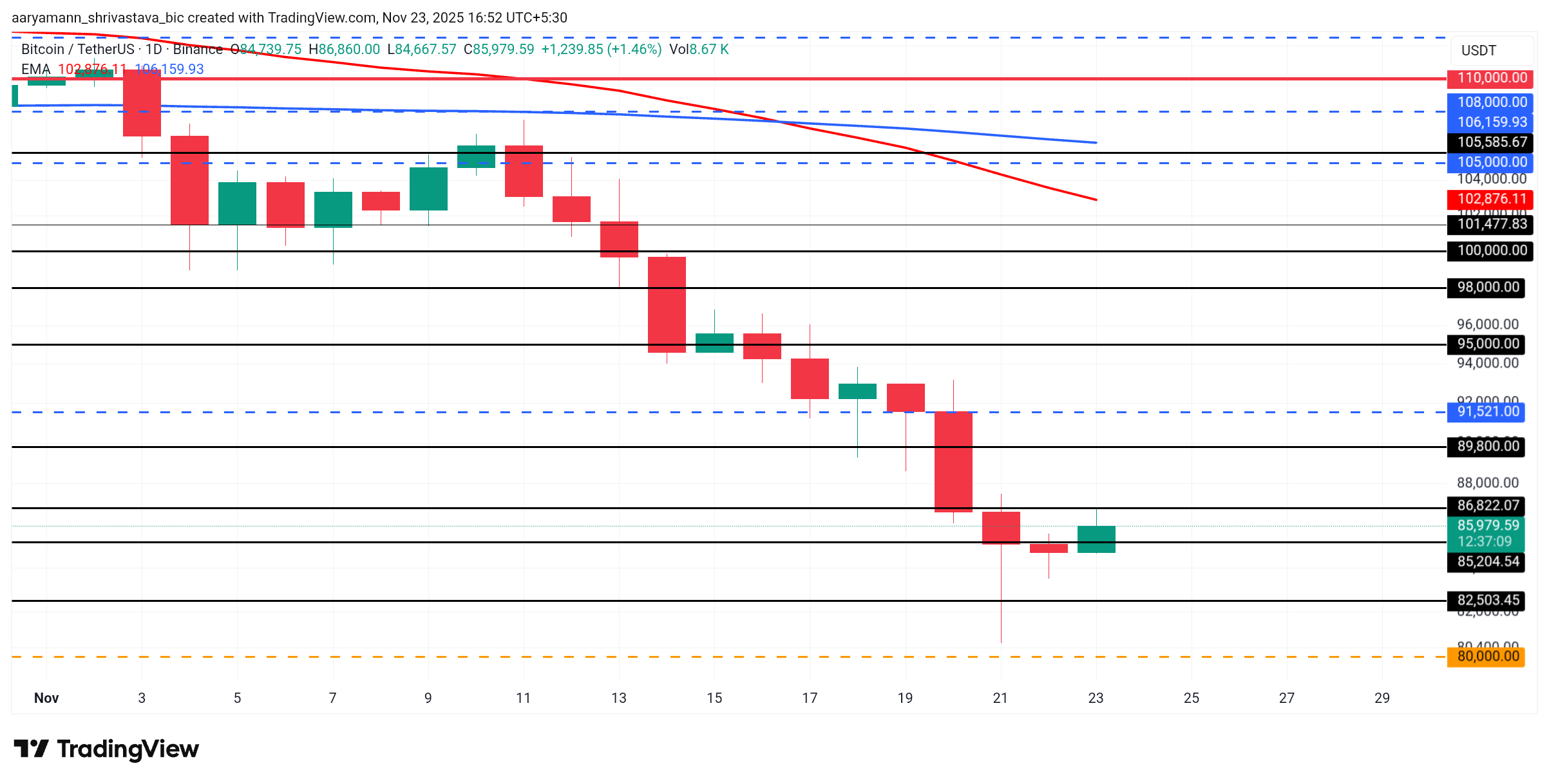

Bitcoin has spent a number of days underneath heavy promoting stress, dropping to the $85,000 zone earlier than making an attempt a modest restoration. The drawdown has shaken market confidence, however the depth of capitulation now rising from Bitcoin holders suggests the market could also be forming a backside.

The value is stabilizing round a key psychological degree, however this stabilization comes at the price of widespread holder give up — a basic bottoming sign.

Sponsored

Sponsored

Bitcoin Merchants And Traders Let Go

Macro momentum indicators present Bitcoin market’s danger expectations shifting aggressively. The 25-delta skew has pushed deeper into put territory throughout all maturities, signaling that merchants are more and more paying up for draw back safety. Quick-dated choices stay probably the most skewed, however the notable shift is in longer expiries.

Six-month places have gained two volatility factors in only a week, highlighting a transfer towards structurally bearish positioning. Merchants at the moment are pricing each quick draw back danger and the potential for a bigger break.

This sample usually seems close to main cyclical backside zones as markets overshoot to the draw back earlier than equilibrium returns.

Bitcoin Choices 25D Skew. Supply: Glassnode

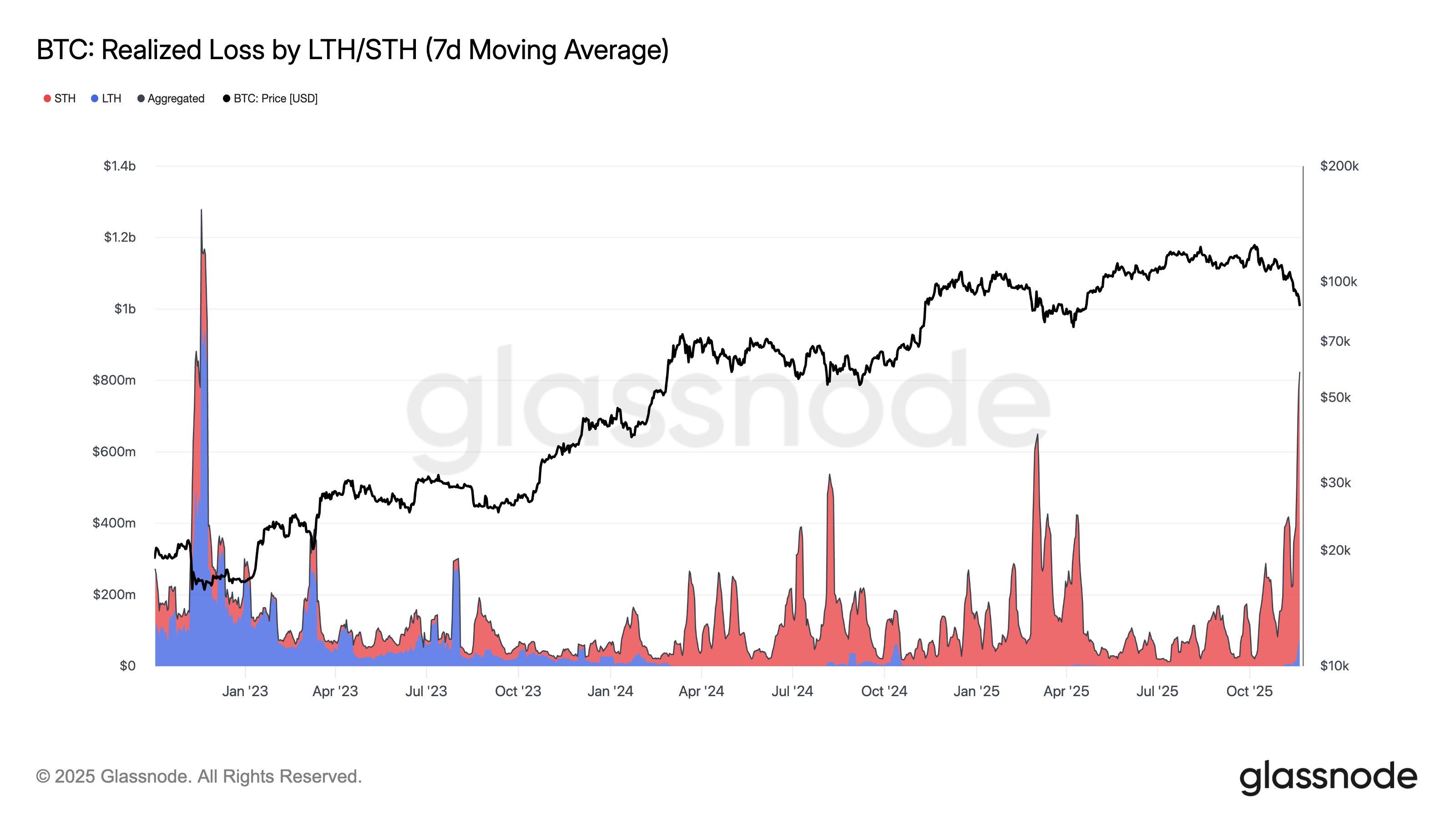

Realized losses amongst Bitcoin holders have surged to ranges not seen because the FTX collapse. Quick-term holders are driving most of this capitulation, reflecting panic promoting from latest consumers who gathered close to the highs. The dimensions and pace of those realized losses point out that marginal demand has been absolutely exhausted.

Sponsored

Sponsored

This sort of aggressive deleveraging traditionally marks the ultimate part of a downturn. When short-term holders unwind en masse, long-term holders usually step in, and accumulation zones start to type.

This aligns with basic bottoming conduct, the place capitulation precedes restoration.

BTC Value Can Bounce Again

Bitcoin trades at $85,979 on the time of writing, holding above the $85,204 assist degree and defending the $85,000 psychological ground. The confluence of capitulation, bearish skew, and deep realized losses suggests {that a} market backside is close to or already forming.

If this backside confirms, Bitcoin may rebound and break via the $86,822 resistance. A transfer above that degree could allow a rally to $89,800 after which $91,521. Clearing these boundaries would restore bullish sentiment, probably driving BTC towards $95,000 within the brief time period.

Nevertheless, if bearish stress intensifies and macro circumstances fail to enhance, Bitcoin could break under $85,204. A decline underneath $82,503 would expose the value to a deeper fall towards $80,000, invalidating the bullish thesis and delaying restoration.