitter.com/FC60PPt2gG

— Capital Flows (@Globalflows) December 11, 2025

Spot Taker Patrons are Stepping Again In

The fourth chart tracks 90-day Spot Taker CVD throughout main exchanges. CVD measures the online quantity of market orders that cross the unfold.

It exhibits whether or not aggressive consumers or sellers dominate.

For weeks throughout the drawdown, the regime was Taker Promote Dominant. Pink bars stuffed the chart as sellers hit bids throughout spot markets. This aligned with the grinding drift decrease in value.

Now the sign has flipped. The metric simply turned Taker Purchase Dominant, with inexperienced bars returning. Aggressive consumers now outnumber aggressive sellers on spot venues.

Taker Purchase momentum is again 🔄

Bitcoin’s 90-day Spot Taker CVD simply flipped to **Taker Purchase Dominant** — marking a shift in market habits after weeks of sell-side strain.

Purchase-side aggression is returning throughout main spot exchanges. pic.twitter.com/w5uaGcGHPi

— Maartunn (@JA_Maartun) December 11, 2025

Sponsored

Sponsored

That is an early however necessary change. Development reversals typically begin with microstructure shifts like this.

First consumers step in, then value stabilizes, then bigger flows observe.

At some point of knowledge isn’t sufficient. Nevertheless, a sustained inexperienced regime would affirm that actual demand is again. It might present spot markets absorbing provide from STHs and capitulating whales.

What It All Means For Bitcoin Worth Heading Into Christmas

Taken collectively, the 4 charts present a late-stage correction, not a recent bull market.

Brief-term holders and new whales carry heavy losses and nonetheless promote into energy. Macro actual yields maintain a lid on danger urge for food on the index degree.

On the identical time, some constructing blocks for a restoration are seen. Capitulation by new whales cleans up the holder base.

Spot taker consumers are returning, which reduces draw back velocity.

Heading into Christmas 2025, Bitcoin seems range-bound with a bearish tilt, hovering round $90,000.

Draw back spikes into the mid or high-$80,000s stay attainable if actual yields keep excessive. A transparent bullish shift doubtless wants three alerts collectively:

First, value should reclaim the short-term holders’ realized value and maintain above it. Second, two-year actual yields ought to roll decrease, easing monetary situations.

Third, Taker Purchase dominance ought to persist, confirming sturdy spot demand.

Till that alignment seems, merchants face a uneven market formed by macro information and trapped holders. Lengthy-term buyers might even see this as a planning zone fairly than a time for aggressive bets.