Fiverr Worldwide Ltd. (NYSE: FVRR) reported income of $430.9 million for the total 12 months 2025, a ten.1% enhance in comparison with $391.4 million in 2024. The corporate reported its monetary outcomes for the fourth quarter and financial 12 months ended December 31, 2025, earlier than the market opened.

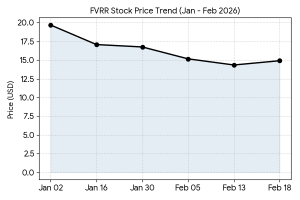

The corporate’s shares elevated 3.97% to $14.91 on the shut of buying and selling on February 18, 2026. Fiverr’s market capitalization stood at $551.6 million as of at present’s shut.

Monetary Outcomes for Fourth Quarter and Full Yr 2025

Fiverr reported income of $430.9 million for the total 12 months 2025, a ten.1% enhance in comparison with $391.4 million in 2024. For the fourth quarter of 2025, income reached $117.4 million, exceeding administration’s earlier steerage vary of $104.3 million to $112.3 million. Internet earnings attributable to atypical shareholders was $23.4 million for the fiscal 12 months, in comparison with a web loss within the prior 12 months.

Operational Metrics and Enterprise Phase Replace

The corporate’s lively purchaser base totaled $3.1 million as of December 31, 2025, representing a 13.6% lower from the earlier 12 months. Nonetheless, spend per purchaser elevated 13.3% year-over-year to $330, pushed by a shift towards high-value tasks and the expansion of Fiverr Professional. Gross Merchandise Worth (GMV) from transactions exceeding $1,000 grew 22.8% in the course of the interval.

Monetary Developments

Strategic Restructuring and AI Integration

In September 2025, Fiverr accomplished a strategic restructuring that decreased its workforce by 30%. The initiative aimed to combine AI-native capabilities throughout the platform and streamline operations. The corporate launched Fiverr Neo and up to date its dynamic matching infrastructure in the course of the second half of 2025 to facilitate extra complicated service requests.

Institutional Analyst Commentary and 2026 Steering

Institutional analysis from corporations together with Needham & Firm and Citigroup maintained a consensus “Hold” ranking following the discharge. Analysts famous the enlargement of adjusted EBITDA margins, which reached 21.3% for the total 12 months. For 2026, Fiverr administration issued income steerage of $457 million and targets an adjusted EBITDA margin of 25%. The outcomes replicate a transition towards high-value managed providers regardless of a contraction within the whole lively purchaser depend.