Crypto market sentiment has deteriorated sharply, with Matrixport’s Greed & Worry index falling to extraordinarily depressed ranges, suggesting the market could also be approaching one other inflection level.

Even so, Matrixport instructed that Bitcoin should see draw back forward.

Sponsored

Sentiment Indicators Potential Inflection Level For Bitcoin

In a current market replace, Matrixport stated total sentiment has dropped to excessive lows, reflecting broad-based pessimism throughout the digital asset area.

The agency highlighted its proprietary Bitcoin concern and greed gauge, explaining that “durable bottoms” have sometimes emerged when the 21-day shifting common dips beneath zero and subsequently begins to show upward. The setup seems to be in place, in line with the chart.

“This transition signals that selling pressure is becoming exhausted and that market conditions are beginning to stabilize,” the put up learn.

Matrixport’s Greed & Worry index. Supply: X/Matrixport Official

The report added that, given the cyclical relationship between sentiment and Bitcoin value motion, the newest excessive studying might point out that the market is nearing one other potential turning level.

On the similar time, Matrixport warned that costs might proceed to say no within the close to time period.

Sponsored

“While caution remains warranted, the current environment is increasingly forcing us to sharpen our focus and prepare for the conditions that typically precede a meaningful rebound,” the agency stated.

On-Chain Indicators Sign Bear Market Stress

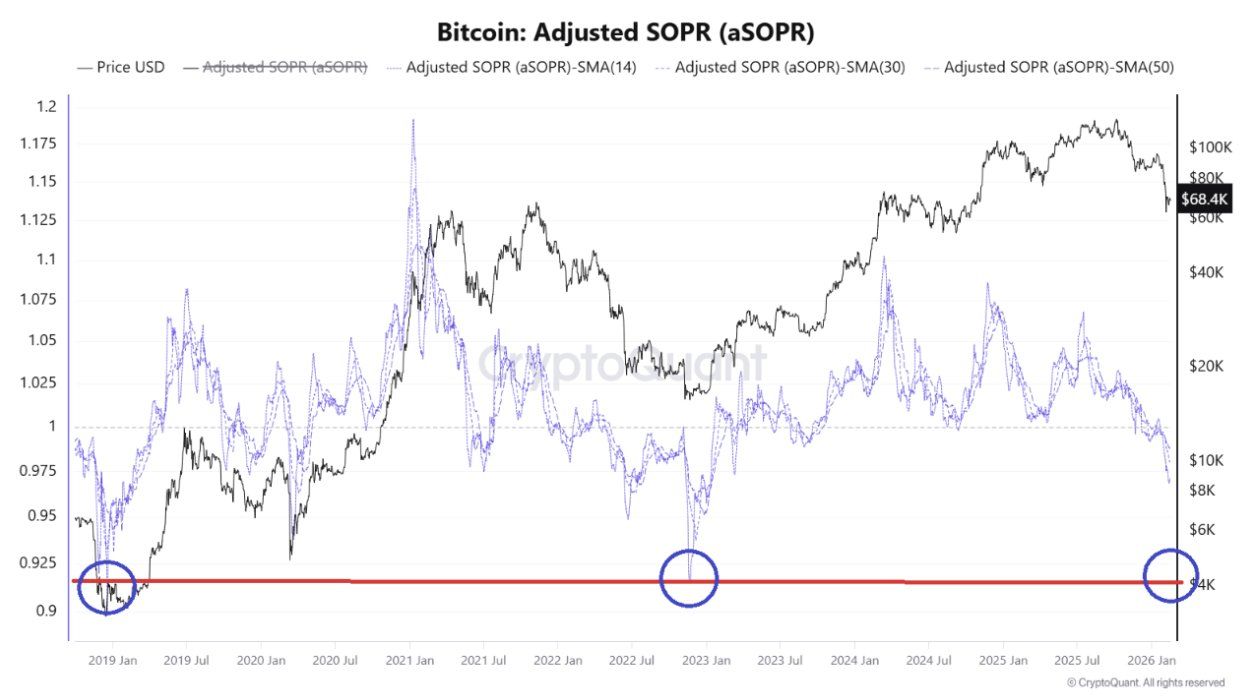

In the meantime, technical indicators strengthen the image of a burdened Bitcoin market. An analyst, Woominkyu, famous that the adjusted Spent Output Revenue Ratio (aSOPR) has fallen again into the 0.92-0.94 vary, a zone that beforehand coincided with main bear-market stress durations.

“In 2019 and 2023, similar readings occurred during deep corrective phases where coins were being spent at a loss. Each time, this zone represented capitulation pressure and structural reset,” the put up learn.

Sponsored

Traditionally, a number of cycle lows fashioned across the 0.92 to 0.93 area. The present construction, Woominkyu famous, resembles prior transitions into bear market phases reasonably than routine mid-cycle pullbacks.

If the metric fails to recuperate above 1.0 within the close to time period, it may enhance the likelihood that Bitcoin is getting into a broader bearish part reasonably than present process a easy correction.

True market bottoms, the analyst argued, are inclined to type solely after deeper compression in aSOPR, peak loss realization, and full exhaustion of promoting stress. Whereas the market seems to be getting into a stress zone, it might not but mirror full capitulation.

“aSOPR is signaling structural deterioration. This looks less like a dip and more like a regime shift. The real bottom may still require deeper compression before a durable reversal forms,” the analyst added.

Sponsored

This view aligns with broader bearish projections suggesting Bitcoin may revisit ranges beneath $40,000 earlier than forming a sturdy backside.

BeInCrypto Markets information exhibits Bitcoin is at present buying and selling round $68,000. A drop beneath $40,000 would suggest a decline of greater than 40% from present ranges, highlighting the size of draw back danger some analysts consider stays on the desk.

For now, sentiment indicators trace at a possible turning level, however on-chain information suggests structural weak point should have to run its course earlier than a restoration can start.