i-80 Gold Corp (NYSE: IAUX) closed at $1.95, down 10.6% within the newest session following its fourth-quarter 2025 earnings launch. Market capitalization: $1.61 billion.

Newest Quarterly Outcomes

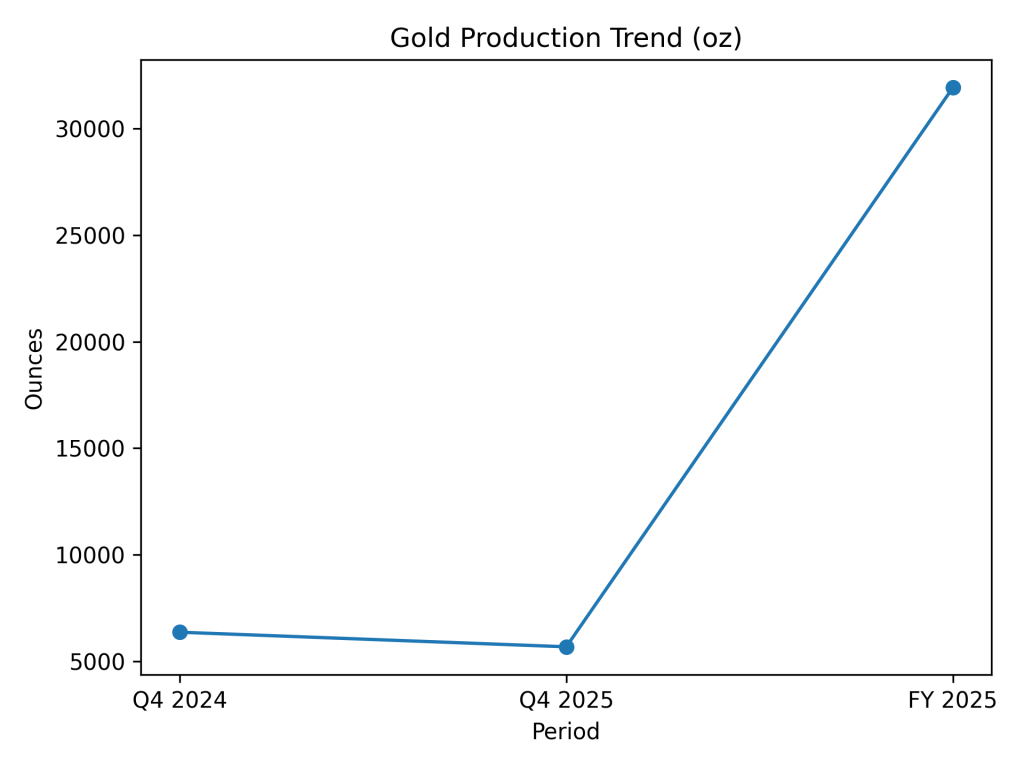

Income for the quarter totaled $21.3 million, in contrast with $23.2 million in This fall 2024, representing a year-over-year decline of -8.3%. Web loss widened to $-85.6 million from $-17.7 million a 12 months earlier. Adjusted loss was $-37.8 million versus $-25.0 million in This fall 2024. Gold manufacturing totaled 5,674 ounces in contrast with 6,359 ounces within the prior-year quarter. Money and money equivalents stood at $63.2 million at year-end.

Full-Yr Outcomes Context

For the 12 months ended December 31, 2025, income rose to $95.2 million, reflecting elevated realized gold costs and better manufacturing volumes relative to 2024. Gold manufacturing for FY2025 reached 31,930 ounces. Full-year internet loss expanded primarily resulting from non-cash honest worth changes and growth expenditures.

Yr-over-Yr Comparability (This fall 2025 vs This fall 2024)

Metric

This fall 2024

This fall 2025

YoY Change

Income ($M)

23.2

21.3

-8.3%

Web loss ($M)

-17.7

-85.6

n.m.

Adjusted loss ($M)

-25.0

-37.8

51.1%

Gold manufacturing (oz)

6,359

5,674

-10.8%

Enterprise & Operations Replace

The corporate accomplished a Class 3 engineering examine for the Lone Tree autoclave refurbishment, confirming a processing capability of two,268 tonnes per day and estimated capital of roughly $430 million. Granite Creek underground operations superior via dewatering and growth actions, whereas Archimedes upper-level work commenced in the course of the quarter. Greater than 6,500 ounces remained in stockpile at year-end pending third-party processing.

Monetary Traits

Working Efficiency — Income Development

Working Efficiency — Gold Manufacturing Development

M&A or Strategic Strikes

Administration introduced a secured financing bundle of as much as $500 million, comprising a $250 million royalty association and a $250 million gold prepayment facility. Proceeds are meant to retire present debt, fund Lone Tree refurbishment, and help exploration and dealing capital.

Fairness Analyst Commentary

Institutional analysis protection highlighted funding execution and challenge supply as key monitoring elements. Analysts targeted on capital construction changes and operational ramp-up timelines.

Steerage & Outlook

For 2026, administration guided Granite Creek manufacturing of 30,000–40,000 ounces and roughly 10,000 ounces from Archimedes and residual operations. Working value steering for Granite Creek ranges between $110–$120 million. Progress capital for the Lone Tree Plant is projected at $140–$160 million.

Efficiency Abstract

Shares declined on the day of the announcement. Quarterly income decreased 12 months over 12 months, whereas full-year income elevated. Web losses widened resulting from non-cash and development-related elements. The recapitalization bundle and challenge growth milestones stay central to near-term efficiency.