Oil States Worldwide, Inc. (NYSE: OIS) reported fourth-quarter outcomes for the interval ended December 31, 2025. The corporate posted consolidated revenues of $178.5 million and a web lack of $117.2 million, which included one-time asset impairment and restructuring fees. Adjusted EBITDA for the quarter was $22.8 million. Market capitalization: $371.6 million.

Newest Quarterly Outcomes (This fall 2025)

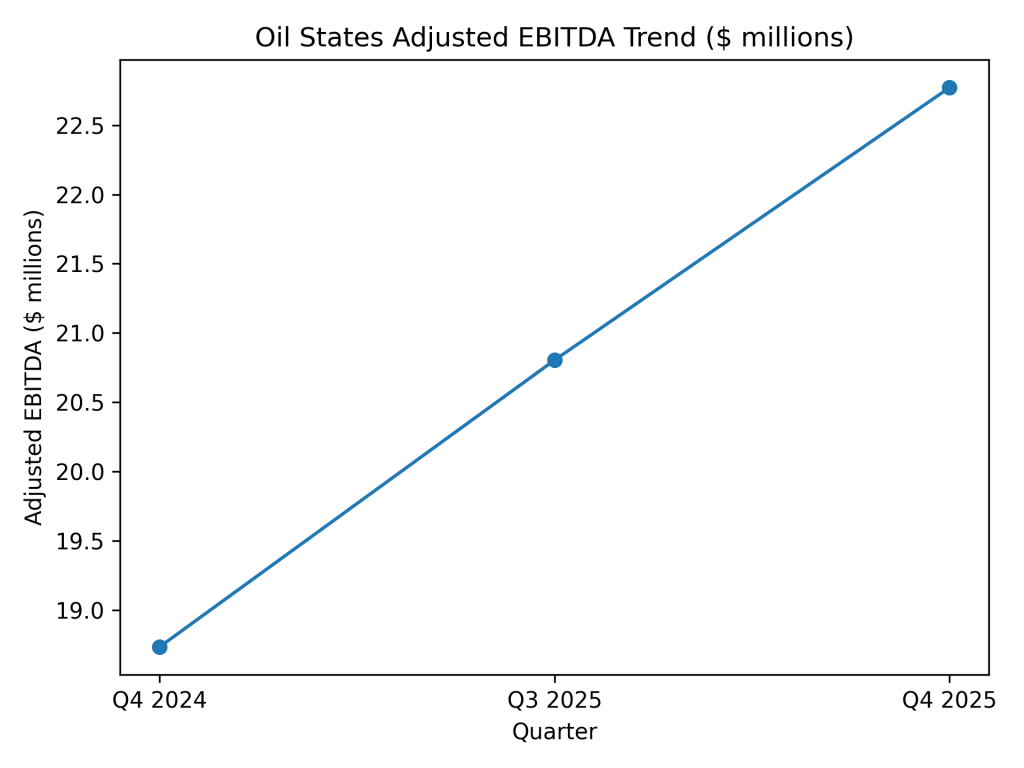

Newest quarterly outcomes (This fall 2025): Consolidated income was $178.5 million, up 8% year-on-year from $164.6 million in This fall 2024. Internet loss for the quarter was $117.2 million versus web revenue of $15.2 million in This fall 2024. Adjusted EBITDA was $22.8 million, in contrast with $18.7 million a 12 months earlier. Adjusted web revenue, excluding fees and credit, was $7.5 million versus $5.5 million in This fall 2024.

Section Highlights

Offshore Manufactured Merchandise income was $123.3 million. Completion and Manufacturing Companies income was $23.1 million. Downhole Applied sciences’ income was $32.1 million.

12 months-over-12 months Comparability

Metric

This fall 2025

This fall 2024

YoY change

Income (This fall)

$178.5M

$164.6M

+8%

Internet revenue (loss) (This fall)

($117.2M)

$15.2M

n.m.

Adjusted EBITDA (This fall)

$22.8M

$18.7M

+22%

Adjusted web revenue excl. fees (This fall)

$7.5M

$5.5M

+36%

Monetary Traits

Working Efficiency — Quarterly income development

Working Efficiency — Adjusted EBITDA development

Full-12 months Outcomes Context

For the 12 months ended December 31, 2025, consolidated income totaled $669.0 million in contrast with $692.6 million in 2024, reflecting a directional contraction year-on-year. Adjusted EBITDA for full-year 2025 was $83.4 million versus $77.0 million in 2024.

Enterprise & Operations Replace

Throughout 2025 the corporate continued to shift emphasis towards offshore and worldwide markets. Backlog in Offshore Manufactured Merchandise reached $435 million as of December 31, 2025. Administration reported new contract awards, together with navy and long-term product contracts, and deployment of latest know-how platforms comparable to managed stress drilling techniques and the Low Affect Workover Bundle.

M&A or Strategic Strikes

No introduced acquisitions have been disclosed within the quarter. Administration used money generated through the quarter to retire $50 million of convertible senior notes and to assist stability sheet flexibility.

Fairness Analyst Commentary

Institutional summaries cited by administration referenced the corporate’s improved adjusted EBITDA and elevated backlog. Analyst commentary referenced the corporate’s restructuring actions and the one-time fees recorded within the quarter.

Steerage & Outlook — what to look at for

Prior steering known as for sequential income development of 8%–13% and adjusted EBITDA of $21 million–$22 million for the fourth quarter. Key gadgets to look at embody backlog conversion, progress on U.S. land restructuring actions, and cash-flow conversion from adjusted EBITDA.

Efficiency Abstract

Revenues rose year-on-year; the reported GAAP web loss mirrored giant non-cash and restructuring fees; adjusted metrics confirmed sequential and year-over-year enchancment. Backlog reached a multi-year excessive, and money era funded debt retirement.