Altcoin season remains to be not right here, however merchants are already expecting early indicators. One DeFi-specific sector stands out greater than others: decentralized exchanges. Whales have been shopping for DEX tokens throughout a weak market, and their value habits exhibits they’ll transfer on their very own when Bitcoin slows down.

If the following altcoin season arrives, this is without doubt one of the few teams that already exhibits early management traits. Allow us to perceive why!

Purpose 1: DEX Buying and selling Share Retains Rising In opposition to CEX Spot and Perps

The DEX market has been gaining floor all 12 months.

Spot DEX buying and selling quantity, measured as a share of world spot quantity, has climbed from 5.4% in September 2022 to 21.19% in November 2025. June 2025 peaked at 37.4%, the best stage on document. This exhibits customers are transferring extra spot exercise on-chain even when the broader market is weak.

Sponsored

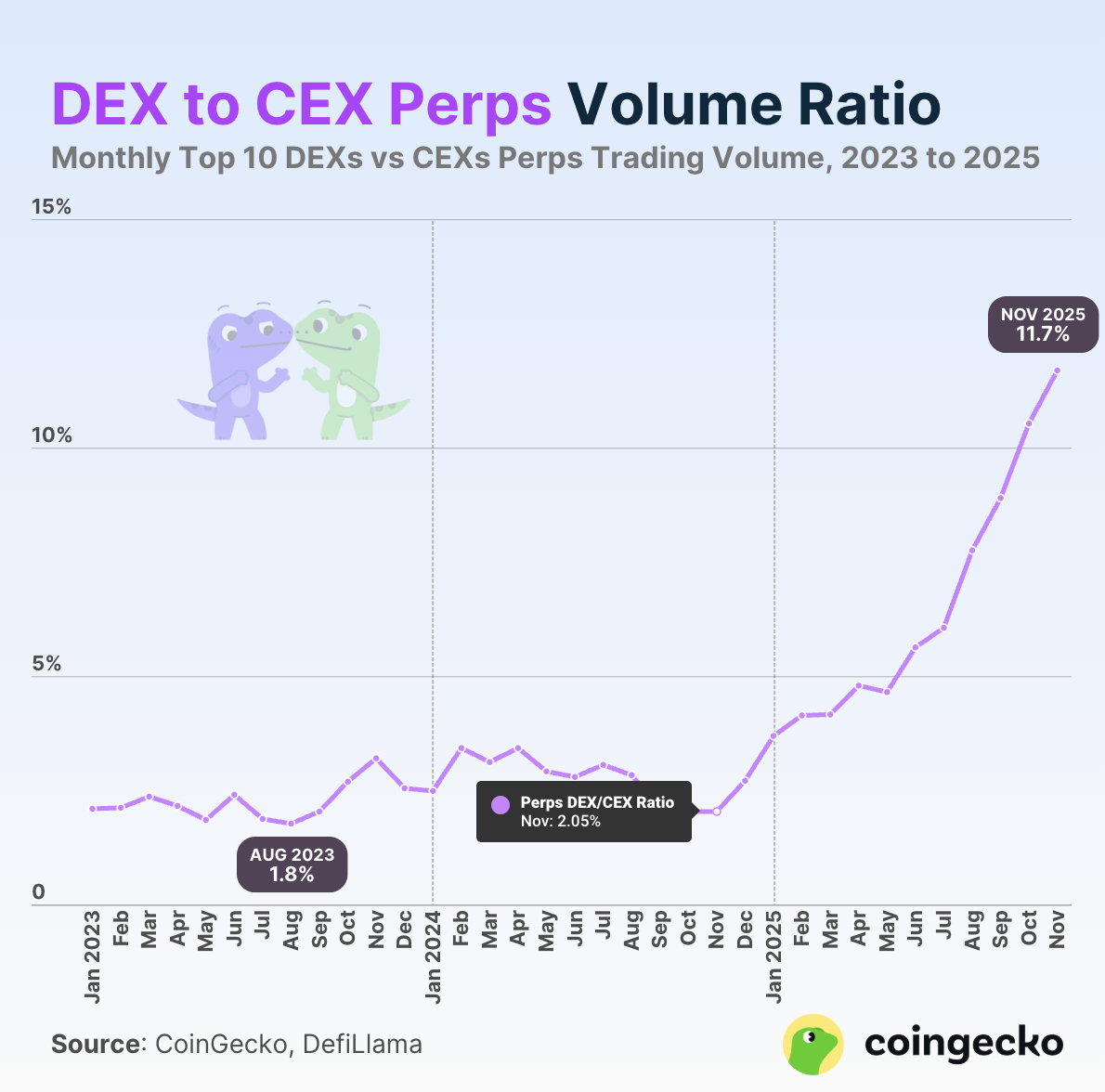

SponsoredDEX TO CEX Ratio: CoinGecko

Derivatives exercise tells the identical story.

The DEX-to-CEX perpetuals ratio jumped from 2.05% in November 2024 to 11.7% this month, its strongest studying but. When extra merchants select on-chain perpetuals over exchange-based ones, it suggests confidence in DEX programs is rising.

Regardless of this energy, the DEX token class remains to be down 3.9% up to now week, whereas CEX tokens are up the identical quantity. This hole factors to undervaluation and creates room for DEX tokens to catch up if sentiment improves.

That’s the reason this subcategory is changing into one of many first locations merchants verify after they rotate away from majors.

Purpose 2: Whales Are Quietly Accumulating Key DEX Tokens

DEX-specific value motion appears weak on the floor, however massive wallets have been shopping for steadily. Whales and mega-whales added throughout the main DEX names even whereas costs drifted sideways to decrease during the last 30 days.

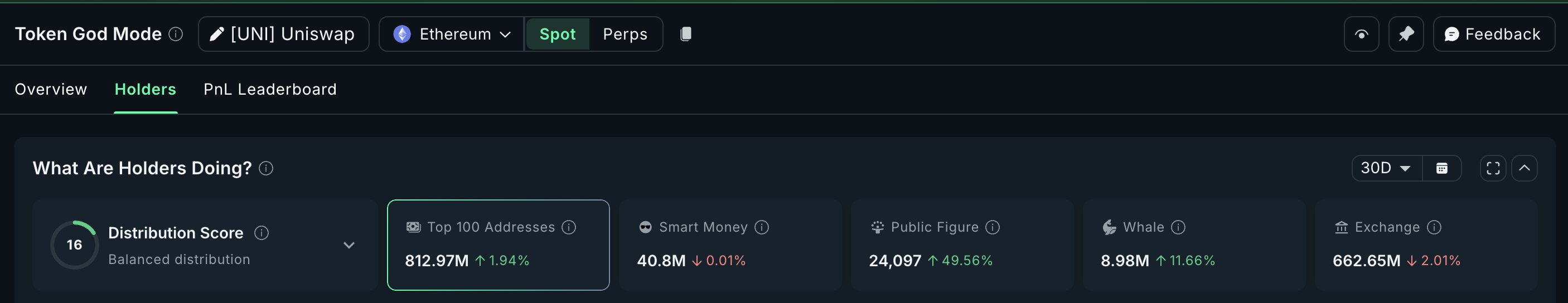

Uniswap (UNI) is down 3.4% in 30 days, however mega-whales elevated holdings by 11.66%. Prime 100 addresses now maintain 8.98 million UNI, exhibiting robust accumulation whereas exchanges proceed to lose provide.

Sponsored

Sponsored

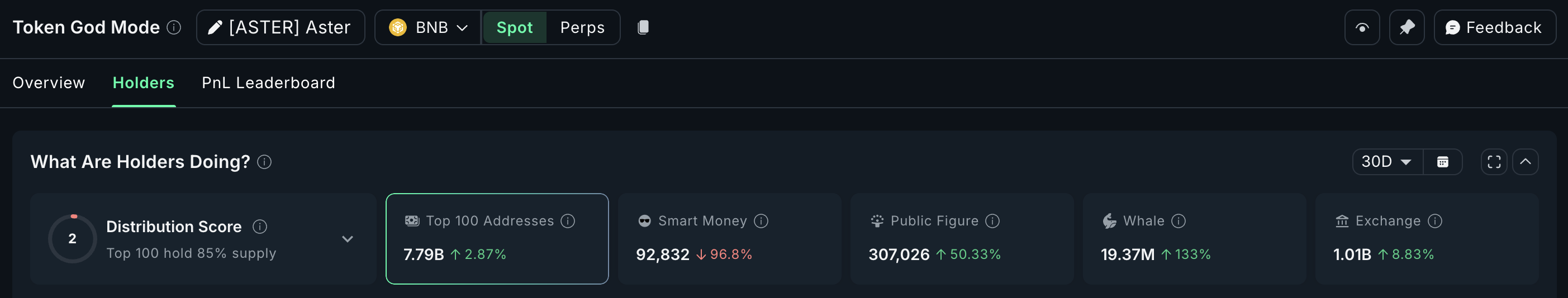

Aster (ASTER) is nearly flat in 30 days, up 0.9%, however the whale sign is even stronger. Whale holdings jumped 133%, and top-tier addresses added 2.87% extra provide. Retail wallets proceed to promote (alternate netflows in inexperienced), however whales positioning early is normally the primary signal of a sector turning earlier than value follows.

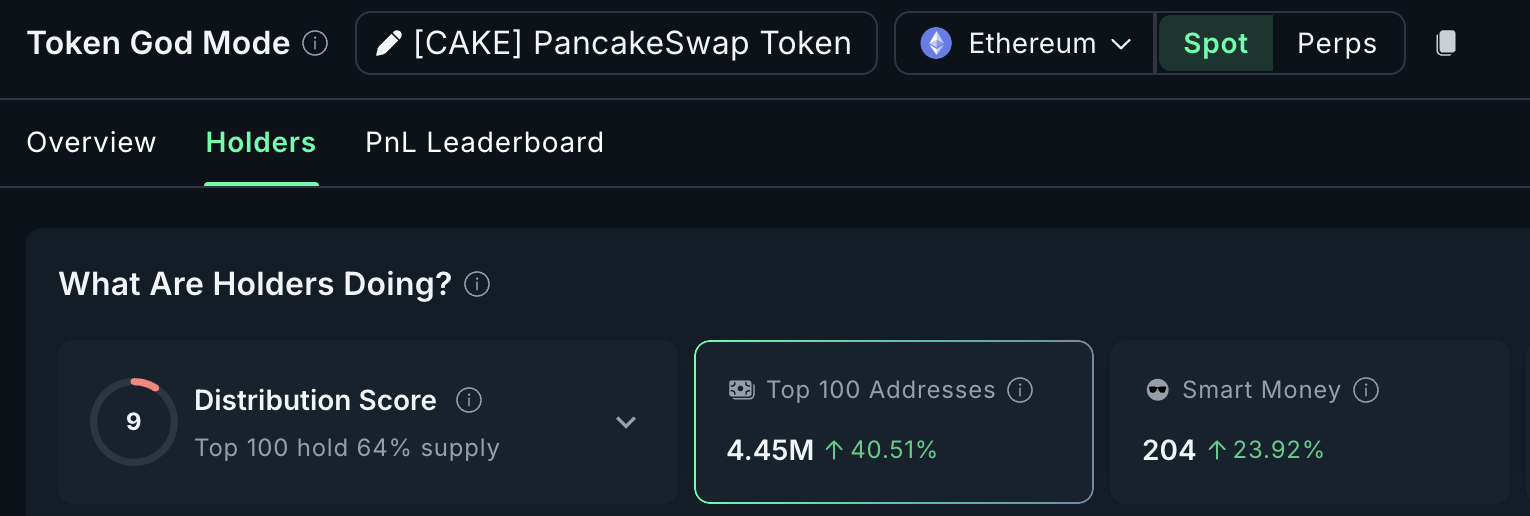

PancakeSwap (CAKE) is down 5.4% in 30 days, but the highest 100 addresses (mega whales) elevated their balances by 40.51%.

This sample throughout three unrelated DEX ecosystems exhibits one widespread message: massive holders are constructing publicity throughout weak spot, not exiting.

When a sector exhibits rising on-chain adoption and rising whale demand on the identical time, it typically turns into one of many earliest beneficiaries when threat urge for food returns.

Purpose 3: DEX Tokens Transfer In another way When Bitcoin Stalls

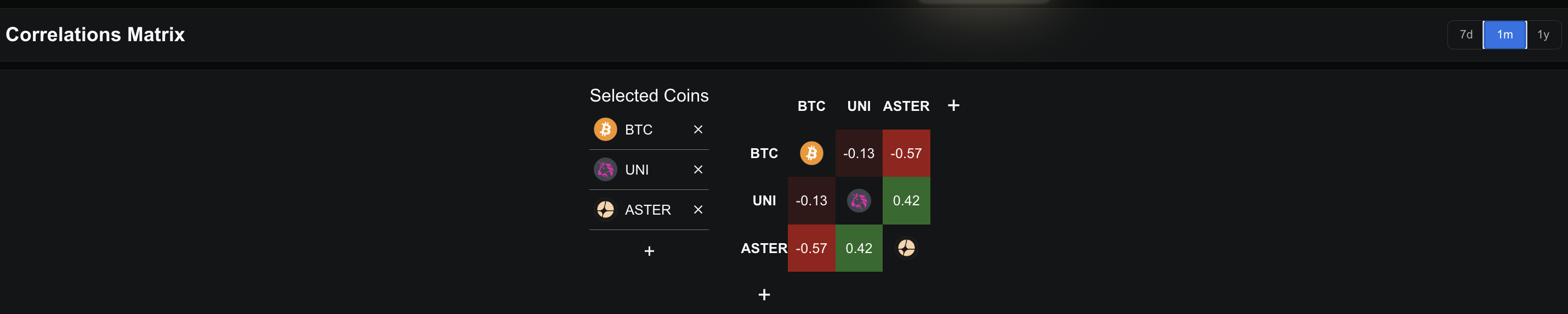

Month-to-month correlation tendencies present that key DEX tokens are not transferring in lockstep with Bitcoin. Correlation right here refers back to the Pearson correlation coefficient, which measures how two costs transfer collectively. A damaging worth means they transfer in reverse instructions.

Sponsored

Sponsored

UNI exhibits a light-weight damaging correlation with Bitcoin at –0.13. ASTER exhibits a a lot stronger damaging studying at –0.57, which is uncommon throughout a Bitcoin-led market.

Because of this when Bitcoin pulls again, these tokens typically don’t observe instantly. In some instances, they appeal to early speculative flows as a result of they transfer independently. This independence is without doubt one of the earliest indicators of altcoin rotation.

Charts assist the identical view.

ASTER’s 12-hour chart exhibits a accomplished bearish crossover between the 20-period and 50-period EMA (Exponential Transferring Common), and the bearish energy has been reducing since. When a token with damaging BTC correlation exhibits weakening bearish stress put up bearish crossover, it turns into one of many first candidates to rebound if market situations flip.

An EMA is a transferring common that offers extra weight to latest value candles.

UNI trades inside a good pennant with a weak higher trendline, solely two touchpoints. A break above $6.91 opens $8.06 after which $10.26, however it’ll want affirmation from its on-balance quantity (OBV). OBV measures quantity movement, and with out an upside shift, breakouts typically fail. Nonetheless, the technical construction aligns with the whale accumulation and the damaging correlation backdrop.

Sponsored

Sponsored

This mixture—whales shopping for, bearish energy fading, and value decoupling—is strictly how early altcoin leaders behave earlier than a broader cycle begins.

However Altcoin Season Has Not Began But

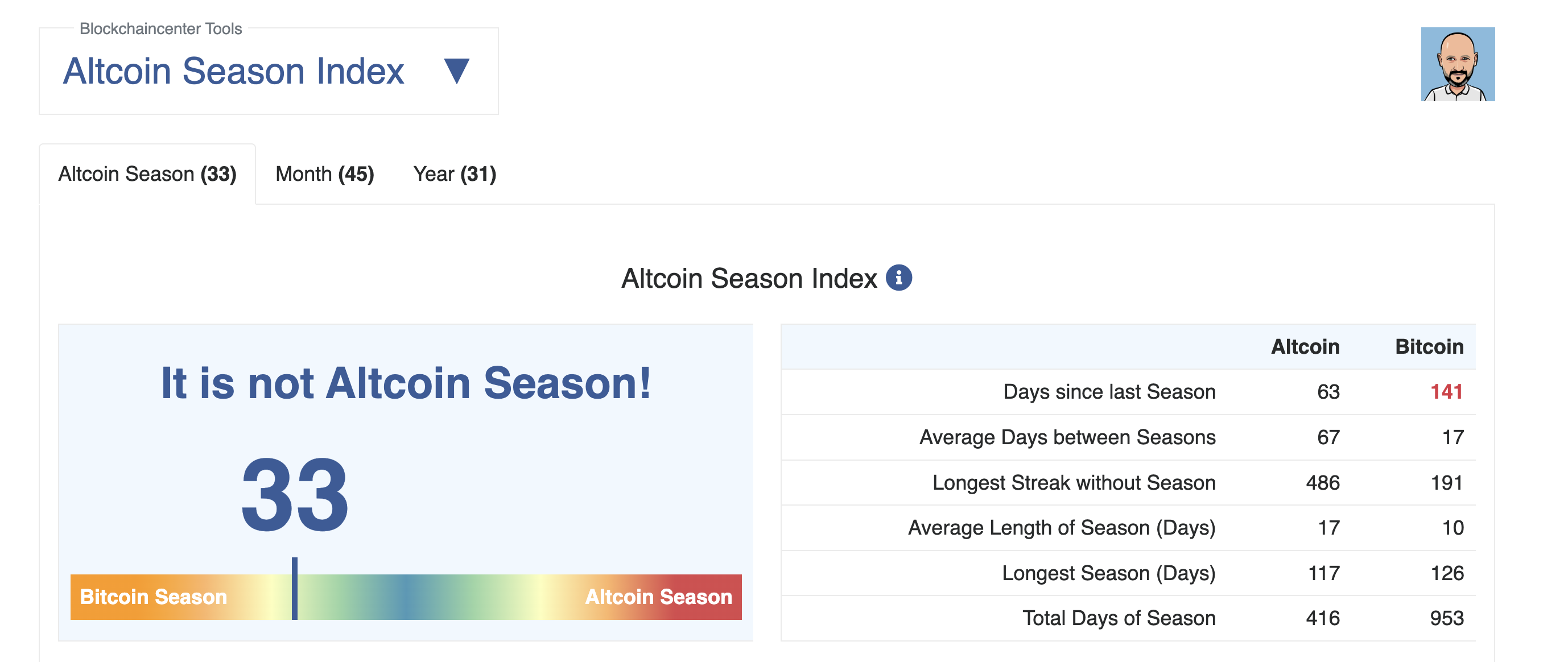

In accordance with BlockchainCenter’s Altcoin Season Index, the present rating is 33, far beneath the 75 threshold that indicators a real altcoin season.

The index additionally exhibits that we’re 63 days because the final altcoin season burst and that the common hole between seasons is 67 days. This locations the market near the window the place rotations normally begin, however not there but.

Bitcoin dominance remains to be excessive, which implies Bitcoin nonetheless controls many of the cash flowing out and in of crypto. For an altcoin season to kind, two issues should occur collectively:

- The overall crypto market cap must develop.

- Bitcoin dominance must fall on the identical time.

That mixture would present that merchants are transferring cash from Bitcoin into altcoins. Solely then can a sector escape in a sustainable method.

If that shift occurs on this cycle, DEX tokens have one of many strongest instances to steer the early wave. They already present rising quantity share, regular whale demand, and damaging correlation with Bitcoin—traits that usually seem within the sectors that rotate first.