This decline comes even after Technique, beforehand MicroStrategy, added extra Bitcoin, decreasing its common buy price. Nonetheless, charts now present that this newest BTC common drop didn’t imply a lot for the speedy destiny of the MSTR. A a lot bigger draw back threat is forming beneath the floor.

Sponsored

Sponsored

MicroStrategy’s Newest Bitcoin Purchase Lowers Common Value Solely Barely

MicroStrategy not too long ago bought 2,486 Bitcoin at a median worth of $67,710. This newest acquisition elevated its whole holdings from 714,644 BTC earlier this month to 717,131 BTC.

As a result of this buy was made beneath MicroStrategy’s earlier common price, it helped decrease the corporate’s general Bitcoin price foundation. MicroStrategy’s common acquisition worth dropped from $76,052 (early this month) to $76,027 (at press time). This represents a $25 common price discount.

Technique Value Foundation: Technique

Whereas this technically improves MicroStrategy’s steadiness sheet, the influence stays small relative to its whole place.

The corporate nonetheless holds Bitcoin at a median price above $76,000, which stays considerably increased than many earlier cycle acquisitions. Extra importantly, market indicators present that huge cash traders are usually not reacting positively, even to this growth.

Sponsored

Sponsored

Capital Move Alerts Technique Traders Stay Cautious

One key indicator explaining investor habits is the Chaikin Cash Move, or CMF. This metric measures whether or not massive traders are placing cash right into a inventory or pulling cash out by combining worth and quantity information. When CMF stays above zero, it indicators web shopping for stress. When it falls towards zero or beneath, it reveals capital inflows are weakening.

Technique’s CMF has been trending decrease and is now sitting near the zero line, getting ready to breaking beneath. Additionally it is approaching a important ascending trendline assist. This reveals that regardless of the newest Bitcoin buy, massive traders are usually not aggressively accumulating the MSTR inventory. As an alternative, capital inflows stay weak.

This lack of conviction turns into extra regarding when mixed with weakening momentum indicators.

Sponsored

Sponsored

Hidden Bearish Divergence Warns of Potential Main MSTR Value Correction

Momentum evaluation utilizing the Relative Power Index, or RSI, reveals a hidden bearish divergence forming. RSI measures shopping for and promoting energy on a scale from 0 to 100 and helps establish weakening developments.

Between Dec. 9 and Feb. 13, MicroStrategy’s inventory worth fashioned a decrease excessive, that means the value failed to succeed in its earlier peak. Nonetheless, throughout the identical interval, RSI fashioned a better excessive. This sample is named hidden bearish divergence. It indicators that sellers stay in management, and the downtrend is anticipated to proceed. The MSTR inventory worth is down over 60% on a 6-month timeframe, highlighting the mentioned downtrend.

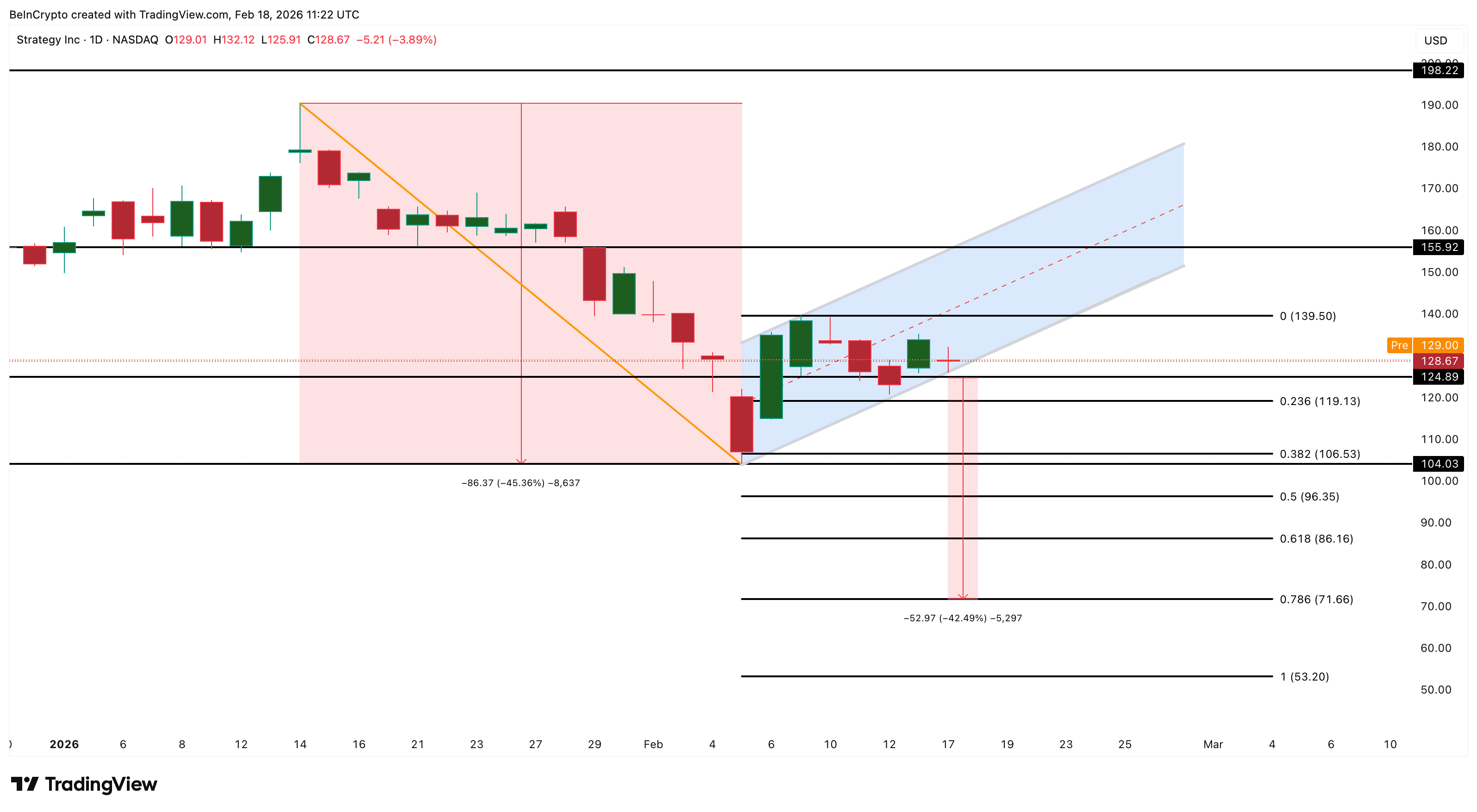

This identical sign appeared earlier between Dec. 9 and Jan. 14. After that divergence fashioned, MicroStrategy inventory dropped greater than 45%, falling to its latest low close to $104. The looks of an analogous construction now suggests one other correction may develop if promoting stress continues. However this time the correction can have comparable penalties.

Bear Flag Construction Reveals MSTR Inventory Might Fall A lot Additional

MicroStrategy’s worth construction now reveals a bear flag sample forming. A bear flag is a bearish continuation sample the place the value briefly strikes upward earlier than persevering with its bigger downtrend. After falling sharply earlier this February, the MSTR inventory rebounded. Nonetheless, this rebound has remained inside a rising channel that varieties the flag portion of the sample.

Sponsored

Sponsored

MicroStrategy inventory is presently buying and selling close to $128, very near the decrease boundary of this construction. If the value breaks beneath the $124 assist degree, the bear flag breakdown may start.

Based mostly on the peak of the earlier decline, this breakdown may push MicroStrategy inventory towards $71, offered assist ranges at $104 and 86 break. This may signify a decline of greater than 40% from present ranges.

Restoration stays potential if consumers regain management. A transfer above $139 would weaken the bearish outlook, whereas a full restoration above $155 would invalidate the bearish construction solely.

Nonetheless, the bearish setup may additionally invalidate even with out a sharp breakout. If the value continues rising slowly and the present channel extends past half of the unique pole’s top, the bear flag would lose its validity. In that case, the construction would shift from a bearish continuation sample right into a broader restoration channel, lowering the speedy draw back threat.

For now, MicroStrategy has efficiently lowered its Bitcoin price foundation barely. However capital movement weak spot, bearish divergence, and fragile worth construction all recommend that this small enchancment is probably not sufficient to forestall a bigger inventory correction.