In accordance with information from Glassnode, US spot Bitcoin exchange-traded funds (ETFs) have recorded their largest steadiness drawdown of the present market cycle following the early October all-time excessive.

Nonetheless, regardless of the latest outflows, the broader ETF image nonetheless stays constructive.

Bitcoin ETFs See Deepest Cycle Pullback as Balances Fall to 1.26 Million BTC

Glassnode information reveals that since October, US spot Bitcoin ETF balances have declined by roughly 100,300 BTC. At press time, whole holdings stood at roughly 1.26 million BTC.

The contraction displays sustained internet outflows, as buyers have withdrawn capital from spot ETFs, main funds to scale back holdings. In accordance with SoSoValue, $1.6 billion was pulled from these merchandise in January alone, extending a streak of month-to-month outflows that started in November 2025.

US Spot ETF Balances Present Largest Drawdown of Cycle. Supply: Glassnode

The decline in ETF balances has unfolded alongside a broader market downturn. Bitcoin has trended decrease since reaching its document excessive of $126,000 in October. The weak spot has spilled into 2026, fueling elevated worry and uncertainty throughout the market.

Though spot ETFs have been broadly seen as a structural catalyst throughout Bitcoin’s rally, consultants counsel the identical mechanism could have intensified draw back stress during times of redemptions. In early February, Arthur Hayes argued that institutional vendor hedging exercise is amplifying downward stress on BTC costs.

“Institutional de-risking has added structural weight to the ongoing weakness, reinforcing the broader risk-off environment,” Glassnode added.

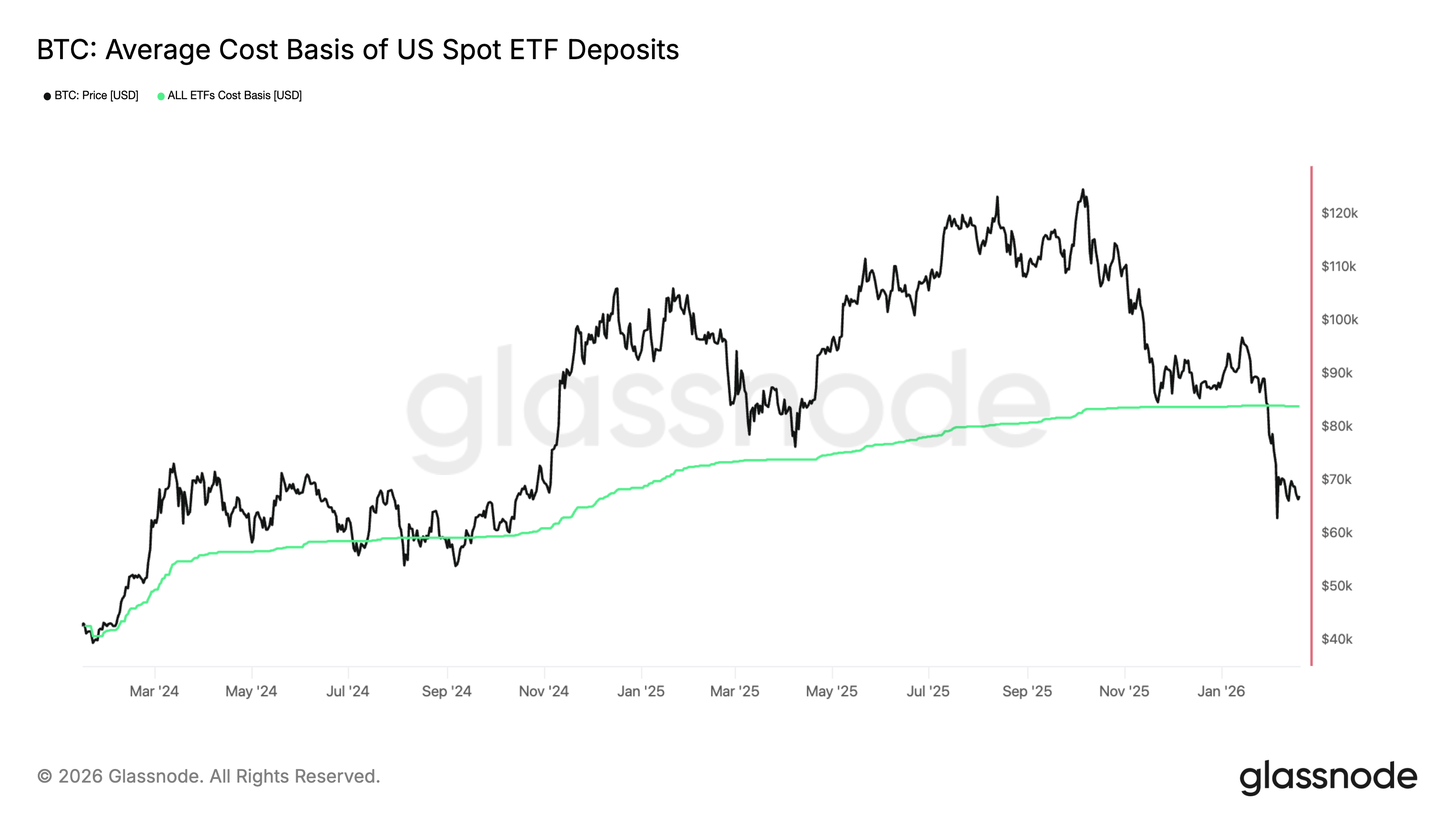

The pressure extends past ETF outflows and into mounting unrealized losses. In accordance with Glassnode, the typical entry value for US spot Bitcoin ETF buyers stands at roughly $83,980 per BTC.

With Bitcoin buying and selling at $67,349 on the time of writing, this cohort is presently sitting on paper losses of roughly 20%.

In the meantime, the outflows aren’t remoted to Bitcoin. BeInCrypto reported $173 million exited digital asset funds final week. This marked the fourth consecutive week of redemptions, totaling $3.7 billion for the interval.

Bitcoin ETF Web Inflows Nonetheless at $53 Billion Regardless of Latest Outflows

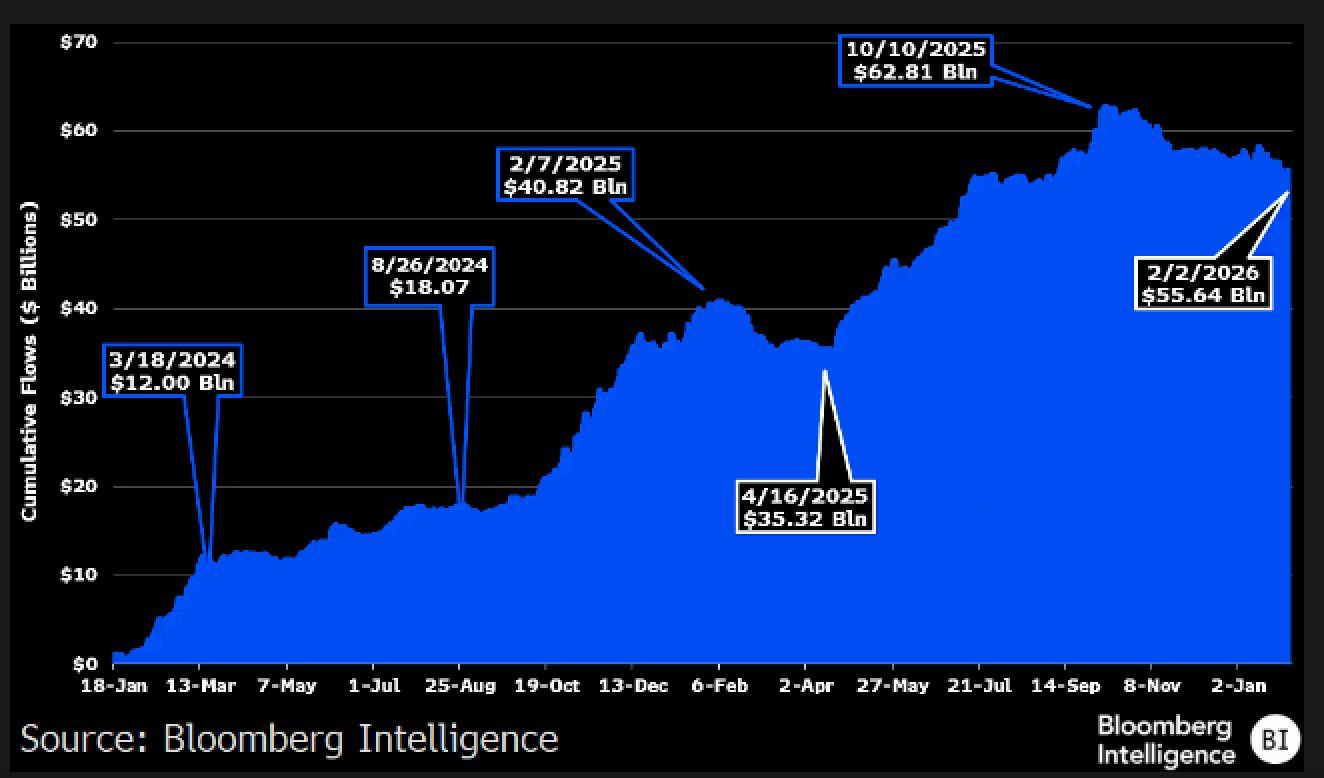

Regardless of the pessimism, some analysts proceed to emphasise the longer-term image. Bloomberg senior ETF analyst Eric Balchunas famous that cumulative internet inflows into Bitcoin ETFs nonetheless stand at roughly $53 billion, down from a peak of over $63 billion in October 2025, even after latest outflows.

“Our (more bullish than most of our peers) prediction was $5-15b in first year. This is imp context to consider when looking/writing about the $8b in outflows since 45% decline and/or the relationship bt btc and Wall street, which has been overwhelmingly positive,” he added.

Taken collectively, the info counsel the present retracement displays cyclical danger discount slightly than a structural reversal. ETF flows have amplified each upside and draw back strikes, embedding Bitcoin extra deeply into conventional capital markets dynamics.

Whereas short-term stress could persist amid broader macro uncertainty, the size and pace of institutional adoption since launch point out that Bitcoin’s integration into Wall Avenue portfolios stays intact.