Picture supply: Getty Photographs

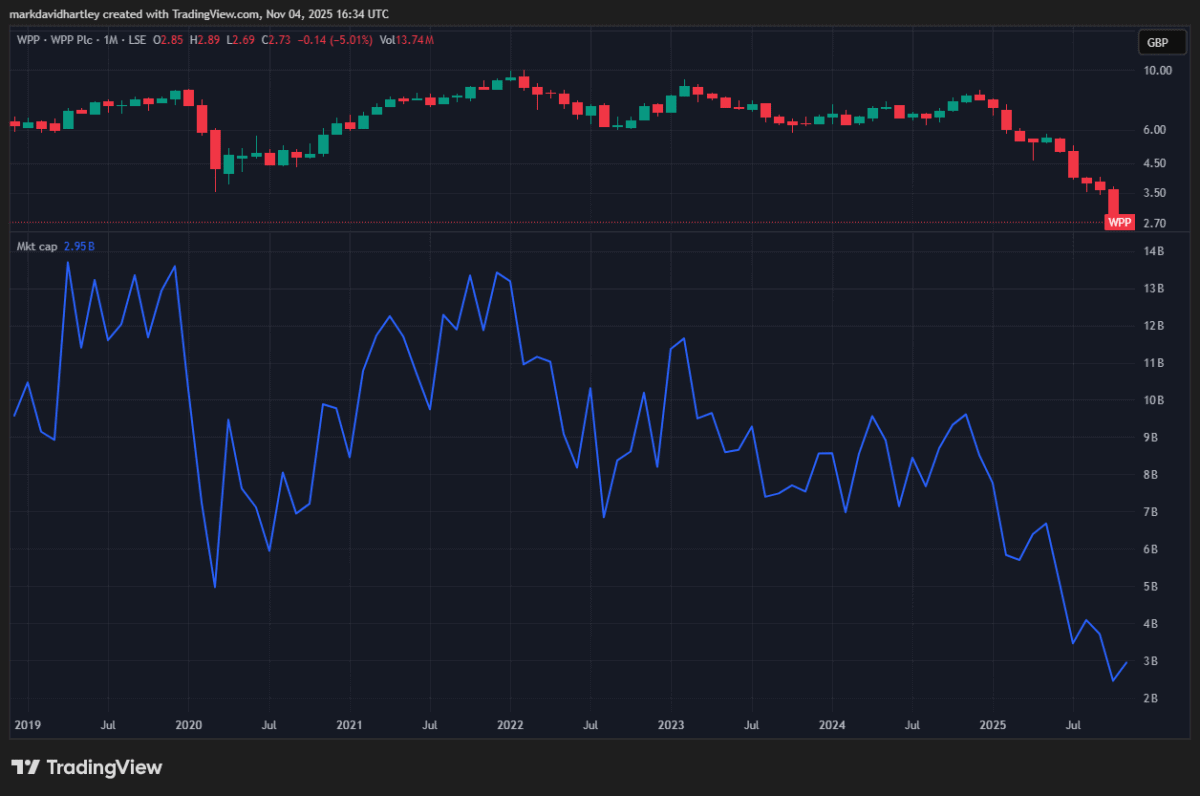

After falling 85% from its all-time excessive, WPP (LSE: WPP) now seems like a key contender to affix the FTSE 250 within the subsequent index reshuffle. The truth is, there are actually no fewer than 20 shares on the mid-cap index with bigger market-caps than it has. The worst of these losses occurred in simply the previous 11 months.

The worth is down 70% since 13 December 2024, when the shares price 893p. Now buying and selling at round 273p, they’re at their lowest stage since October 1998 — earlier than the dotcom crash! And the FTSE 100‘s up 104% in the identical time interval.

It’s onerous to consider that the corporate was price virtually £14bn simply earlier than Covid hit.

Created on TradingView.com

Created on TradingView.com

Why’s this occurred?

The fast rise of digital and synthetic intelligence (AI)-driven promoting has been recognized as a key contributor to WPP’s struggles. Unable to compete with technological challenges, it misplaced main shoppers corresponding to Mars and Coca-Cola, resulting in a pointy income decline.

Macroeconomic challenges additional compounded this, resulting in lowered promoting budgets, particularly in key markets corresponding to North America. Add to this pricey management modifications and you’ve got the proper storm to ship a inventory spiralling.

In order that leaves the query: is WPP a misplaced trigger or a possibility hiding in plain sight for worth buyers?

Down. However not out

For these prepared to play the lengthy recreation, it’s truthful to say that WPP might make an honest restoration. The corporate’s presently dealing with important sector-specific headwinds however previously, it was a titan of trade.

It couldn’t obtain that with out the trimmings of a well-run enterprise. Subsequently, it’s not unrealistic to think about it might regain the success of yesteryear — if it may well solely navigate the challenges of the fashionable world.

Proper now, AI’s inflicting important disruption in a number of industries, notably media. Nonetheless, lots of its makes use of are nonetheless being examined, and there’s little proof to recommend it’ll absolutely substitute providers for a lot of firms.

Rescue stations

As soon as the mud settles, we could discover that conventional companies nonetheless play a core position in media and different sectors. And with many years of expertise, WPP’s well-positioned to tackle that position.

Just lately-appointed CEO Cindy Rose has taken the result in implement operational modifications amid all of the monetary stress. She’s already introduced plans to streamline inner operations and deal with know-how and enterprise options to revive development.

By a current partnership with Google AI, the writer plans to create a proprietary platform, WPP Open, utilizing superior generative AI instruments. The goal is to allow sooner artistic content material technology, from advert ideas to video narration and product photographs, enormously accelerating marketing campaign manufacturing and lowering prices.

My opinion

In at this time’s AI-driven world, the long run’s extra unsure than ever. Nonetheless, I feel WPP has a great likelihood of bouncing again. With the value down 67% in a yr, it now seems extraordinarily undervalued. It has a ahead price-to-earnings (P/E) ratio of 4.42 and a price-to-sales (P/S) ratio of 0.21.

On the similar time, earnings are up 89% yr on yr, regardless of the sharp fall in income. So it’s nonetheless price contemplating, for my part.

Naturally, any important turnaround could take a while. However for these prepared to attend, would possibly this change into the subsequent Roll-Royce-style restoration story?