The inventory market has notched a exceptional restoration from its early-April lows, delivering wholesome double-digit returns within the wake of mounting optimism that stimulus from the One Large Stunning Invoice Act and Fed rate of interest cuts offset tariff headwinds.

Main market returns since April 8 lows:

- S&P 500: 32.7%

- Nasdaq: 46.7%

- Dow Jones Industrial Common: 22.4%

The rally has lifted the most important market averages, together with the S&P 500 benchmark index, to all-time highs in September, irritating many bears who argue that inventory costs have change into untethered to actuality given the market’s valuation.

Naysayers have a degree.

The S&P 500 is buying and selling at a ahead value to earnings (p/e) ratio of twenty-two.6, in response to FactSet, greater than in February earlier than the index tumbled 19% due to tariffs, and a stage traditionally coincident with poor efficiency throughout the next yr.

Considerations over the S&P 500’s p/e ratio are seemingly a significant cause many buyers have remained on the sidelines since April, lacking the transfer. Satirically, that sidelined cash could present the vitality for greater costs as, one after the other, discouraged doubters cowl quick positions or purchase to affix the social gathering.

In fact, there aren’t any ensures in terms of investing. Nonetheless, one widespread analyst, Carson Group’s Chief Market Strategist Ryan Detrick, crunched the information, and his take is that the inventory market’s record-setting run is probably not over.

The S&P 500 and Nasdaq Composite have notched spectacular positive factors since April’s low.

Picture supply: TheStreet

Inventory market rally thumbs nostril at financial warning indicators

In April, widespread pondering was that enacting tariffs would gas inflation and derail financial progress, sparking job losses and sending the U.S. economic system right into a tailspin.

That hasn’t occurred, however there are warning indicators flashing:

- CPI inflation is trending greater.

- Unemployment is climbing.

- Client confidence is weak.

Whereas inflation stays manageable and considerably under the 8%-plus peak notched in June 2022, it’s begun rising once more. The Client Worth Index CPI inflation measure clocked in at 2.9% in August, far above the current 2.3% low in April earlier than most tariffs kicked in.

The August inflation studying was the best since January 2025, when it was 3%. A breakout above 3% might result in ahead inflation expectations chugging greater—crimping the economic system and probably tossing chilly water on hopes for extra rate of interest cuts in 2026.

Associated: Financial institution of America reveals Palantir inventory value goal replace

The Fed’s financial coverage is dominated by a twin mandate to encourage low inflation and unemployment. This mission is simpler mentioned than finished, particularly now, on condition that unemployment can be rising.

Based on the Bureau of Labor Statistics, the unemployment fee was 4.3%, the best since late 2021 when it was retreating due to Covid-stimulus-driven GDP progress. For perspective, the unemployment fee was 3.4% in April 2023.

Rising inflation and unemployment aren’t good, and shoppers have taken word. The Convention Board’s Client Confidence report for August revealed that its Expectations Index fell 1.2 factors to 74.8 final month, remaining under the brink of 80 that traditionally alerts a looming recession.

Rising dangers, stretched valuations could not matter

The inventory market sometimes struggles in September, however up to now, it has carried out remarkably properly. Based on the Inventory Dealer’s Almanac, September is traditionally the worst month for common S&P 500 returns since 1950, delivering a median lack of 0.7%.

The S&P 500 is up about 2% in September this yr. If the inventory market would not roll over, positive factors would prolong its successful streak to 5 consecutive months.

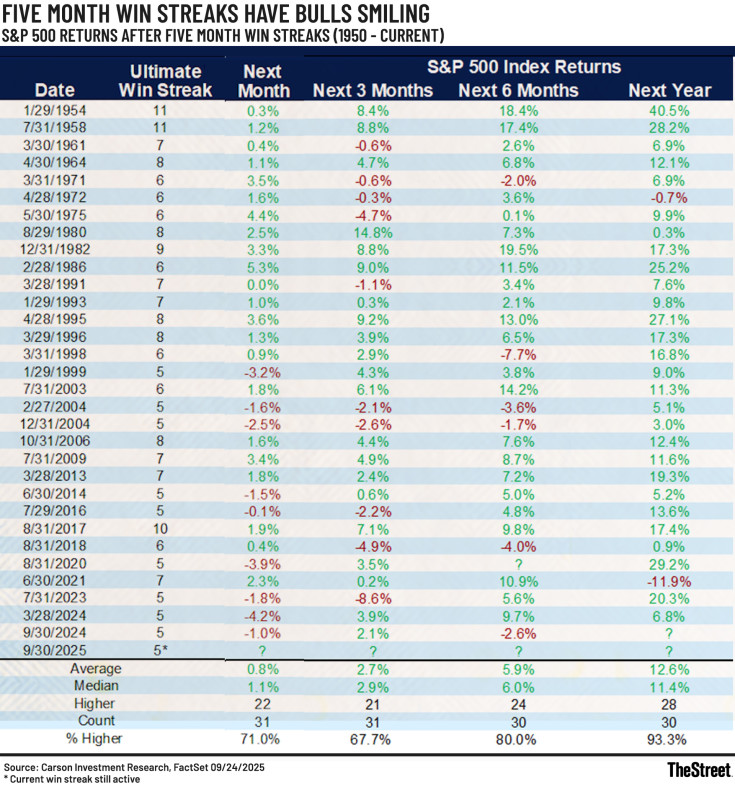

Up to now, successful streaks of that size preceded greater inventory costs, in response to Carson Group’s Ryan Detrick. In a put up on X, Detrick wrote:

Wish to make your favourite perma-bear mad? The S&P 500 is about to be up 5 months in a row. A yr after 5 month win streaks? Increased 28 out of 30 instances and up 12.6% on avg.

5 Month Win Streaks have beforehand preceded additional inventory market positive factors.

Carson Funding Analysis

Extra intriguing? The win fee. Detrick famous 30 situations of 5-month successful streaks since 1950, and the market was greater one yr later in 28 of them, a formidable 93% success fee.

Extra Wall Avenue:

- Ray Dalio sends Wall Avenue a vital $37.5 trillion message

- Tesla inventory falters, however UBS factors out aggressive benefits

- Goldman Sachs resets S&P 500 goal for remainder of 2025

Inventory Dealer’s Almanac’s Jeffrey Hirsch has equally discovered encouraging information for future returns following a powerful September.

“New all-time highs in September have historically been rather bullish,” wrote Hirsch in an electronic mail to subscribers. “Q4 performance has historically been solid but it also improved following five or more new all-time highs in September with only one loss in 8 years.”

Based on Hirsch, the S&P 500’s common and median return within the fourth quarter following this setup have been 5.21% and 5.01%, respectively.

One phrase of warning, although. Hirsch’s information exhibits that October was decrease in 5 of the eight situations, leading to a median October lack of 0.74%. That might imply we are going to see some promoting emerge within the coming weeks.

Nonetheless, Hirsch doesn’t assume any sell-off shall be a lot to fret about.

“We nonetheless anticipate any pullback, or retreat to be comparatively transient and shallow,” wrote Hirsch. “Afterwards the present bull market is prone to propel the market to extra new all-time highs as yearend approaches.”

Associated: AutoZone makes harsh change clients will discover in shops