Bitcoin worth has rebounded greater than 4% since February 19, serving to it get well above $68,200. This bounce provided short-term aid after weeks of weak spot. Nonetheless, new technical and on-chain indicators now present that Bitcoin could also be approaching its most harmful stage of 2026.

A mixture of bearish chart construction, heavy provide clusters beneath worth, and rising leverage danger suggests a deeper correction might start quickly.

Bitcoin’s 8-hour chart at present reveals a head-and-shoulders sample. This can be a bearish reversal construction that varieties when worth creates three peaks, with the center peak larger than the others. It indicators weakening shopping for power and growing promoting strain.

On the identical time, Bitcoin has shaped a hidden bearish divergence between February 6 and February 20. Throughout this era, the Bitcoin worth created a decrease excessive, which means the restoration failed to totally regain its earlier peak.

Nonetheless, the Relative Energy Index, or RSI, shaped the next excessive.

Bitcoin Worth Danger: TradingView

RSI measures shopping for and promoting momentum on a scale from 0 to 100. When RSI rises, however worth fails to rise equally, it reveals that purchasing power is weakening. This sample usually seems earlier than worth declines or pullbacks.

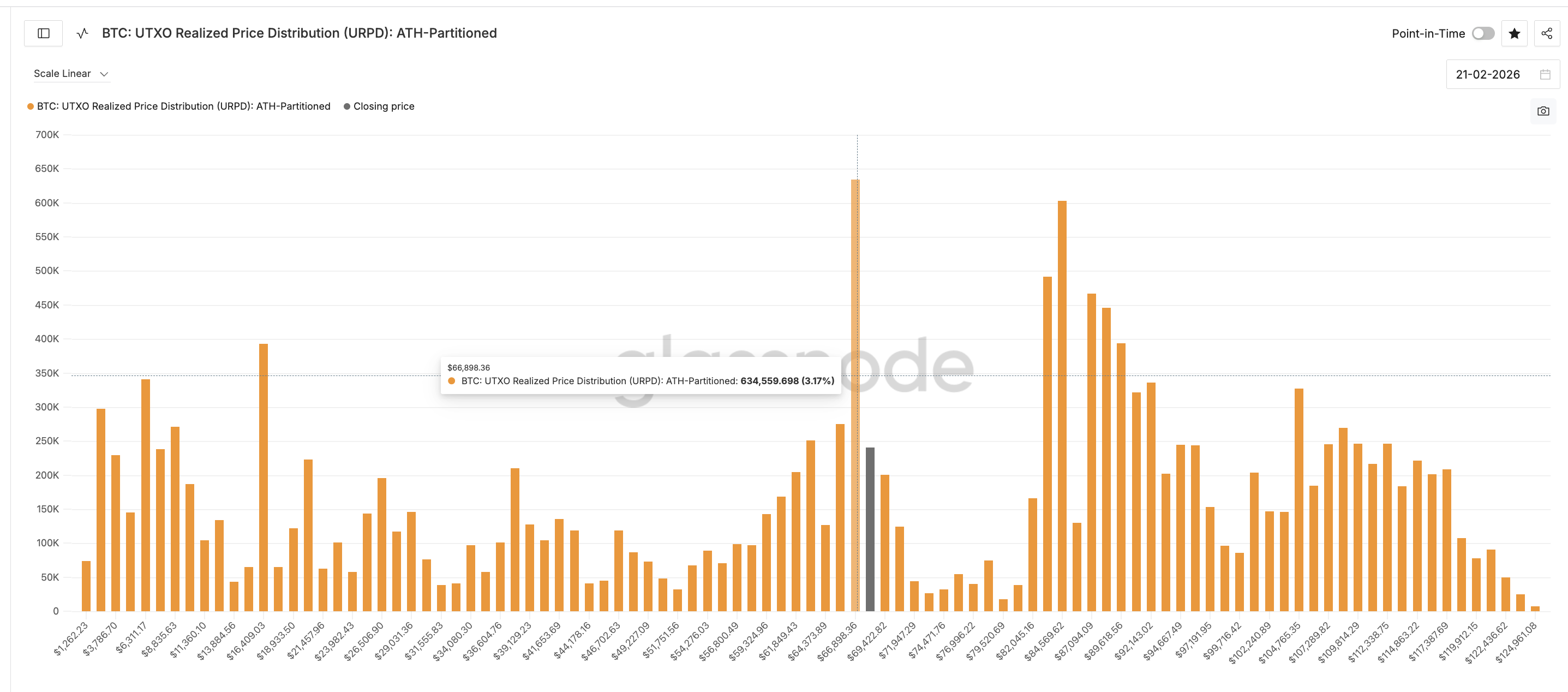

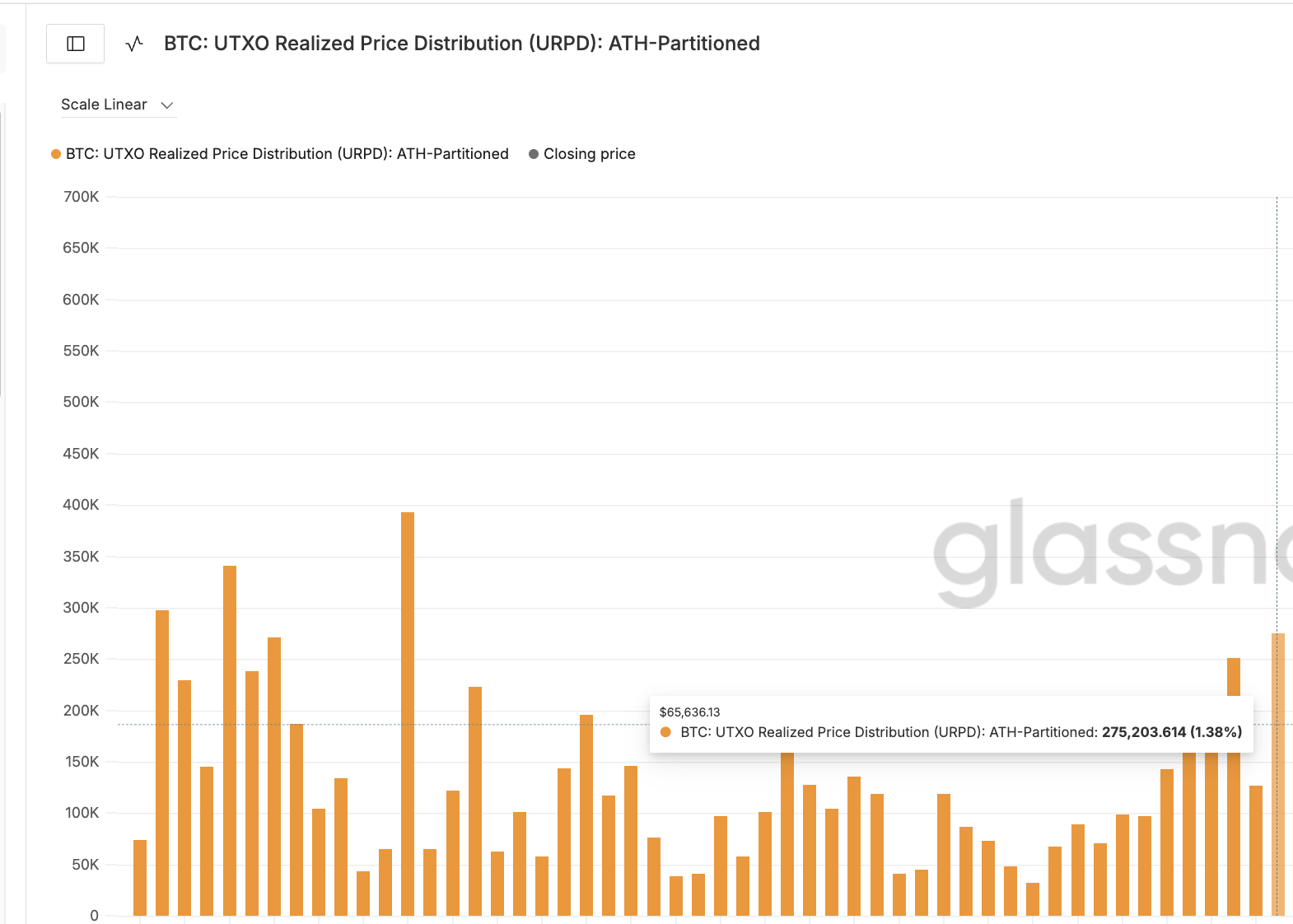

The largest danger now comes from Bitcoin’s on-chain value foundation ranges. Information from the UTXO Realized Worth Distribution, or URPD, reveals that the biggest provide cluster sits at above $66,800. This stage holds 3.17% of Bitcoin’s complete circulating provide.

One other main cluster sits at $65,636, holding a further 1.38% of provide.

These ranges are vital as a result of they symbolize costs at which many traders purchased Bitcoin. If Bitcoin falls beneath these ranges, holders might start promoting to keep away from losses. This will speed up the value decline rapidly.

Collectively, these clusters symbolize greater than 4.5% of Bitcoin’s provide concentrated just under the present worth. This creates a high-risk zone instantly underneath Bitcoin’s help. That explains the largest worth warning

If Bitcoin closes beneath this area, the head-and-shoulders sample realization might acquire power.

Rising Leverage and ETF Outflows Improve Liquidation Menace

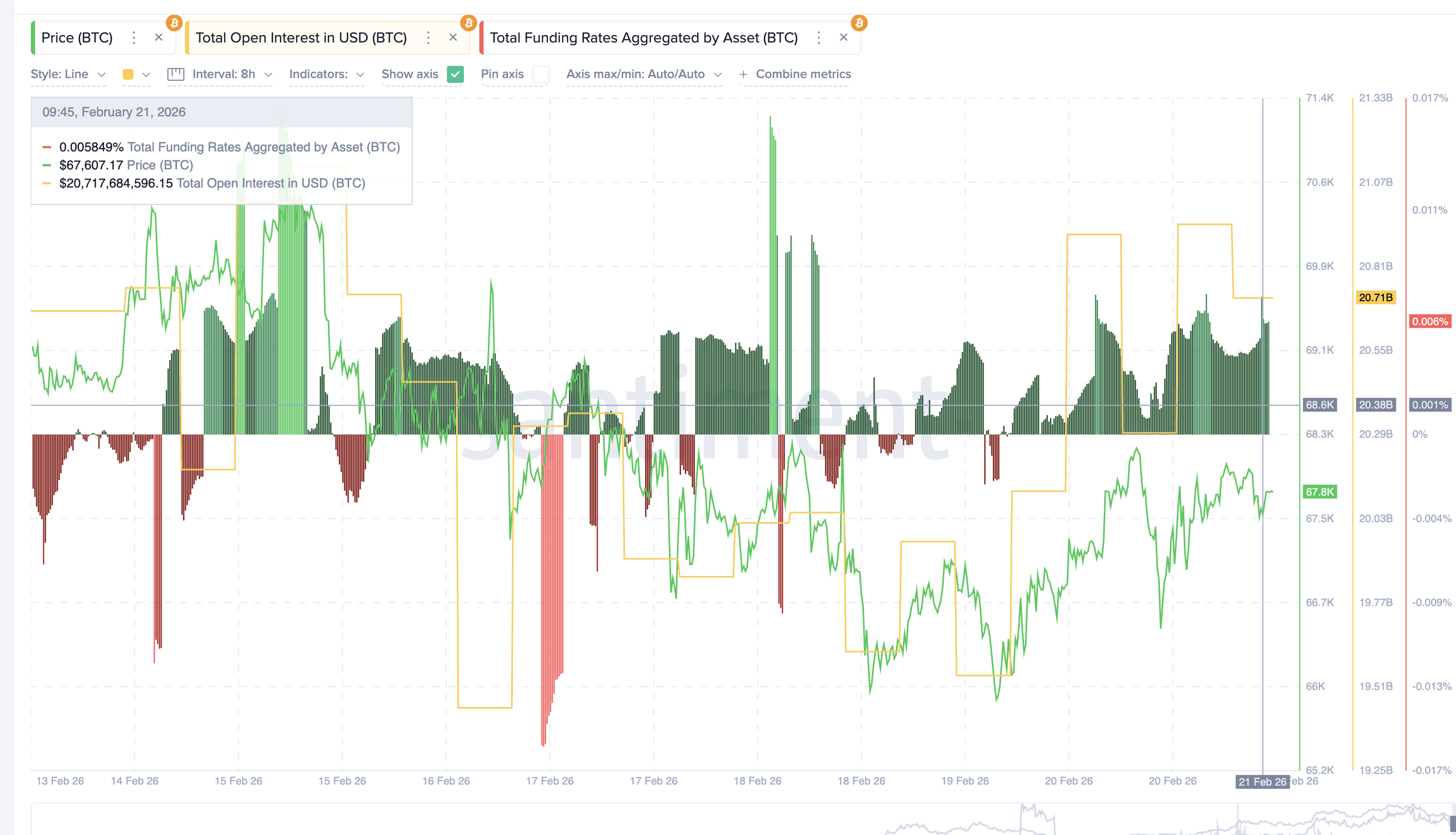

Derivatives information reveals rising liquidation danger as Bitcoin rebounded. Open curiosity, which measures the entire worth of energetic futures positions, has elevated from $19.54 billion on February 19 to about $20.71 billion now, throughout the bounce.

This implies extra merchants have entered leveraged positions throughout the restoration.

On the identical time, funding charges have turned optimistic. Funding charges are funds between lengthy and quick merchants. Optimistic funding means extra merchants are betting on worth will increase. This creates a harmful state of affairs.

If the Bitcoin worth begins falling, these leveraged lengthy positions could also be compelled to shut. This triggers an extended squeeze, the place bullish merchants are pushed out of their positions. Such compelled exits can create a liquidation cascade, including further promoting strain and accelerating the value drop.

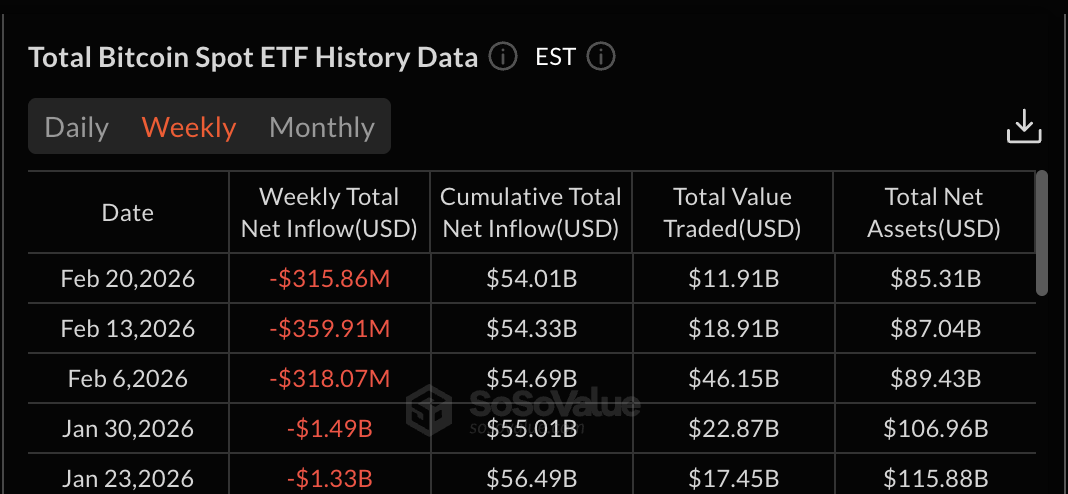

Institutional sentiment additionally stays weak. Spot Bitcoin ETFs have now recorded 5 consecutive weeks of internet outflows. This reveals that institutional traders are nonetheless withdrawing capital moderately than accumulating.

This reduces help throughout worth declines.

Bitcoin Worth Faces Essential Check Beneath Institutional Resistance

Bitcoin additionally stays beneath its month-to-month Quantity Weighted Common Worth, or VWAP, which sits close to $70,000. VWAP represents the common worth weighted by buying and selling quantity. Month-to-month VWAP is broadly used as a proxy for institutional value foundation.

When Bitcoin trades beneath VWAP, it means the common institutional place is at present at a loss. This usually causes establishments to cut back publicity or keep away from new shopping for, explaining the ETF apathy.

A restoration above $70,000 would sign renewed institutional power. However so long as Bitcoin stays beneath this stage, restoration makes an attempt might stay restricted, and the broader construction stays bearish.

On the draw back, Bitcoin’s first key help sits close to $67,300. If this stage breaks, the following help seems at $66,500, adopted by $65,300. These ranges align intently with the foremost provide clusters talked about earlier. Failure to carry these ranges might set off the bigger head-and-shoulders breakdown close to the $60,800 neckline.

A breakdown can then set off a worth breakdown goal of over 7.5%, hinting at a goal worth of $56,000, within the near-to-mid-term.

On the upside, Bitcoin should reclaim $68,200 to stabilize its short-term construction. Nonetheless, a full restoration would require reclaiming the $70,000 VWAP stage.