Picture supply: Getty Pictures

Not like a SIPP, any contributions right into a Shares and Shares ISA don’t appeal to the potential for top-up funds by the federal government. Nevertheless, all good points made via such a automobile are utterly freed from tax, whatever the dimension of the ultimate pot. That makes them an especially enticing proposition for these searching for a second revenue in retirement.

Estimating potential returns

Constructing a pot massive sufficient to withdraw £30,000 a 12 months at retirement is not any imply feat. Reaching that concentrate on will depend upon many various elements. These embody a person’s investing time horizon and the annual yield earned on one’s portfolio.

However, if we take as a base case that the drawdown section will final for 25 years, notionally, the scale of the portfolio would should be £750,000 at retirement.

A person can contribute as much as £20,000 into an ISA every year. However provided that solely about 8% of ISA holders put apart this quantity, then we should be just a little bit extra real looking in constructing our contribution mannequin.

Crunching the numbers

Allow us to assume that a person has a 25-year investing time horizon and that they may improve their contributions as specified by the desk under.

Tiered yearsYearly ISA contribution1-5£5,0006-10£10,00011-15£15,00016-25£20,000

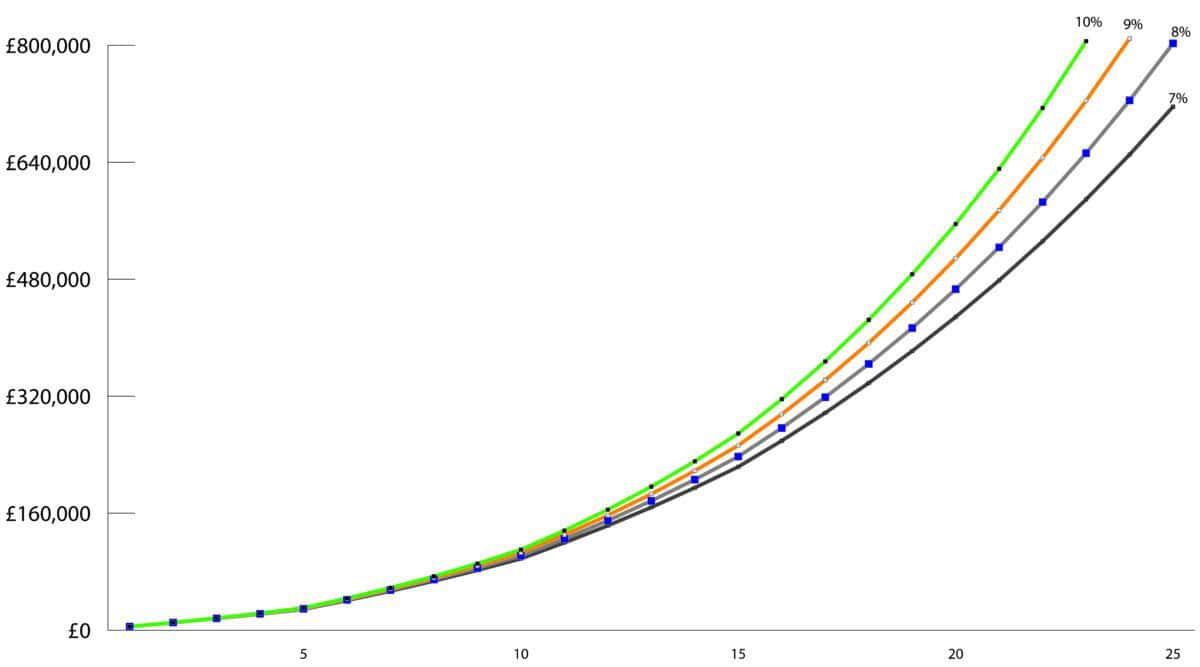

The next chart highlights how a lot such a stepped-contribution could be value, based mostly on numerous annual returns.

Chart created by writer

Importantly, you possibly can see that small modifications in funding efficiency turn into magnified over a very long time body. That is due to the all-important issue of compounding good points. A 7% acquire by no means reaches the required quantity inside 25 years, whereas a ten% annual returns will get to £750,000 inside 22 years.

Diversified portfolio

Setting up a portfolio able to reaching excessive single-digit annual returns 12 months after 12 months is not going to be simple. My most popular technique is to decide on a mixture of development shares, which additionally pay a modest dividend, along with high-yielding shares.

Within the former class, I actually like specialist chemical substances producer Croda (LSE: CRDA). The dividend yield presently stands at 4.2%, however this can be a firm with luggage of development potential.

One main development space is within the manufacture of ceramides. Throughout the sweetness business, ceramides have turn into the primary talked about energetic ingredient. A type of lipid, they preserve pores and skin hydrated, supple, and agency.

To this point, Croda has been unsuccessful in commercialising the chance offered by this revolutionary energetic ingredient. It has now put in place a brand new technique that can hopefully flip this round.

Dividend play

For an out-and-out dividend payer, Authorized & Basic (LSE: LGEN) stays one among my agency favourites. A dividend yield of 9.2%, makes it one of many highest payers within the FTSE 100.

It is a firm with a long-track report of accelerating its payout. Certainly, it has not lower the dividend for the reason that international monetary disaster. Since 2015, complete shareholder returns have amounted to 83%.

Lately, its share worth has come beneath strain over rising competitors considerations within the pension threat switch (PRT) market. Nevertheless, I stay optimistic that its main worth proposition on this enviornment will proceed to resonate with shoppers, thereby guaranteeing that dividends preserve flowing effectively in to the longer term.