Crypto market sentiment has fallen into “Excessive Worry” territory as asset costs proceed to say no amid mounting macroeconomic and geopolitical pressures.

Whereas some buyers view such durations as potential alternatives to purchase the dip, one analyst means that excessive warning might not essentially translate into optimum entry factors.

“Bitcoin Going to Zero” Searches Attain All-Time Excessive Amid Excessive Market Worry

In accordance with the most recent information, the Crypto Worry & Greed Index, a broadly used sentiment indicator that measures market temper on a 0–100 scale, stands at 9 as we speak. This marks a slight restoration from 8 yesterday and an excessive low of 5 final week.

Regardless of the modest uptick, the most recent studying suggests the market stays firmly in “Excessive Worry” territory.

In the meantime, investor nervousness can also be mirrored in search habits. Google Developments information exhibits that searches for “Bitcoin going to zero” have reached their highest degree on document, surpassing earlier market downturns.

The search curiosity rating hit 100, indicating peak retail curiosity and heightened concern amongst members.

Search Curiosity for “Bitcoin going to zero.” Supply: Google Developments

Nonetheless, a number of market analysts argue that durations of maximum pessimism typically signify shopping for alternatives.

You would like you purchased throughout the FTX collapse?

Right here is your probability pic.twitter.com/K0PFIQpQXF

— Quinten | 048.eth (@QuintenFrancois) February 18, 2026

Beforehand, Santiment famous that spikes in unfavorable sentiment typically happen when costs decline quick. In accordance with the analytics agency, widespread predictions of collapse and narratives centered round phrases like “down,” “promoting,” or “going to $0” are sometimes interpreted as indicators of retail capitulation, when shaken confidence pushes weaker palms out of the market.

“And when you see the predictions of doom for cryptocurrency, it’s typically the most effective time to formally purchase the dip,” Santiment acknowledged.

The identical greed that stopped individuals promoting at $126K goes to cease them from shopping for the underside.

On the $BTC prime you refused to promote since you have been satisfied $150K was coming. Greed.

On the backside you may refuse to purchase since you’re satisfied $30K is coming. Additionally greed.…

— Ardi (@ArdiNSC) February 18, 2026

Bitcoin’s Greatest Returns Got here Throughout Excessive Greed, Not Worry, Knowledge Reveals

Nonetheless, Nic Puckrin, funding analyst and co-founder of Coin Bureau, questioned the standard narrative to purchase Bitcoin throughout excessive worry.

“Shopping for BTC in ‘Excessive Worry’ is NOT the most effective name,” he stated.

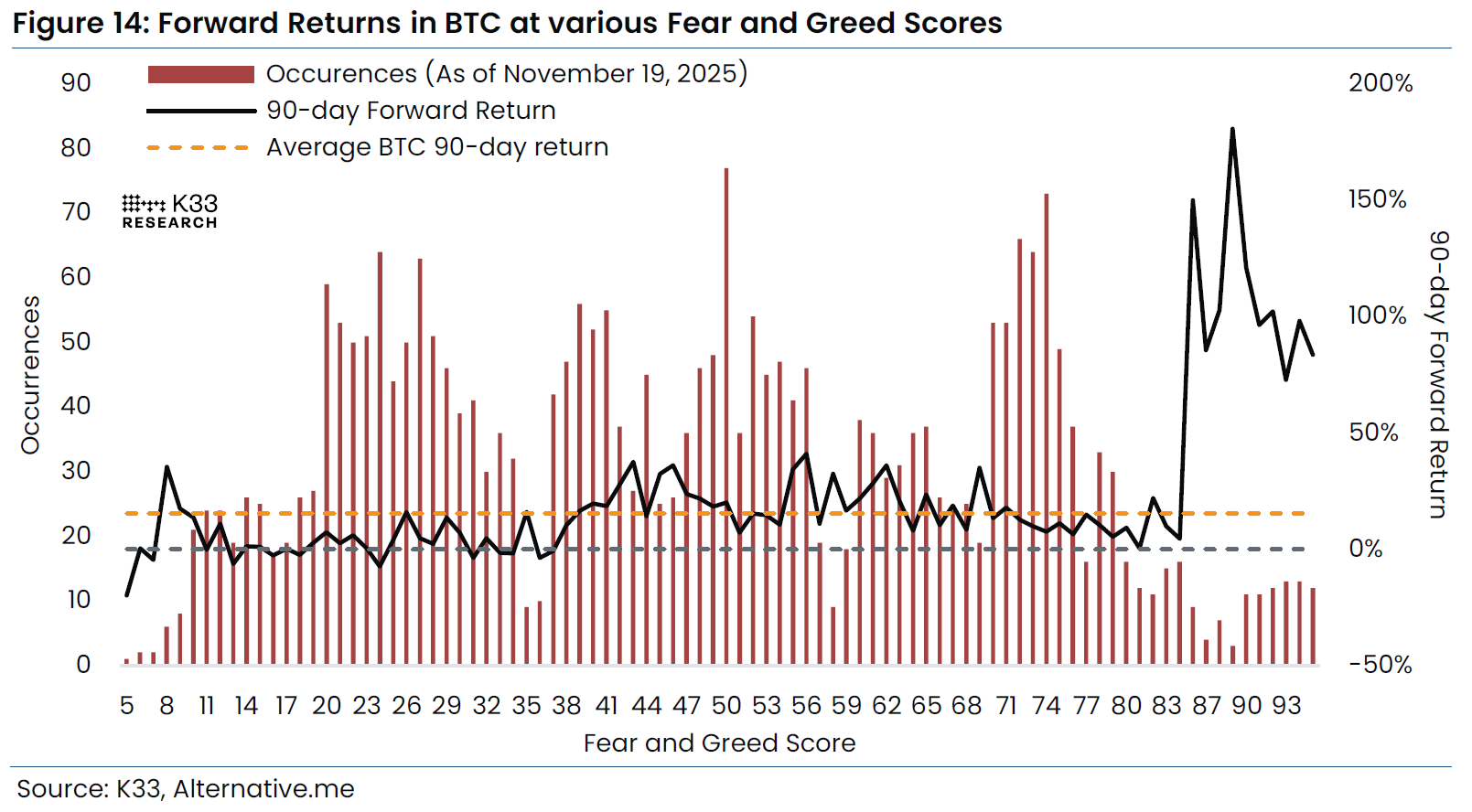

Puckrin argued that the information complicates the broadly held perception that excessive worry mechanically alerts a sexy entry level. His evaluation exhibits that when the Worry & Greed Index drops under 25, the typical 90-day ahead return has traditionally been simply 2.4%.

By comparability, shopping for in durations categorized as “Excessive Greed” has delivered considerably stronger efficiency, with common 90-day returns reaching as excessive as 95%. The findings counsel that momentum and sustained bullish situations, somewhat than peak pessimism, have traditionally aligned with stronger ahead returns.

“The F&G index is nothing however a backward-looking momentum indicator. It’s much less related for predicting returns,” he added.

Nonetheless, a number of analysts shortly questioned his alternative of timeframe. Critics argue {that a} 90-day window is just too slender. One market watcher famous that whereas returns might seem modest three months after an excessive worry studying, the longer-term image tells a special story.

“You may see that 12 months after excessive fear- Bitcoin has averaged over 300% positive factors traditionally. The F&G index isn’t a 90-day sign. It’s a 12-month accumulation alert. You’re not imagined to really feel wealthy instantly after shopping for excessive worry,” a person replied.

Finally, whether or not this second represents alternative or threat might rely much less on sentiment itself and extra on an investor’s time horizon and technique.

The put up Is Excessive Worry a Purchase Sign? New Knowledge Questions the Standard Knowledge appeared first on BeInCrypto.