The Bitcoin value stays beneath stress even after rebounding from its post-crash lows. Over the previous 24 hours, BTC has slipped 1.4%, extending its weekly loss to almost 9%.

Whereas the market seems to have stabilized because the “Great Reset,” Bitcoin’s value construction nonetheless leans a tad bearish — and one key stage (talked about on this piece) might resolve whether or not it lastly flips bullish.

Sponsored

Sponsored

On-Chain Metrics Trace at Stabilization, however Conviction Nonetheless Lags

Regardless of the cautious value motion, on-chain information suggests the muse for restoration is forming.

The Internet Unrealized Revenue/Loss (NUPL) — a metric exhibiting whether or not buyers are sitting on paper earnings or losses — dropped to 0.50 on October 11, its lowest stage since April. This exhibits most merchants have absorbed their losses, usually an indication that the promoting part is close to exhaustion.

Bitcoin Unrealized Revenue Made A Native Low: Glassnode

The final time NUPL moved near this stage was on September 25, when Bitcoin fashioned a neighborhood backside round $109,000 and rebounded to $124,000 inside two weeks. That’s a 14% rise.

The Holder Internet Place Change, which tracks how a lot Bitcoin long-term buyers are shopping for or promoting, can be enhancing.

It turned much less unfavourable after the crash, rising from –24,506 BTC on October 10 to –21,172 BTC by October 13 (a 14% enchancment) — exhibiting that long-term holders are step by step returning to accumulation. That shift means the heavy promoting stress seen throughout the liquidation part is easing. But, the conviction lags till the web place change flips inexperienced or buyer-specific.

Sponsored

Shawn Younger, Chief Analyst at MEXC Analysis, instructed BeInCrypto that the crash or the reset marked a crucial “cleansing” second for the market:

“In many ways, the “Great Reset” has strengthened Bitcoin’s elementary narrative”, he mentioned

Younger additionally highlighted the important thing cleaning catalyst right here:

“Bitcoin’s swift recovery towards $115,000, following the largest liquidation event in crypto history, reveals how resilient and mature the market has become. The $20 billion leverage wipeout that followed President Trump’s tariff announcement was a wake-up call for traders, revealing how fragile risk sentiment can become. The forceful unwinding removed a substantial layer of speculative exposure, effectively cleansing the system and setting the tone for a more sustainable uptrend movement”, he added.

Younger’s unique commentary to BeInCrypto highlights catalysts past hodler web place change and NUPL:

Sponsored

Sponsored

“U.S. spot Bitcoin ETFs only recorded a modest outflow of over $4 million and still saw over $2.7 billion in weekly inflows, signaling that smart money is still betting on Bitcoin’s safe-haven and debasement trade narrative”, he highlighted.

Collectively, the information recommend that whereas short-term sentiment is cautious, structural power is quietly returning beneath the floor.

Bitcoin Worth Nonetheless Bearish — $125,800 Breakout Might Flip Pattern

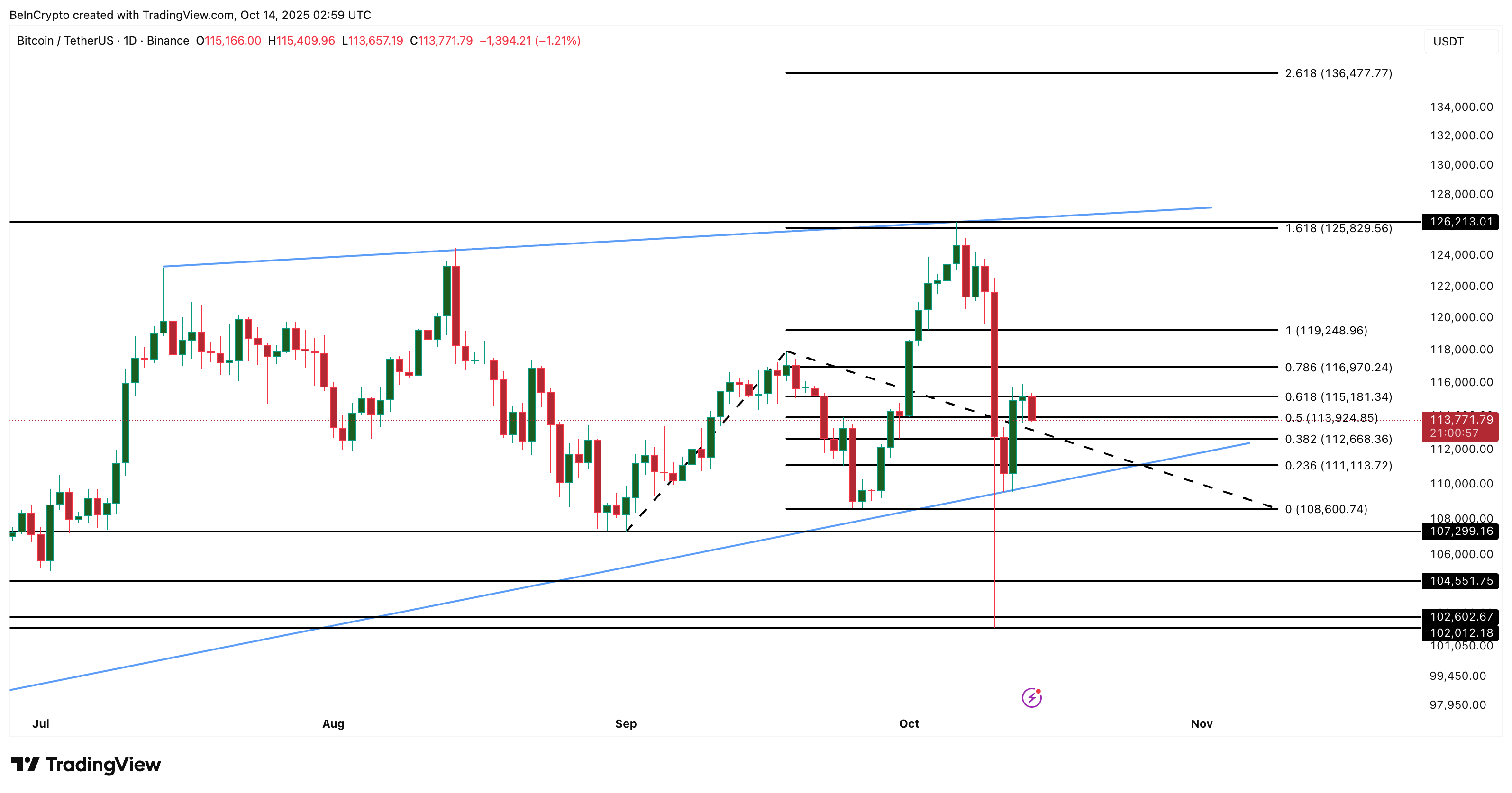

Since then, the value has hovered between $113,900 and $115,100, with momentum capped beneath $119,200. As the primary hurdle, the Bitcoin value wants a each day shut above $115,100 to achieve some power. But, a clear each day shut above $125,800 stays the important thing stage to observe for your complete construction to show bullish.

That will verify a breakout above the wedge’s higher boundary and will open the trail past $126,200, Bitcoin’s earlier all-time excessive.

Sponsored

Sponsored

If momentum strengthens past that, the Fibonacci extension targets level towards $136,400 as the following potential leg greater.

Shawn Younger’s commentary additionally validates this chart-led view:

“Should BTC continue to hold above the $110,000 support zone, we could see momentum rebuild towards retesting and breaching $126,000, a move which unlocks the path to $130,000 as the market re-prices growth expectations”, he talked about

Nevertheless, till such a breakout happens, Bitcoin’s pattern stays fragile. Failure to clear $119,200 might invite renewed promoting, whereas dropping $111,100 would danger deeper corrections towards $104,500 and $102,000.

Younger mentioned Bitcoin’s short-term pattern stays downward, but additionally highlighted some key ranges:

“BTC now seems to be in a downward trend in many short-term time frames and needs to break above $120,000 again to invalidate these bearish setups. A break above $122,000 would confirm that the market has fully absorbed the impact of last week’s market storm and is ready to make new market highs”, he added.