The Helium One International (LSE:HE1) share worth is on fireplace for the time being. On the time of writing (20 February), the inventory’s altering fingers for over 40% greater than it was a month in the past.

What’s inflicting this sudden curiosity within the comparatively unknown gasoline explorer? Let’s take a more in-depth look.

Picture supply: Getty Pictures

A finger in two pies

Helium One has two tasks on the go.

Probably the most superior is its Galactica-Pegasus three way partnership in Colorado. And this seems to be the catalyst for a lot of the £19m enhance within the group’s market cap over the previous 4 weeks or so.

The corporate lately stated that “integrated plant operations” have been scheduled for the top of the month because it gears up for manufacturing later within the 12 months. Considerably, it additionally stated: “Arrangements have been made for spot sales of helium and discussions in respect of long-term contracts with both helium and CO2 off-takers are progressing.”

However this can be a comparatively small operation. In March 2025, the group stated it expects “an average of approximately US$2m per annum will accrue to the company over a period of five years.” This can be a income determine, not revenue. For context, throughout the 12 months ended 30 June 2025, the group’s whole administrative bills have been $4.1m.

Nevertheless, the estimate excludes any profit from the sale of carbon dioxide (CO2). And there may very well be additional undiscovered deposits of each gases.

However I believe shareholders imagine a probably greater prize lies elsewhere.

Miles away

That’s as a result of the group owns 83% of the Southern Rukwa Undertaking in Tanzania.

Right here, additional testing utilizing {an electrical} submersible pump has resulted in water circulation charges “exceeding expectations”. That is essential as a result of the helium isn’t standard dry gasoline. As an alternative, it’s present in water aquifers, which the group acknowledges is “unique”. And I believe this casts some doubt on its recoverability.

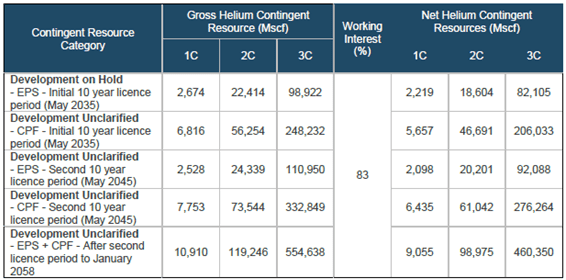

Nevertheless, if it’s capable of overcome this problem, there’s monumental potential in accordance with an unbiased estimate of reserves. However given the uncertainty typical of the business, it’s regular to cite a variety of figures.

Supply: ‘Itumbula West-1 Rukwa Basin, Onshore Tanzania Competent Persons Report’, Sproule ERCE (June 2025)/Mscf = thousand normal cubic ft

Supply: ‘Itumbula West-1 Rukwa Basin, Onshore Tanzania Competent Persons Report’, Sproule ERCE (June 2025)/Mscf = thousand normal cubic ft

For context, though there isn’t a spot worth for the gasoline, I’ve seen experiences suggesting helium sells for as much as $1,000 per thousand normal cubic ft relying on its grade. As a result of its particular traits, particularly its cooling properties, demand for helium is rising, which might drive costs greater.

The final time I wrote about Helium One I used to be contacted by an business knowledgeable claiming that it’s not “technically or financially possible” to move compressed helium by sea from Africa utilizing ISO tanks. I put this to a consultant of the corporate who agreed. However they advised me that “helium can also be transported as a compressed gas in tube trailers by ship”.

No thanks!

However I don’t wish to make investments.

The corporate says round $100m will probably be wanted to commercialise manufacturing. I believe shareholders will, subsequently, be additional diluted. This isn’t a criticism. It’s a truth of life for pre-revenue firms. From June 2020 to June 2025, Helium One elevated its variety of shares in problem by over 6bn (3,417%).

There are a great deal of mining firms which can be already efficiently producing and, extra importantly, absolutely funded. On this foundation, I believe there are much less dangerous alternatives to think about elsewhere.