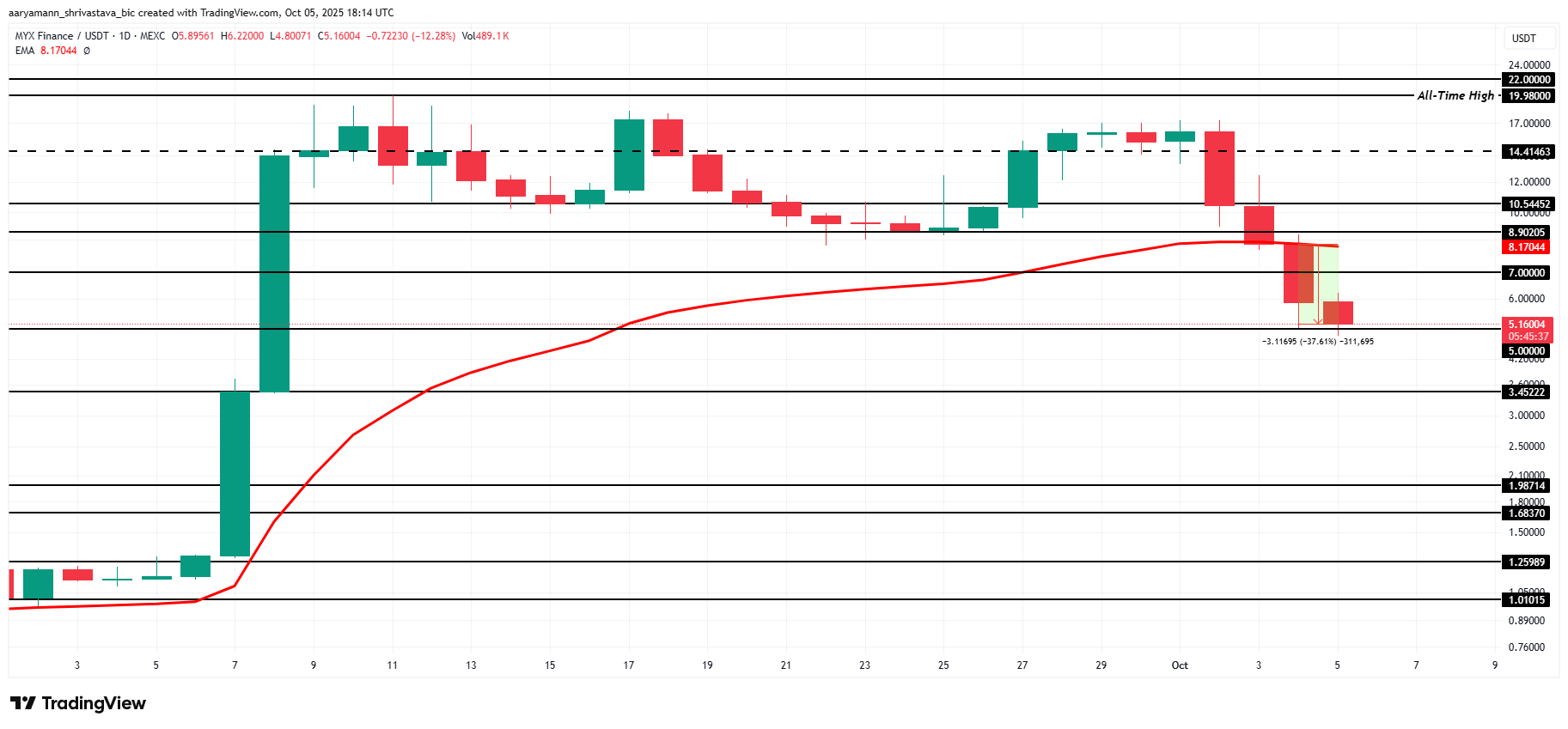

MYX Finance has witnessed a dramatic collapse in its market worth, plunging by practically 67% over the previous week.

The altcoin’s ongoing sell-off displays a rising disconnect from Bitcoin, which has surged to new all-time highs. Buyers seem more and more unsure about MYX’s restoration potential amid this divergence.

MYX Finance and Bitcoin Half Methods

The Relative Power Index (RSI) highlights MYX Finance’s bearish shift. The indicator is at the moment lodged beneath the impartial 50.0 mark, firmly throughout the bearish zone. This exhibits that optimistic momentum has vanished, leaving sellers in management. MYX’s lack of ability to draw shopping for stress has strengthened issues about sustained downward motion.

Sponsored

Sponsored

Including to this, MYX remains to be removed from getting into the oversold zone, suggesting there’s room for additional decline earlier than a possible reversal. The shortage of bullish indicators signifies that merchants stay hesitant, preferring to attend for stabilization earlier than reentering. This sentiment paints a bleak short-term outlook, as bears proceed to dominate the market.

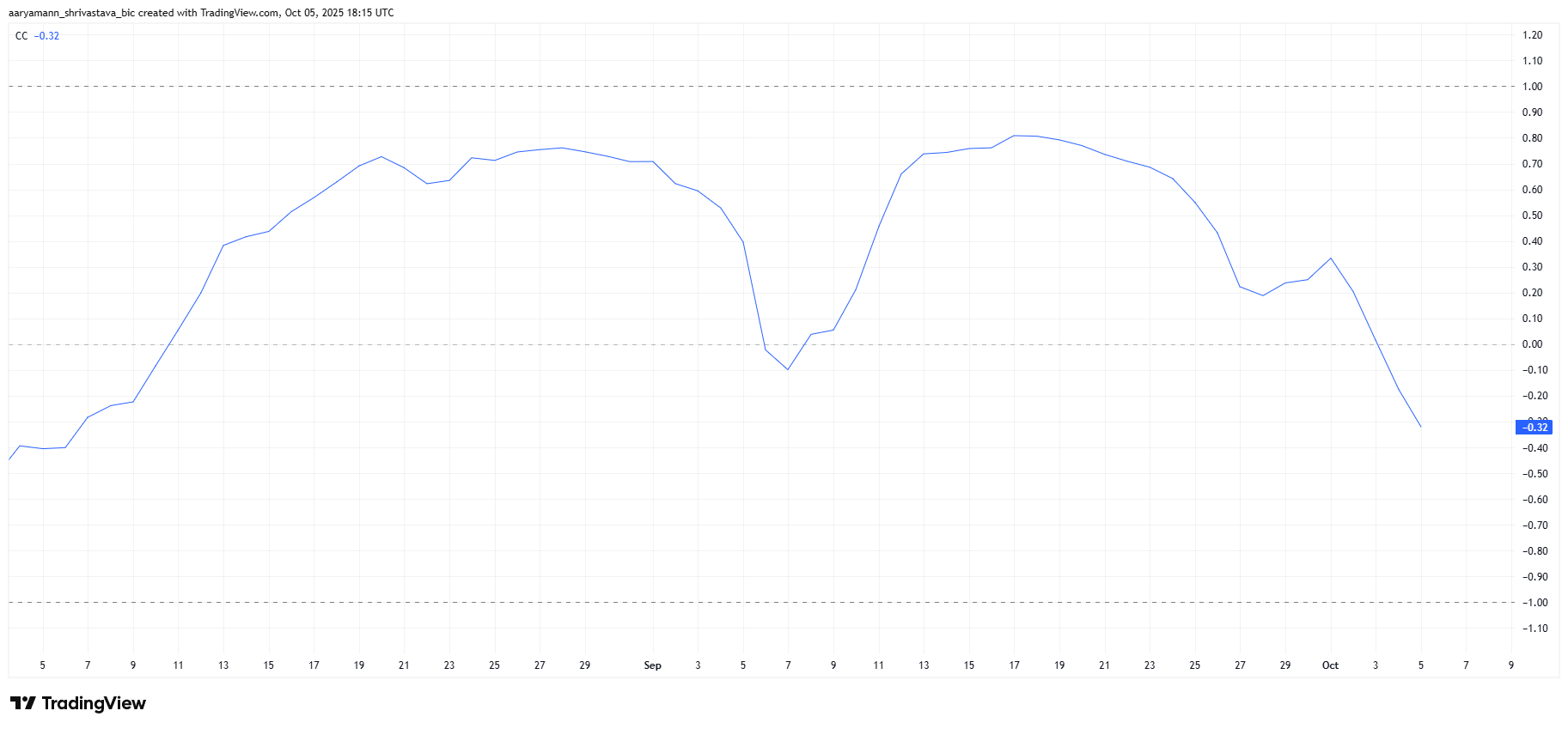

MYX RSI. Supply: TradingView

MYX’s broader momentum is weakening additional because of its detachment from Bitcoin’s pattern. The altcoin’s correlation with BTC has dropped to -0.32, indicating an inverse relationship between the 2. This unfavourable correlation is alarming, particularly since Bitcoin reached a brand new all-time excessive at this time, leaving MYX transferring in the other way.

Traditionally, MYX benefited from Bitcoin’s power, as market optimism usually spilled over into smaller altcoins. Nonetheless, the present divergence suggests buyers are rotating capital away from MYX, amplifying its volatility. As Bitcoin’s momentum grows, MYX might proceed to face stress until it reestablishes alignment with the broader market pattern.

MYX Worth Might Lose $5.00

MYX Finance’s value is down by 37.6% prior to now 24 hours, buying and selling at $5.16 on the time of writing. The token barely holds above its essential psychological help of $5.00, which might decide its subsequent directional transfer.

The latest breakdown beneath the 50-day exponential transferring common (EMA) confirms short-term bearishness, supporting the indicators from technical indicators. If promoting continues, MYX might slip beneath $5.00 and fall towards $3.45 within the coming classes.

Alternatively, if buyers step in to build up at discounted ranges, MYX might see a reduction rally. A rebound from $5.00 may propel the value to $7.00 and probably breach $8.90. This could invalidate the prevailing bearish outlook and sign the beginning of restoration.