Banco Santander (LSE:BNC) shares actually haven’t been unnoticed of the European financial institution inventory rally in current instances. In simply 12 months, they’ve jumped from underneath 500p to 935p.

Together with dividends, this highly effective efficiency would have remodeled a £15,000 funding into nearly £30,000.

Much more unbelievable is the efficiency since July 2022. Over this era, Santander inventory has skyrocketed roughly 360% — sufficient to show £15k into roughly £70k!

Why are buyers so bullish on the Spanish financial institution inventory? And would possibly it nonetheless be price contemplating right this moment?

Picture supply: Getty Pictures

A high-performing financial institution

Santander operates in 10 core markets throughout Europe, the US, and Latin America. Like all banks, it has benefitted from greater rates of interest. This has boosted its internet curiosity margin (the distinction between the curiosity earned on loans and paid out on deposits).

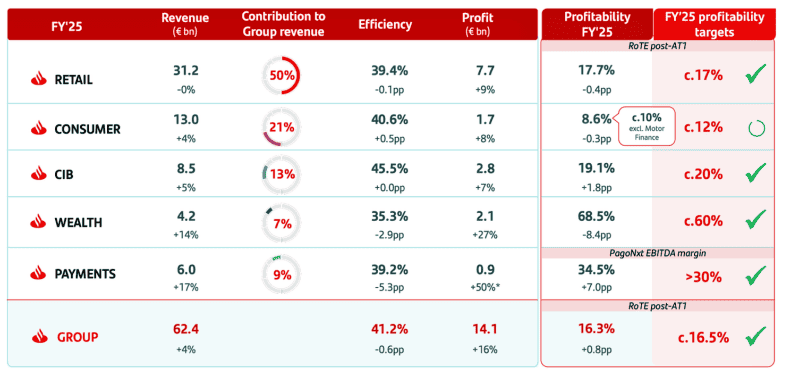

In 2025, the lender’s revenue rose 12% to €14.1bn, marking the fourth consecutive 12 months of file outcomes. Earnings per share (EPS) jumped by a powerful 17%, boosted by Santander’s meaty share buybacks.

Since 2021, the corporate has repurchased round 18% of its excellent shares. And dividend funds have been extra beneficiant than in earlier years (when Santander was seen as barely stingy).

In the meantime, loan-loss provisions are secure, with a stable value of threat at 1.15% final 12 months, supported by “proactive threat administration, low unemployment charges and easing financial insurance policies in most nations“.

The non-performing mortgage ratio improved to 2.91%, an traditionally low stage. So whereas the unstable geopolitical backdrop provides threat, circumstances have truly been fairly benign.

Through the 12 months, Santander added one other 8m clients, bringing the entire to 180m. It additionally snapped up Webster Monetary within the US, the place it intends to develop into a significant participant in retail banking.

Santander estimates this acquisition will almost double its return-on-tangible-equity (RoTE) ratio, a key measure of profitability, to 18% within the US by 2028. And it’ll ship about 7%-8% EPS accretion for the group.

Trying forward, administration expects greater earnings in 2026 and 2027, with group RoTE anticipated to exceed 20% by 2028.

Supply: Santander

Supply: Santander

What concerning the dividend yield?

I’ve been bullish on Santander inventory for a while because of its good mixture of markets, each mature (US, UK, Spain) and progress (Brazil, Mexico, Chile). I see this geographic diversification as a key power.

“The US financial outlook is stronger than anticipated, Europe is gaining momentum and Latin America stands out as a transparent winner when it comes to competitiveness within the new international context“, mentioned Ana Botín, Santander’s government chair.

Is Santander nonetheless price a glance? It may be for buyers who’re bullish on Latin America long run. The area is house to tens of hundreds of thousands of unbanked or underbanked folks, which ought to help monetary companies progress for a few years to return.

Nevertheless, I word Santander’s price-to-tangible-book (P/B) ratio is 1.8. This represents the onerous belongings of the corporate, and suggests the valuation may be a tad excessive proper now.

Plus, after the robust share worth run, the forecast dividend yield is barely 2.8%. From an earnings perspective, that doesn’t appear enticing to me once I can get Aviva and HSBC on potential yields of 6.4% and 4.5%, respectively.

Traders could make up their very own minds, after all, however I see extra probably profitable alternatives in different monetary shares right this moment.