Ethereum’s long-term trajectory has develop into a focus once more after Arthur Hayes laid out a sweeping forecast for the asset’s institutional future, worth potential, and aggressive area.

His feedback arrived as Ethereum trades close to $3,200, fluctuating between $3,060 and $3,440 over the previous week. Main gamers akin to Tom Lee’s BitMine additionally elevated their Ethereum holdings at an unprecedented tempo.

Ethereum Turns into the Institutional Default

Hayes believes the market nonetheless misunderstands how deeply conventional establishments intend to combine Ethereum. He argues that after years of failed experiments with non-public blockchains, banks now acknowledge the necessity for a public settlement layer.

Sponsored

Sponsored

“These organizations finally understand that you cannot have a private blockchain; you must use a public blockchain for security and real usage,” he mentioned.

He hyperlinks this shift to the stablecoin growth, which has pressured banks to simply accept the worth of on-chain settlement.

In line with Hayes, Ethereum is positioned as the one platform with the safety, liquidity, and developer depth establishments want.

He expects this shift to drive a major worth resurgence for Ethereum within the coming cycle, complementing aggressive treasury accumulation by corporations akin to BitMine.

BitMine purchased 33,504 ETH ($112 million) this week and 138,452 ETH (~$435 million) earlier in December, bringing its whole to roughly 3.86 million ETH. That scale of accumulation has strengthened the narrative that establishments are positioning for Ethereum’s subsequent main cycle.

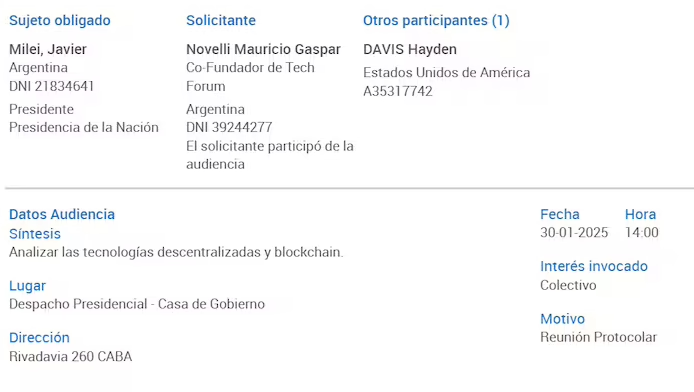

Ethereum Treasuries Maintain Almost 5% of ETH Provide. Supply: CoinGecko

Privateness Stays Ethereum’s Largest Weak point, However L2s Will Cowl It

Hayes acknowledges Ethereum nonetheless lacks the privateness ensures giant establishments require. He notes that that is “the biggest thing Ethereum doesn’t have yet,” although he says Vitalik Buterin’s roadmap is actively addressing it.

Sponsored

Sponsored

Regardless of this hole, he argues institutional adoption is not going to be delayed. As an alternative, enterprises will deploy privacy-enabled Layer-2 networks whereas counting on Ethereum for settlement.

He believes Ethereum L1 stays the “security substrate” no matter whether or not exercise happens on L2s like Arbitrum or Optimism.

“There may need to be a debate about how fees are distributed between L2s and Ethereum L1,” he mentioned, however he careworn that this doesn’t change the underlying actuality: establishments will nonetheless safe their operations utilizing Ethereum.

This aligns with present ecosystem traits. Alternate balances are at multi-year lows, and whales have collected over 900,000 ETH in latest weeks, in keeping with Santiment information.

Institutional structure continues to type across the Ethereum base layer, at the same time as charges fall amid L2 migration.

Sponsored

Sponsored

A Slender Subject of Winners: Ethereum First, Solana Second

Hayes sees the way forward for public blockchains consolidating round a really small group. He locations Ethereum because the clear long-term winner, with Solana in a distant however sturdy second place.

He credit Solana’s rise from $7 to $300 to intense meme coin exercise in 2023 and 2024. Nevertheless, he states Solana “needs a new trick” to outperform Ethereum once more.

Whereas he expects Solana to stay related, he doesn’t anticipate it to match Ethereum’s institutional position or long-term worth energy.

Hayes views almost all different L1s as structurally weak. He dismissed high-FDV chains akin to Monad as over-inflated initiatives prone to collapse after an preliminary pump.

“Monad won’t be able to compete with Ethereum

I have no belief that this is a legitimate blockchain.

It’ll never have any real usage.”

— Arthur Hayes

for those who perceive community results, you already know Ethereum’s right here to remain on the high.

Monad’s answer is easy: construct on… pic.twitter.com/EuXpU6VK1N

— rip.eth (@ripeth) November 29, 2025

Sponsored

Sponsored

50 ETH to Turn out to be a Millionaire by Subsequent Election

Hayes supplied his most express numerical prediction when requested how a lot ETH one would wish to develop into a millionaire within the subsequent cycle.

He said that Ethereum may attain $20,000, implying that 50 ETH can be sufficient to succeed in a seven-figure portfolio.

The BitMex founder expects this worth goal to materialize by the subsequent US presidential election. His outlook aligns with the present provide setting: trade reserves are shrinking, establishments are accumulating, and treasury patrons like BitMine proceed to deploy a whole bunch of hundreds of thousands into ETH.

Arthur Hayes was simply requested about Tom Lee saying $ETH may flip $BTC.

He says Ethereum is one of the best L1, with probably the most builders, one of the best DeFi, and the strongest expertise. pic.twitter.com/EsQ74JpNRV

— SamAlτcoin.eth 🌎 (@SAMALTCOIN_ETH) October 21, 2025

If Ethereum fails to satisfy these expectations, Hayes says it is going to be resulting from narrative breakdown.

Additionally, if stablecoin utilization slows or establishments retreat from on-chain buying and selling, Bitcoin may outperform Ethereum for a protracted interval.

Nevertheless, he argues that present market construction favors Ethereum’s long-term dominance—particularly as banks put together to execute Web3 methods on public infrastructure.