Picture supply: Getty Photographs

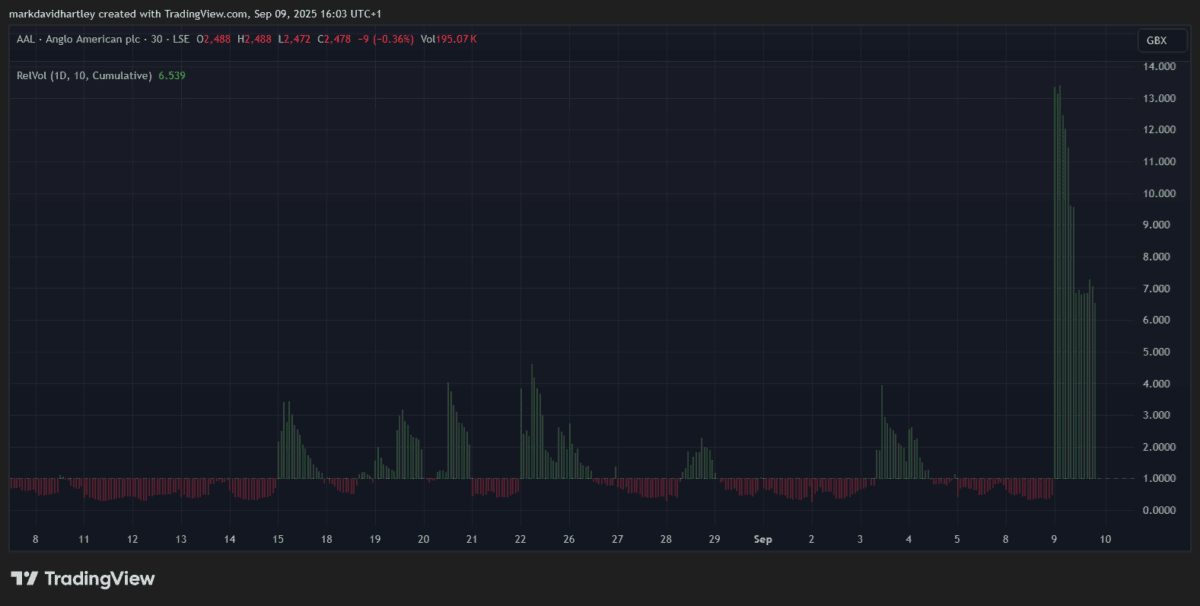

It’s been an fascinating week for FTSE 100 miners. Shares in Glencore (LSE: GLEN) and Anglo-American (LSE: AAL) have seen unusually excessive buying and selling volumes, regardless of each firms reporting sharp earnings losses in current months.

Created on Tradingview.com

Created on Tradingview.com

Others, together with gold miner Fresnillo, loved progress this yr on account of jitters within the US financial system. The mixture of commerce tariff uncertainty and a potential rate of interest reduce have fuelled demand for safe-haven belongings like gold and different metals.

However Glencore and Anglo haven’t had the best journey in 2025 — each shares stay within the purple, with Glencore down 14.6% yr to this point and Anglo off 7%. However with volumes climbing and dealmaking heating up, restoration may lastly be on the playing cards.

So are these mining giants price contemplating at right now’s costs?

Glencore: stretched steadiness sheet

Glencore’s been significantly laborious hit. Earnings per share (EPS) collapsed 285% yr on yr, pushing the corporate right into a £1.28bn loss for 2024. That’s regardless of revenues of greater than £180bn. Margins have proven indicators of stabilising in H1 2025, nevertheless it’s hardly been sufficient to revive confidence.

For the present yr, analysts count on full-year EPS of simply 10p per share — lower than half the 24p delivered in 2024. The steadiness sheet doesn’t encourage a lot religion both. Debt now outweighs fairness, leaving the corporate closely uncovered if commodity costs fall additional.

I can see why some buyers could be tempted, given Glencore’s monumental income base and world attain. However personally, it’s not a inventory I’d think about proper now. The numbers stay weak and the leverage drawback feels too large to disregard.

Anglo-American: a merger increase

Anglo-American nevertheless, appears to be like extra promising. The inventory jumped 10% this week after asserting a $53bn merger with Canadian copper miner Teck Sources. Collectively they’ll management two strategically-positioned Chilean mines — Quebrada Blanca and Collahuasi — which ought to create value financial savings and synergies.

The timing’s vital. Copper demand’s projected to soar within the coming many years as electrical automobiles (EVs), photo voltaic panels and wind farms drive the worldwide transition to wash vitality. By combining assets in Chile, Anglo and Teck needs to be well-placed to capitalise on this megatrend.

After all, Anglo isn’t resistant to challenges. It posted a £2.4bn loss final yr on £21.41bn of income, highlighting simply how costly mining operations will be. However not like Glencore, Anglo’s debt stays nicely lined by fairness, giving it extra respiration area.

A vibrant future

The Teck merger, whereas promising, isn’t danger free. Political shifts within the US have just lately slowed photo voltaic improvement, threatening demand progress for copper. Integrating two massive mining operations might assist mitigate this however isn’t simple both, with value overruns and operational hiccups a chance.

However dangers apart, I believe it makes Anglo a extremely interesting possibility. The steadiness sheet is stronger, the merger might unlock actual worth and long-term copper demand is difficult to disregard. It’s actually a inventory buyers might need to think about for long-term progress – and one I plan so as to add to my portfolio as quickly as I’ve some free capital.

For me, the takeaway’s clear. FTSE 100 miners should still be below strain, however not all are created equal. Glencore appears to be like caught in impartial, whereas Anglo-American’s merger might mark the beginning of a brand new chapter.