In the case of investing, there are not any certainties, besides that nothing is for certain. These of us who’ve been round for 30 years or extra have realized to talk in generalities reasonably than absolutes, recognizing that whereas historical past rhymes, it would not essentially repeat.

One of many normal truths I’ve realized over my thirty-year investing profession is that shares are likely to tip over when everyone seems to be standing on the identical aspect of the proverbial boat. They do a lot better when there is a regular stream of individuals nonetheless on the opposite aspect making an attempt to get throughout.

What worries me this yr is that each Wall Avenue analyst has moved to the identical aspect of the boat, and that is probably a giant drawback as a result of it suggests there is not some huge cash nonetheless on the sidelines left to purchase shares.

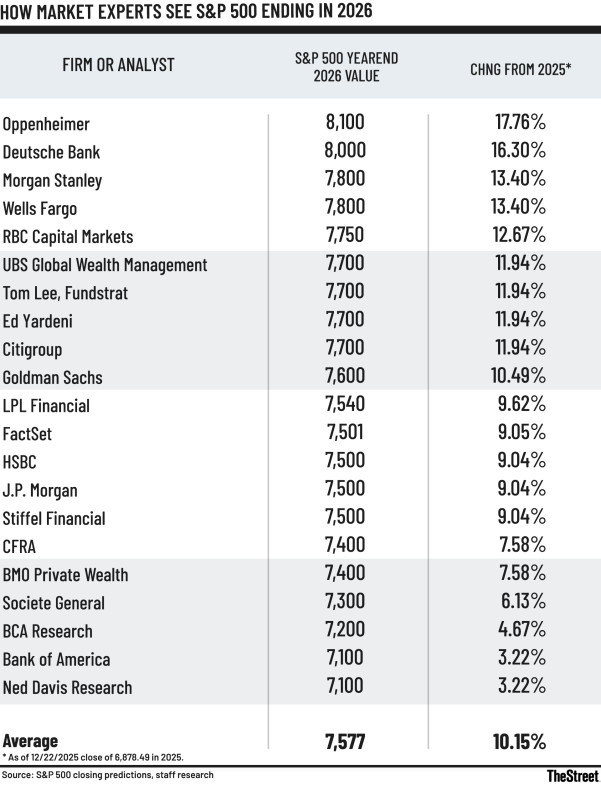

Our personal Charley Blaine surveyed the most important Wall Avenue analysis corporations in December. The targets differ, however they share one factor in frequent. Each single analyst expects the S&P 500 to complete 2026 greater than it began. That is a distinction to final yr, when Blaine’s survey confirmed a number of corporations nonetheless had bearish forecasts.

Wall Avenue analysts predict a fourth consecutive yr of S&P 500 positive factors in 2026.

Reuters

Inventory market targets are overwhelmingly bullish

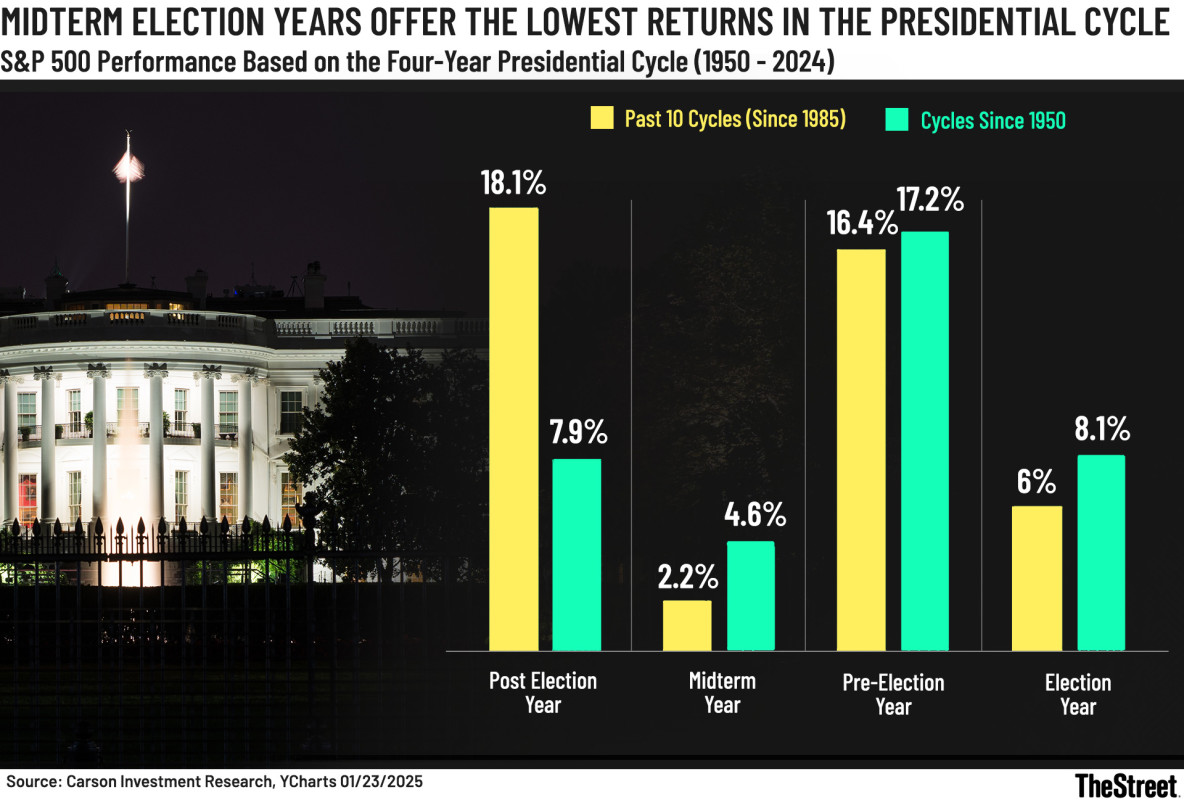

I learn a variety of analysis reviews, and one factor that stands out this yr is that whereas most analysts level out rocky tendencies throughout mid-term election years (learn extra right here), all of them anticipate any rockiness to be short-lived, with the S&P 500 delivering a fourth consecutive yr of positive factors in 2026.

To be clear, that is not a nasty guess.

Mid-term years have the worst historical past of intrayear drawdowns of the four-year Presidential cycle, falling a median of 18%. Nonetheless, the harm is often executed within the second and third quarters of the yr, with shares discovering their footing and rallying when election craziness is over.

Nonetheless, there are many years when shares completed the yr decrease.

“Midterm election year 2026 promises to be fraught with crisis, bear market action, and economic weakness,” notes Jeffrey Hirsch within the 2026 version of the Inventory Dealer’s Almanac.

Since 1950, the typical S&P 500 return in mid-term years is 4.6%, considerably beneath the 17.2% return notched in pre-election years and the 8% return in Presidential election years. Efficiency has been worse since 1985.

Midterm Election Years provide the Lowest Returns within the Presidential Cycle Chart

Carson Funding Analysis, YCharts, TheStreet

General, there have been nineteen Presidential cycle mid-years, and 20% bear market drops have occurred six occasions, together with a 33.8% retreat in 2002 and a 25.4% drop in 2022.

These had been distinctive occasions, however you get the gist: shares aren’t assured to ship positive factors, even when everybody thinks that they’ll. But, Wall Avenue analysts stay firmly within the bull market camp. Of the 21 analysts surveyed, 100% anticipate the S&P 500 to be up in 2026, together with 10 who forecast double-digit returns.

Wall Avenue analysts provide bullish forecasts for 2026.

S&P 500

It is not simply Wall Avenue that is bullish and largely all-in. Each month, the American Affiliation of Particular person Buyers (AAII) shares respondents’ allocation to shares.

“As of the end of December, their allocation to stocks was fractionally over 70%,” wrote technical analyst Helene Meisler on TheStreet Professional.

Meisler factors out that readings this excessive have solely occurred 4 occasions previously twenty years. Every time, the studying got here inside about one yr of a considerable pullback, together with in 2021 forward of 2022’s bear market drop and in December 2024, earlier than the near-bear market drop final spring.

My tackle what traders can do now

Shares go up and to the proper over time, however they do not do it in a straight line. They zigzag and take all kinds of detours that may preserve traders awake at evening. We definitely noticed that final yr, when the S&P 500 tumbled almost 20% within the spring earlier than rallying over 40% from April’s lows by way of year-end.

Sadly, no one rings a bell signaling market tops or bottoms, however there are indicators you may observe to see if shares get overbought or oversold. TheStreet Professional’s Meisler has been monitoring markets as a technical analyst because the Eighties, together with a stint at Goldman Sachs. She watches the share of advancers to decliners over 10 days and 30 days, the Every day Sentiment Index, and different metrics for clues to when shares could also be overbought or oversold.

Associated: Micron makes huge transfer as supercycle ramps

These instruments are finest, nevertheless, for lively merchants. Primary Avenue traders usually wrestle to time entry and exit factors, making a buy-and-hold strategy or delicate shifts extra prudent. As an alternative of reacting to media noise within the second, most traders are finest served by making changes on the margin reasonably than leaping out and in of shares continuously, hoping to time issues completely.

If, like me, you are involved that everybody is so bullish, minor changes may embody normalizing the scale of positions in your portfolio. For instance, in case your regular place is 10% and one thing has grown to twenty%, contemplate lowering it to 10% once more to lift a little bit money that you would be able to put in a cash market account whilst you wait to see if shares do certainly retreat throughout their typical mid-year swoon.

Equally, when you purchased a inventory that you simply now not comply with or if the catalyst for getting or proudly owning now not applies, rethink if it is the perfect identify to personal in your portfolio. If it is not, promoting may assist cut back your danger and offer you a little bit more cash on the sidelines to purchase later within the yr on a pullback.

Associated: 30-year veteran analyst reveals 2026 roadmap