Gold has set 37 report closes this yr, marking its greatest annual efficiency since 1979 and lapping U.S. fairness benchmarks just like the S&P 500 and the Nasdaq Composite, which have set 28 and 19 respectively. However in latest weeks, the dear steel notched two new spectacular data, together with one not bested since 1980.

Beginning with the 45-year-old report: gold lastly broke via its inflation-adjusted report from Jan. 1980.

First reported by Bloomberg, who factored in “decades of consumer price increases” for the evaluation, the information reveals the secure haven’s worth going parabolic in latest months, coinciding with higher geopolitical uncertainty and recent worries in regards to the U.S. Greenback.

Bloomberg

Since setting this report, gold has continued to soldier upward for a collection of latest report closes. On Tuesday, Steady Gold Contracts rose 0.58% to three,796.90, ending out the day after an intraday report.

Learn extra:

- Billionaire says gold is ‘great’ provided that ‘no one digs more’ of it

- Morgan Stanley recommends gold over ‘exhausting asset’ in inflation technique

- Gold and Silver Understand the Fed Is Headed Towards Big Mistake

Individually, etf.com reported that gold set a distinct type of report on Wall Avenue. This time, it has to do with buyers’ pleasure and urge for food for the secure haven.

On Friday, the most important U.S-listed exchange-traded fund, the SPDR Gold Shares GLD, pulled in $2.2 billion in inflows. That was the “largest single-day inflow in the fund’s 21-year history” per etf.com’s Sumit Roy, who tabulated information from Bloomberg.

etf&interval;com

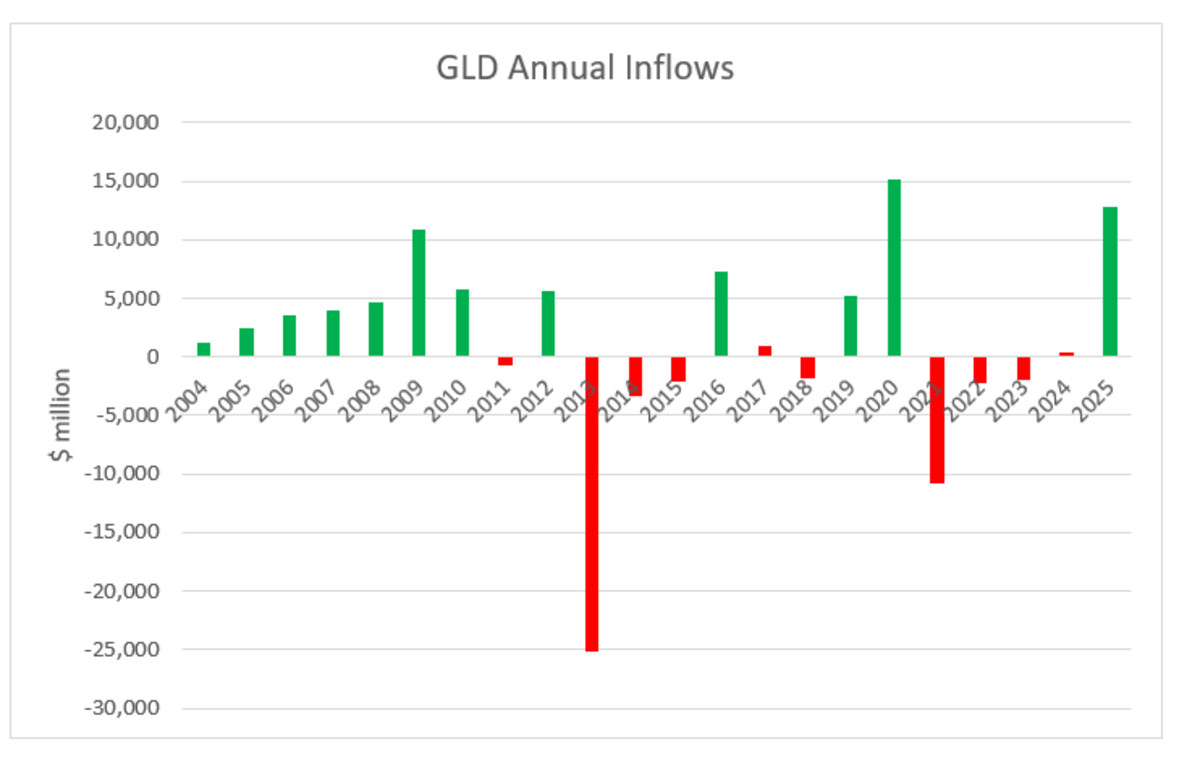

The ETF’s two different greatest influx days additionally occurred earlier in 2025. In complete, the fund has hauled in additional than $12.9 billion in internet inflows, which places it on observe to surpass its 2020 data.

The robust inflows have helped flip across the ETF’s fund flows, in response to Macro Ops’ Brandon Beylo, who shared a chart of the 10-year pattern on X (f/okay/a Twitter.)

Different gold ETFs have additionally appreciated a bump of curiosity, together with the iShares Gold Belief (IAU) and SPDR Gold MiniShares Belief (GLDM) , the second- and third-largest gold ETFs by belongings underneath administration (AUM). Taken collectively, world gold ETFs are inching nearer to a $500 billion AUM milestone.

Gold, probably the most well-known secure haven, is a method that buyers have hedged their portfolio in opposition to uncertainty and inflation. Institutional buyers and hedge funds have wager closely on the dear steel, which has already risen dramatically this yr.

Their latest power has pushed the Relative Power Index (RSI) on gold ETFs into “overbought” territory. Nonetheless, analysts maintain that gold will proceed to rally within the face of worldwide uncertainty and decrease rates of interest.

Yr-to-date, the Gold Steady Contract was up 43.9% on Tuesday night, sitting at $3,798, per information from MarketWatch.