Billionaire fund supervisor David Tepper despatched a transparent sign by strolling away from Intel (INTC) inventory totally, WhaleWisdom reported.

Following the chipmaker’s comeback rally (practically a 50% surge) backed by foundry optimism, authorities assist, and renewed religion in its potential turnaround, Tepper hit the exit.

As soon as now we have that in thoughts, the remainder of Appaloosa’s 13F snaps into focus.

He lowered his holdings in many of the massive tech corporations, releasing up billions, after which went cut price searching in locations the market was overlooking.

Whirlpool, regional banks, and beaten-up cyclicals — Tepper didn’t abandon shares, however as an alternative his strikes present that the simple cash in tech has gone, and arguably the actual alternative was within the bruised.

Appaloosa’s Q3 submitting reveals a swift departure from high-flying Intel inventory.

Photograph by Icon Sportswire on Getty Pictures

Who’s David Tepper?

David Tepper isn’t simply any billionaire hedge fund supervisor; he’s the man Mr. Market watches intently on Wall Road, the place the subsequent massive flip is perhaps.

After his profitable stint as a high-yield dealer at Goldman Sachs, he launched Appaloosa Administration in 1993, racking up a stellar 25% common annual return over greater than twenty years.

Fund supervisor buys and sells

- Stanley Druckenmiller’s newest buys recommend shifting tech development

- Fund supervisor has shocking tackle massive Tesla inventory drop

- Jim Cramer delivers pressing tackle the inventory market

- Cathie Wooden dumps $30 million in longtime favourite

Forbes pegs his web price at $23.7 billion. That, plus his highly effective monitor file, places him in an elite group of buyers whose strikes basically change into headlines.

At present, Appaloosa manages practically $17 billion, most of which is Tepper’s personal capital, basically functioning as his household workplace out of Miami Seaside, whereas he additionally owns the NFL’s Carolina Panthers.

Associated: Morgan Stanley revamps Nvidia’s value goal forward of huge Q3

Through the years, he has constructed a stable popularity solid on daring, contrarian calls.

Maybe his most well-known guess was when he scooped up beaten-down financial institution shares in 2009 and minted billions when the sector rebounded.

His investing type is greatest described as elastic however conviction-driven, which basically entails shopping for what’s hated, promoting what’s overheated, and pivoting rapidly when the cycle shifts.

Why Tepper walked away from Intel

Chip large Intel’s Q2 comeback was arguably the market’s loudest shock this 12 months.

Over the previous three months, the inventory has risen 40%, pushed by authorities subsidies, early traction in its hotly anticipated foundry reboot, and investor pleasure over Nvidia-linked tech wins.

Tepper used that energy to dump his whole stake within the firm. For a worth inventory opportunist who’s been identified to purchase distressed turnarounds, that exit was maybe the quarter’s greatest inform.

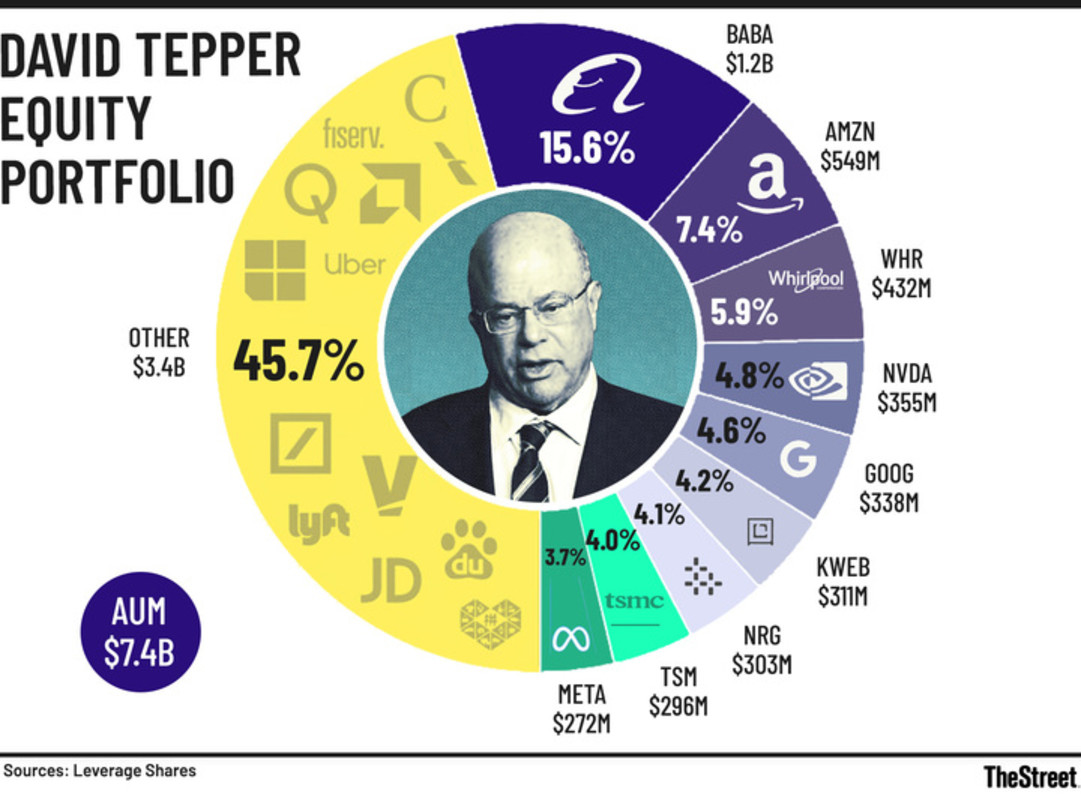

David Tepper Q3 Fairness Portfolio

TheStreet

Intel’s revival is actual, however it’s important to acknowledge that it’s gradual and capital-intensive, and it comes with a major execution threat.

And Intel wasn’t precisely an remoted transfer.

The identical playbook was absolutely on show throughout Appaloosa’s Q3 trims in Amazon, Alphabet, Meta, Microsoft, Alibaba, and JD.com, together with a near-complete exit from UnitedHealth.

Tepper’s tech trims are basically all the way down to the mathematics and timing.

Following the power-packed surge in AI valuations from 2023 to 2025, valuations throughout massive tech have clearly change into stretched, with cloud earnings being nearly priced for perfection, and China tech remaining largely risky.

How a lot Tepper trimmed every main tech title:

- Amazon: Lowered his stake by practically 7%

- Alibaba: Lowered by practically 9%

- Alphabet (Class A & C): Modest trims throughout each share courses

- Meta Platforms: Small discount to lock in good points

- Microsoft: Small trim as a part of the broader tech de-risking

- JD.com: Significant discount according to his China tech pullback

- UnitedHealth: Slashed by 92%

- Oracle: Totally exited

- Intel: 100% exit

Tepper buys ache, not hype

Tepper cashed out of Intel, trimming most of his massive tech holdings. However he didn’t simply sit on the money; he redeployed it within the more-overlooked corners of the market.

Arguably, the largest swing got here with residence home equipment large Whirlpool, the place his agency opened a 5.5 million-share place price practically $432 million.

That guess made it roughly 6% of his portfolio, turning Whirlpool into Appaloosa’s third-largest holding.

The inventory took a monumental beating, down 75% from its 2021 highs and practically 40% 12 months so far, which is why Tepper pounced.

He additionally made a push into the regional banks, scooping up Truist (1.39 million shares), KeyCorp (2.02 million), and Fiserv (925,000), together with new/expanded stakes in CFG, Comerica, Western Alliance, and Zions. These have been the companies that got here below duress attributable to funding-related troubles and deposit-cost spikes.

Furthermore, he didn’t abandon tech totally, including AI poster-child Nvidia into the combination.

Associated: Peter Thiel dumps prime AI inventory, stirring bubble fears